Answered step by step

Verified Expert Solution

Question

1 Approved Answer

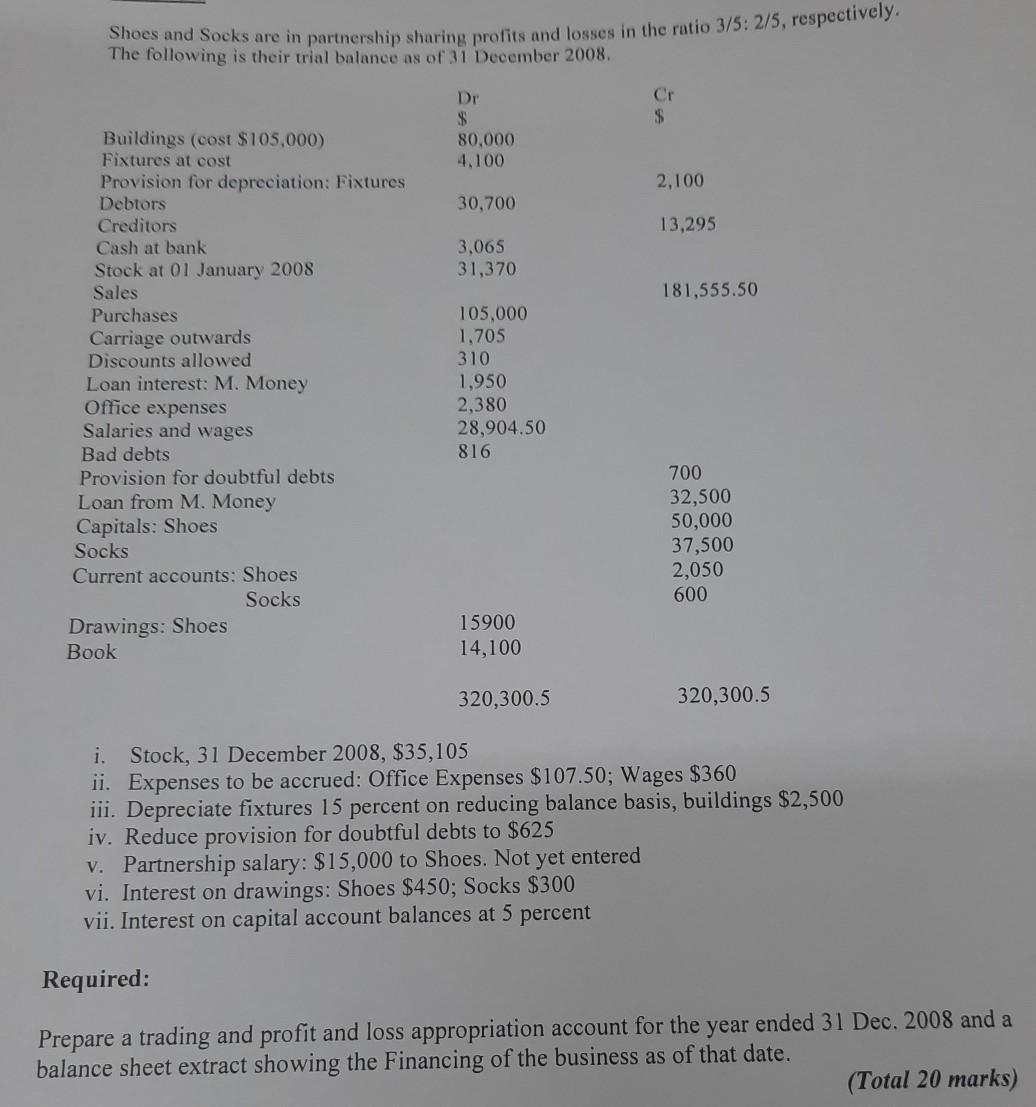

Shoes and Socks are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively. The following is their trial balance as of

Shoes and Socks are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively. The following is their trial balance as of 31 December 2008. Buildings (cost $105,000) Fixtures at cost Provision for depreciation: Fixtures Debtors Creditors Cash at bank Stock at 01 January 2008 Sales Purchases Carriage outwards Discounts allowed Loan interest: M. Money Office expenses Salaries and wages Bad debts Provision for doubtful debts Loan from M. Money Capitals: Shoes Socks Current accounts: Shoes Socks Drawings: Shoes Book Dr. $ 80,000 4,100 30,700 3,065 31,370 105,000 1,705 310 1,950 2,380 28,904.50 816 15900 14,100 320,300.5 Cr $ 2,100 13,295 181,555.50 700 32,500 50,000 37,500 2,050 600 320,300.5 i. Stock, 31 December 2008, $35,105 ii. Expenses to be accrued: Office Expenses $107.50; Wages $360 iii. Depreciate fixtures 15 percent on reducing balance basis, buildings $2,500 iv. Reduce provision for doubtful debts to $625 v. Partnership salary: $15,000 to Shoes. Not yet entered vi. Interest on drawings: Shoes $450; Socks $300 vii. Interest on capital account balances at 5 percent Required: Prepare a trading and profit and loss appropriation account for the year ended 31 Dec. 2008 and a balance sheet extract showing the Financing of the business as of that date. (Total 20 marks)

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Opening Stock Purchase Less Discount a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started