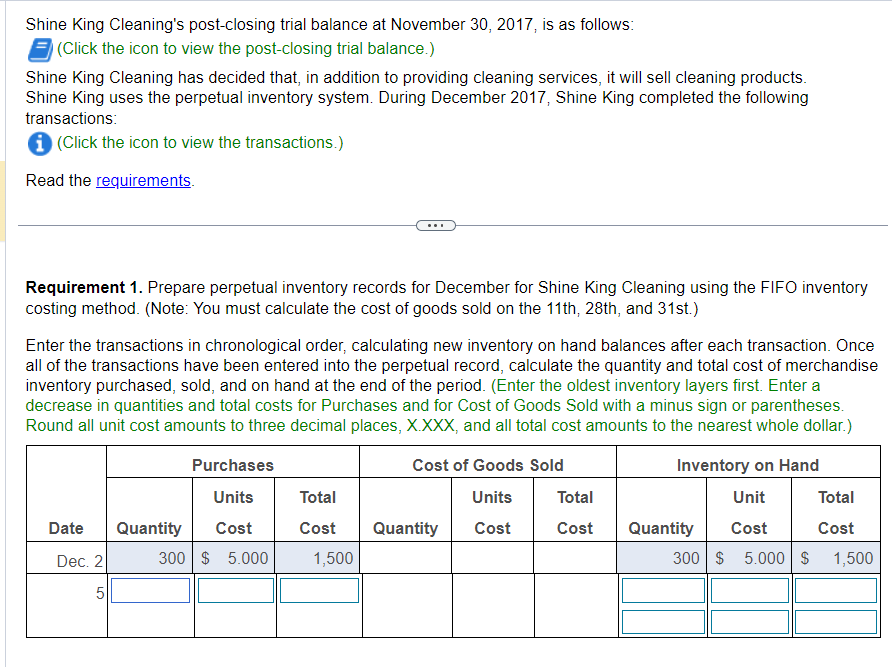

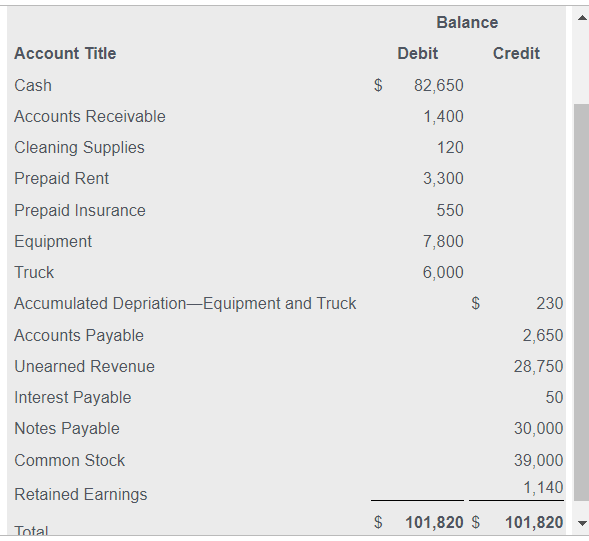

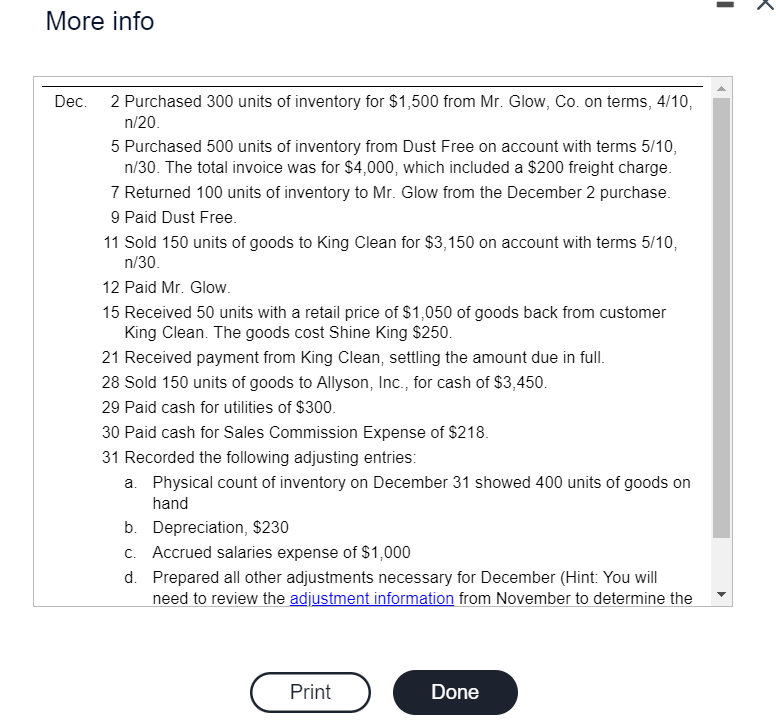

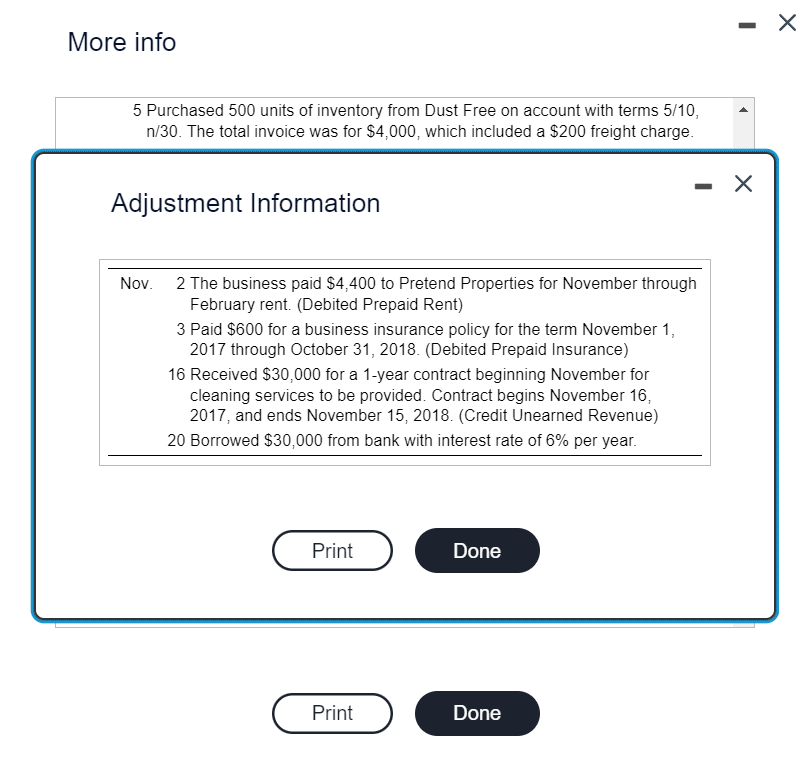

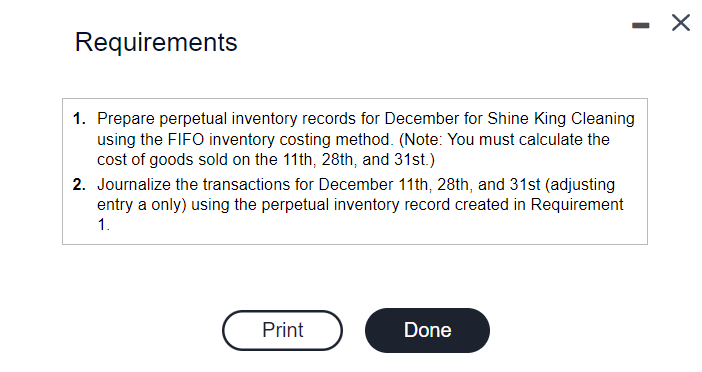

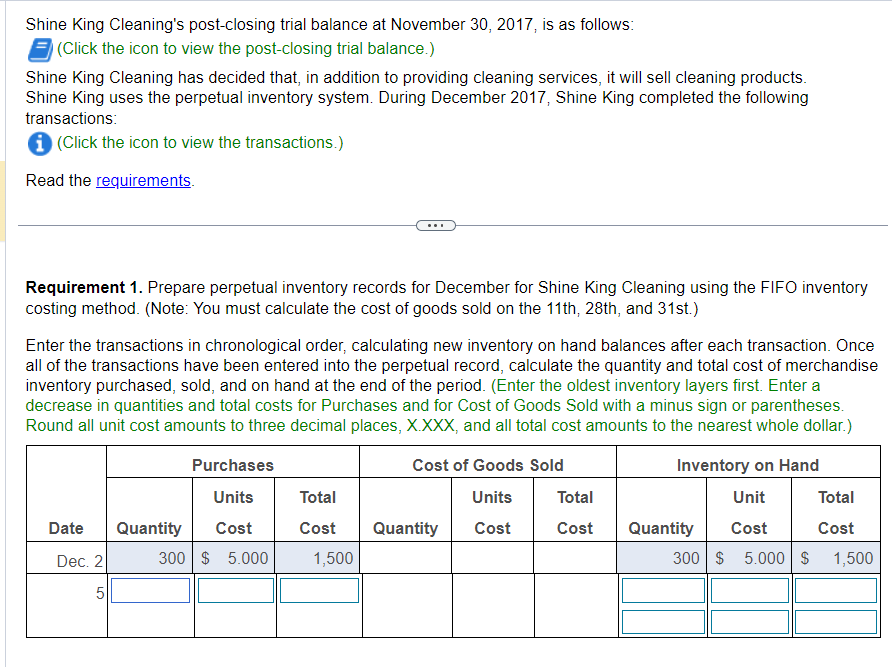

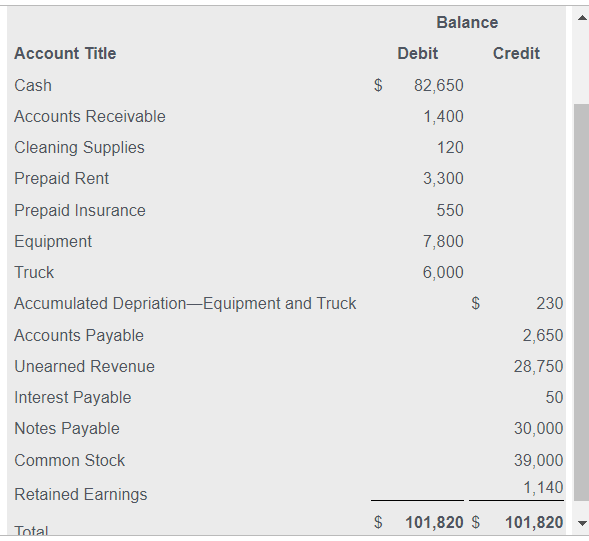

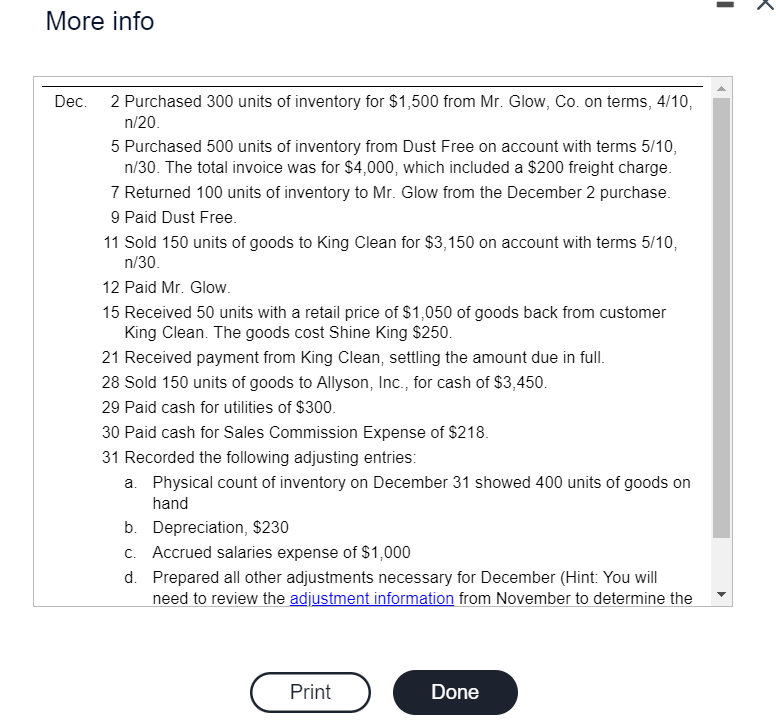

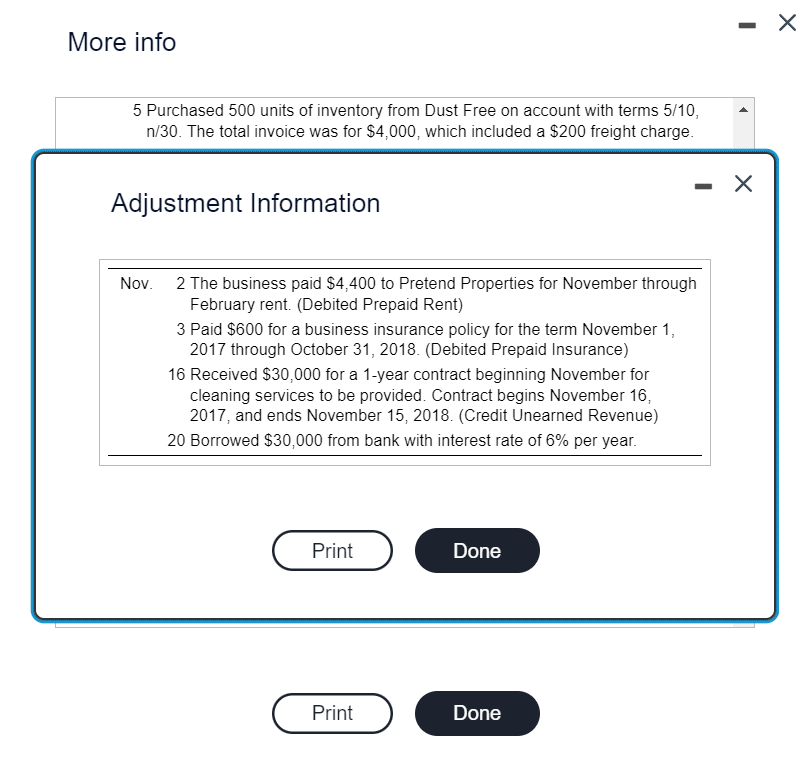

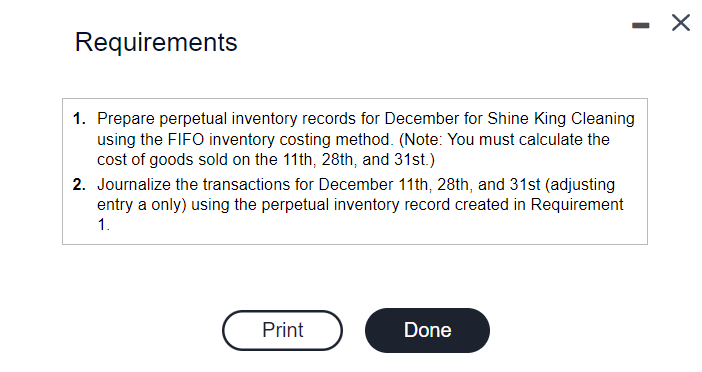

Shine King Cleaning's post-closing trial balance at November 30,2017 , is as follows: (Click the icon to view the post-closing trial balance.) Shine King Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Shine King uses the perpetual inventory system. During December 2017, Shine King completed the