Question

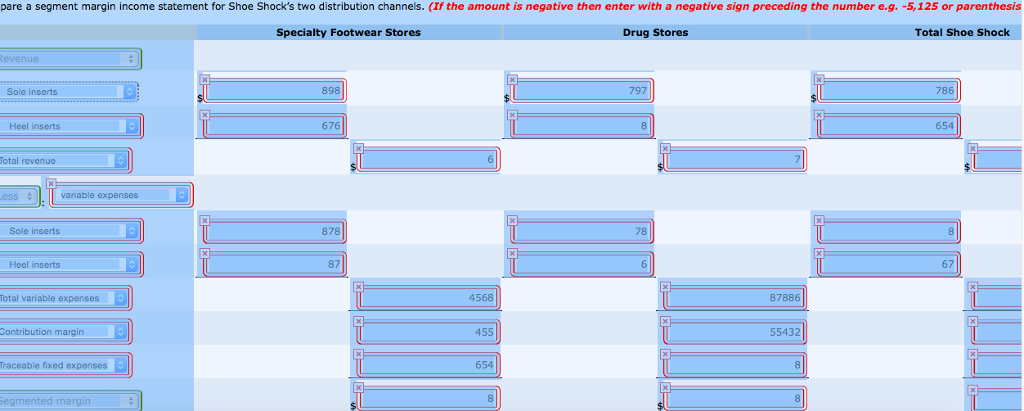

Shoe Shock Innovations manufactures athletic shoe inserts that cushion the foot and reduce the impact of exercise on the joints. The company has two divisions,

Shoe Shock Innovations manufactures athletic shoe inserts that cushion the foot and reduce the impact of exercise on the joints. The company has two divisions, Sole Inserts and Heel Inserts. A segmented income statement from last month follows.

| Sole Inserts Division | Heel Inserts Division | Total Shoe Shock | ||||

| Revenue | $490,000 | $2,500,000 | $2,990,000 | |||

| Less variable expenses | 300,000 | 2,000,000 | 2,300,000 | |||

| Contribution margin | 190,000 | 500,000 | 690,000 | |||

| Less traceable fixed expenses | 120,000 | 348,000 | 468,000 | |||

| Segment margin | $70,000 | $152,000 | 222,000 | |||

| Common fixed costs | 170,000 | |||||

| Net operating income | $52,000 |

Chris Kelly is Shoe Shocks sales manager. Although this statement provides useful information, Chris wants to know how well the companys two distribution channels, specialty footwear stores and drug stores, are performing. Marketing data indicates that 20% of sole inserts and 75% of heel inserts are sold through specialty footwear stores. A recent analysis of corporate fixed costs revealed that 50% of all fixed costs are traceable to specialty footwear stores and 45% of all fixed costs to drug stores.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started