Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Should Peoples Federal Savings have hedged its September 1 savings certificate rollover? What would you have advised Mr. Myers to do on August 6? How

- Should Peoples Federal Savings have hedged its September 1 savings certificate rollover?

- What would you have advised Mr. Myers to do on August 6?

- How should Mr. Myers explain his future losses to the board on August 27?

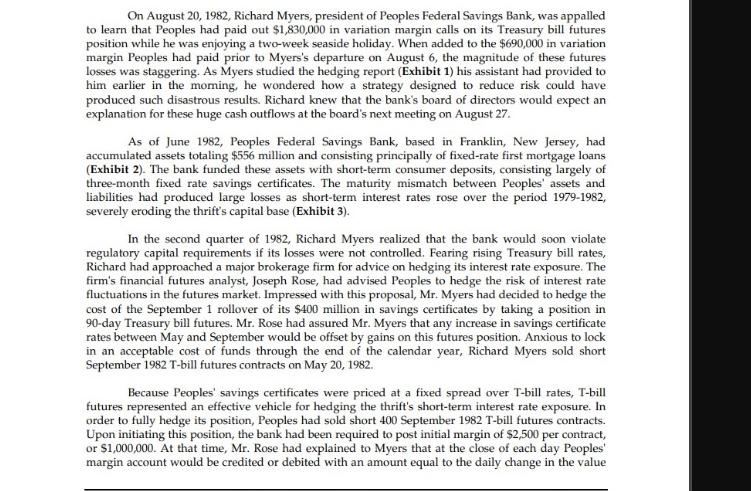

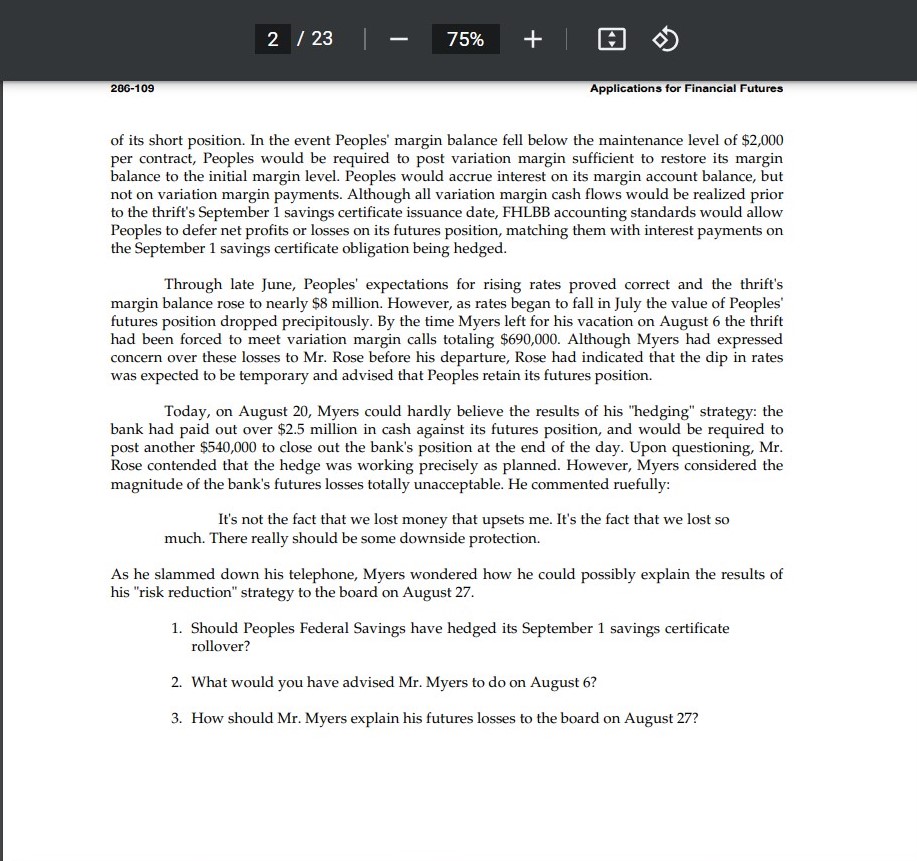

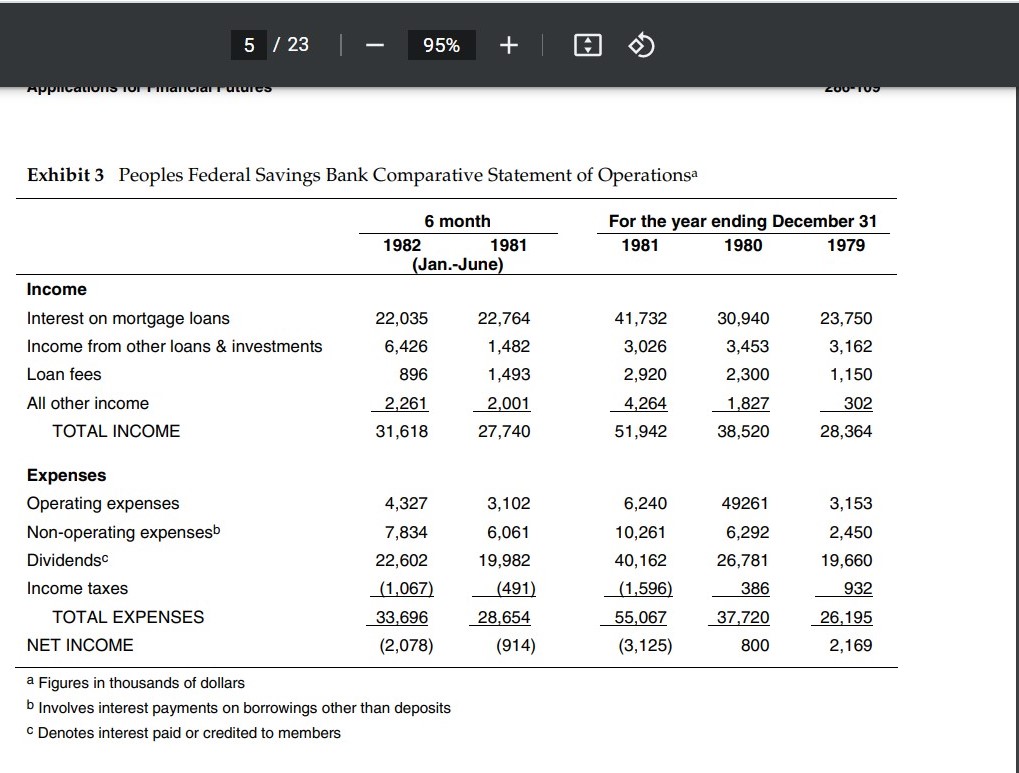

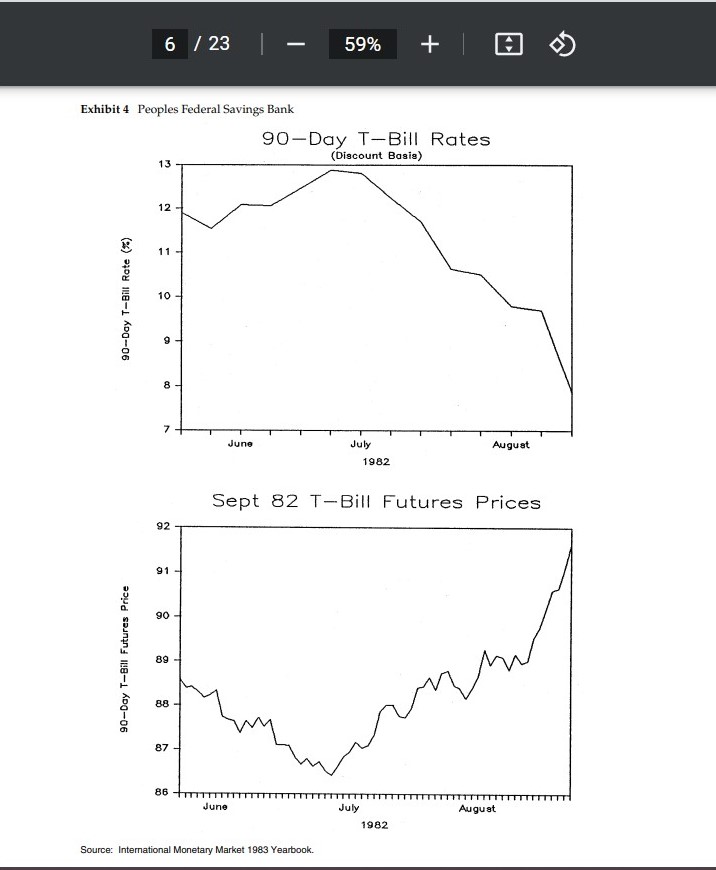

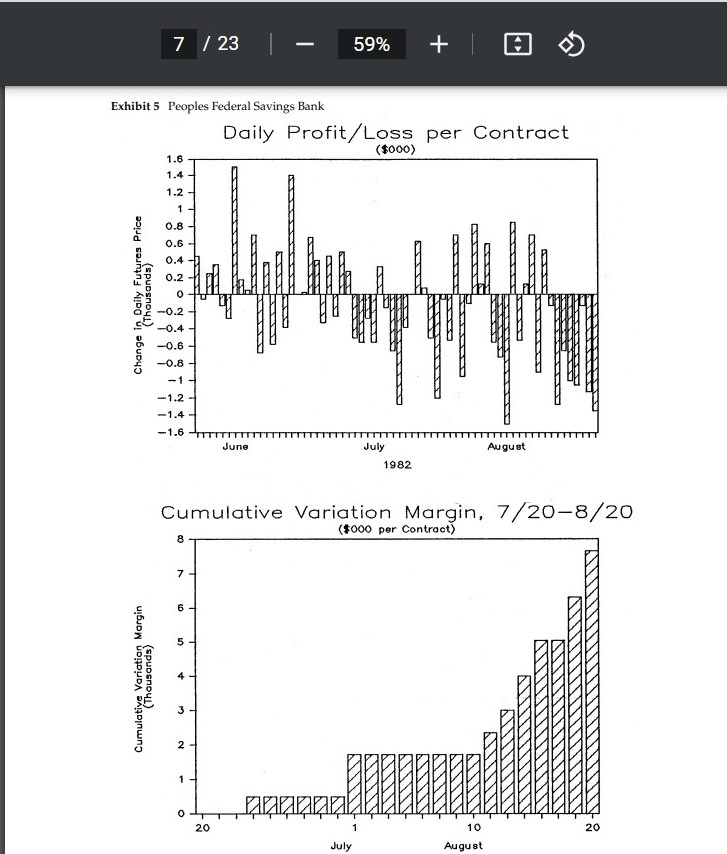

On August 20, 1982, Richard Myers, president of Peoples Federal Savings Bank, was appalled to learn that Peoples had paid out $1,830,000 in variation margin calls on its Treasury bill futures position while he was enjoying a two-week seaside holiday. When added to the $690,000 in variation margin Peoples had paid prior to Myers's departure on August 6, the magnitude of these futures losses was staggering. As Myers studied the hedging report (Exhibit 1) his assistant had provided to him earlier in the morning, he wondered how a strategy designed to reduce risk could have produced such