following transactions: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Prepare perpetual inventory records for December for Shine King Cleaning using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 11th, 28th, and 31st.) Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first. Enter a decrease in quantities and total costs for Purchases and for Cost of Goods Sold with a minus sign or parentheses. Round all unit cost amounts to three decimal places, X.XXX, and all total cost amounts to the nearest whole dollar.) More info Dec. 2 Purchased 300 units of inventory for $1,500 from Mr. Glow, Co. on terms, 4/10, n/20. 5 Purchased 500 units of inventory from Dust Free on account with terms 5/10, n/30. The total invoice was for $4,000, which included a $200 freight charge. 7 Returned 100 units of inventory to Mr. Glow from the December 2 purchase. 9 Paid Dust Free. 11 Sold 150 units of goods to King Clean for $3,150 on account with terms 5/10, n/30. 12 Paid Mr. Glow. 15 Received 50 units with a retail price of $1,050 of goods back from customer King Clean. The goods cost Shine King $250. 21 Received payment from King Clean, settling the amount due in full. 28 Sold 150 units of goods to Allyson, Inc., for cash of $3,450. 29 Paid cash for utilities of $300. 30 Paid cash for Sales Commission Expense of $218. 31 Recorded the following adjusting entries: a. Physical count of inventory on December 31 showed 400 units of goods on hand b. Depreciation, $230 c. Accrued salaries expense of $1,000 d. Prepared all other adjustments necessary for December (Hint: You will need to review the adjustment information from November to determine the More info 5 Purchased 500 units of inventory from Dust Free on account with terms 5/10, n/30. The total invoice was for $4,000, which included a $200 freight charge . Adjustment Information Requirements 1. Prepare perpetual inventory records for December for Shine King Cleaning using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 11th, 28th, and 31st.) 2. Journalize the transactions for December 11th, 28th, and 31st (adjusting entry a only) using the perpetual inventory record created in Requirement 1