Question

Shimano corporation has an opportunity to manufacture and sell one of two new products for a five year period. The company's tax rate is 30%

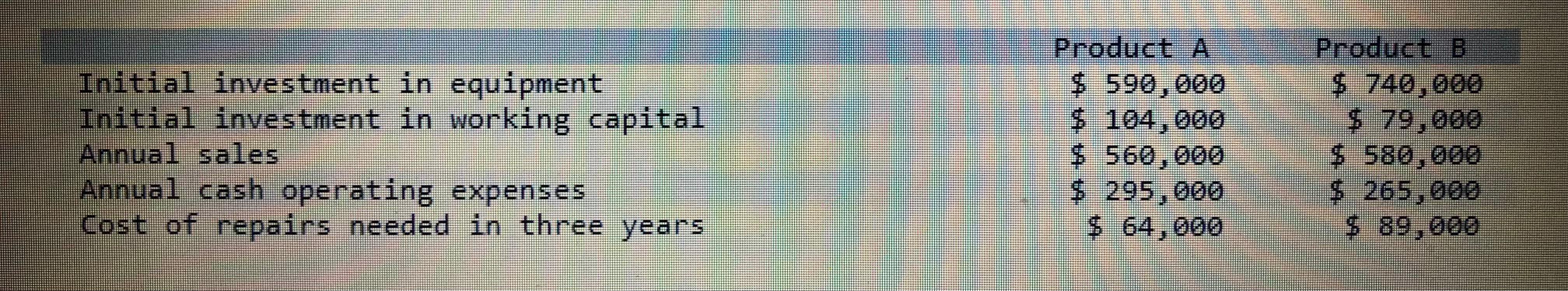

Shimano corporation has an opportunity to manufacture and sell one of two new products for a five year period. The company's tax rate is 30% and its after tax cost of capital is 12%. The cost and revenue estimates for each product are as follows:

The equipment pertaining to both products has a useful life of five years and no salvage value. The company uses the straight line depreciation method for financial reporting and tax purposes. At the end of five years, each product's working capital will be released for investment elsewhere within the company.

The equipment pertaining to both products has a useful life of five years and no salvage value. The company uses the straight line depreciation method for financial reporting and tax purposes. At the end of five years, each product's working capital will be released for investment elsewhere within the company.

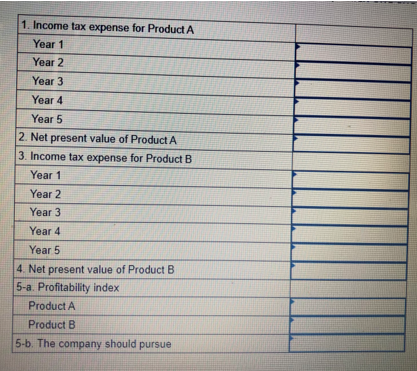

1. Calculate the annual income tax expense for each years 1 through 5 that will arise id Product A is introduced

2. Calculate the net present value of the investment opportunity pertaining to Product A

3. Calculate the annual income tax expense for each of years 1 through 5 that will arise if Product B is introduced.

4. Calculate the net present value of the investment opportunity pertaining to Product B

5a. Calculate the profitability index for Product A and Product B

5b. Based on the profitability index of the two products, which one should the company pursue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started