disastrous results. Richard knew that the bank's board of directors would expect an explanation for these huge cash outflows at the board's next meeting on August 27. As of June 1982, Peoples Federal Savings Bank, based in Franklin, New Jersey, had accumulated assets totaling $556 million and consisting principally of fixed-rate first mortgage loans (Exhibit 2). The bank funded these assets with short-term consumer deposits, consisting largely of three-month fixed rate savings certificates. The maturity mismatch between Peoples' assets and liabilities had produced large losses as short-term interest rates rose over the period 1979-1982, severely eroding the thrift's capital base (Exhibit 3). In the second quarter of 1982, Richard Myers realized that the bank would soon violate regulatory capital requirements if its losses were not controlled. Fearing rising Treasury bill rates, Richard had approached a major brokerage firm for advice on hedging its interest rate exposure. The firm's financial futures analyst, Joseph Rose, had advised Peoples to hedge the risk of interest rate fluctuations in the futures market. Impressed with this proposal, Mr. Myers had decided to hedge the cost of the September 1 rollover of its $400 million in savings certificates by taking a position in 90-day Treasury bill futures. Mr. Rose had assured Mr. Myers that any increase in savings certificate rates between May and September would be offset by gains on this futures position. Anxious to lock in an acceptable cost of funds through the end of the calendar year, Richard Myers sold short September 1982 T-bill futures contracts on May 20, 1982. Because Peoples' savings certificates were priced at a fixed spread over T-bill rates, T-bill futures represented an effective vehicle for hedging the thrift's short-term interest rate exposure. In order to fully hedge its position, Peoples had sold short 400 September 1982 T-bill futures contracts. Upon initiating this position, the bank had been required to post initial margin of $2,500 per contract, or $1,000,000. At that time, Mr. Rose had explained to Myers that at the close of each day Peoples' margin account would be credited or debited with an amount equal to the daily change in the value

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here is an analysis of the case through stepbystep calculations 1 Peoples had 400 million in savings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started