show all steps for study purposes

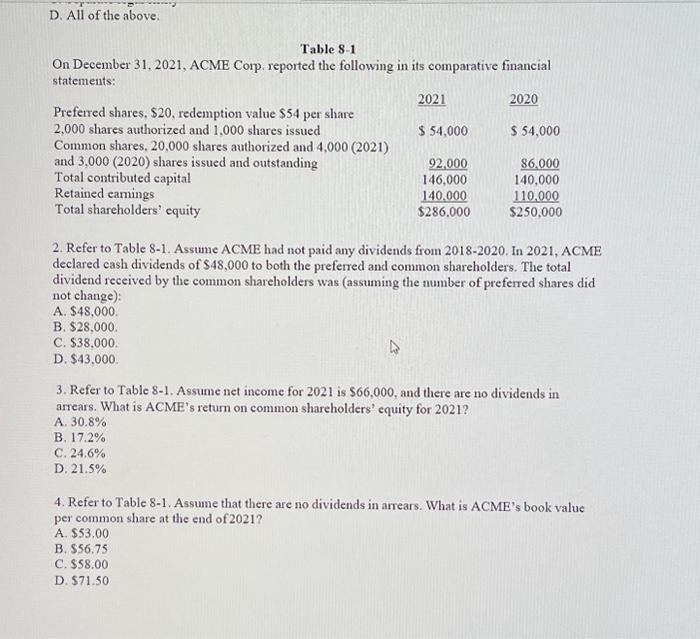

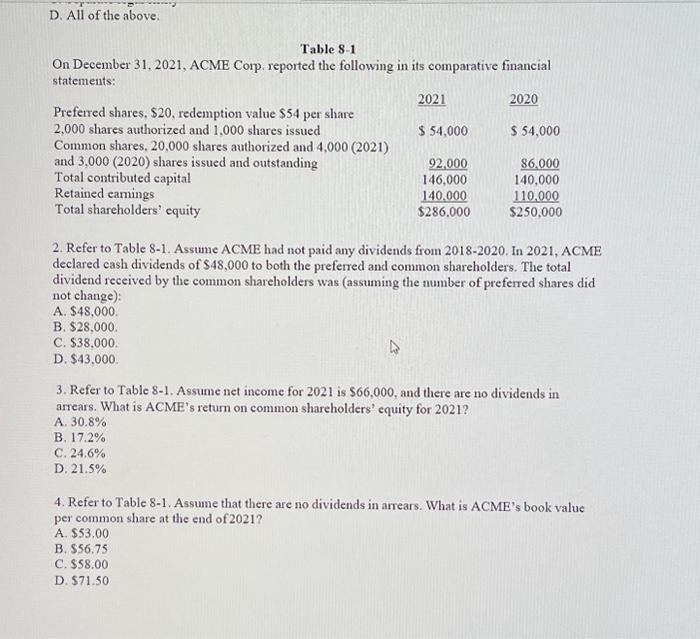

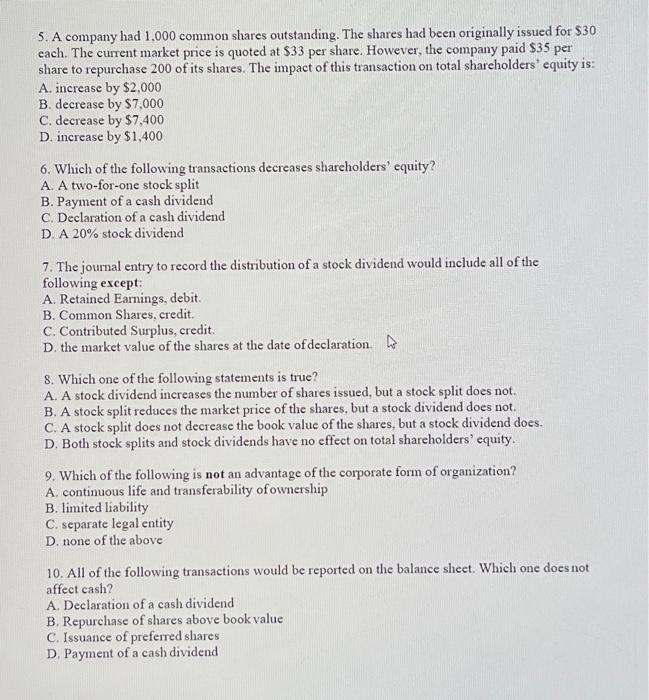

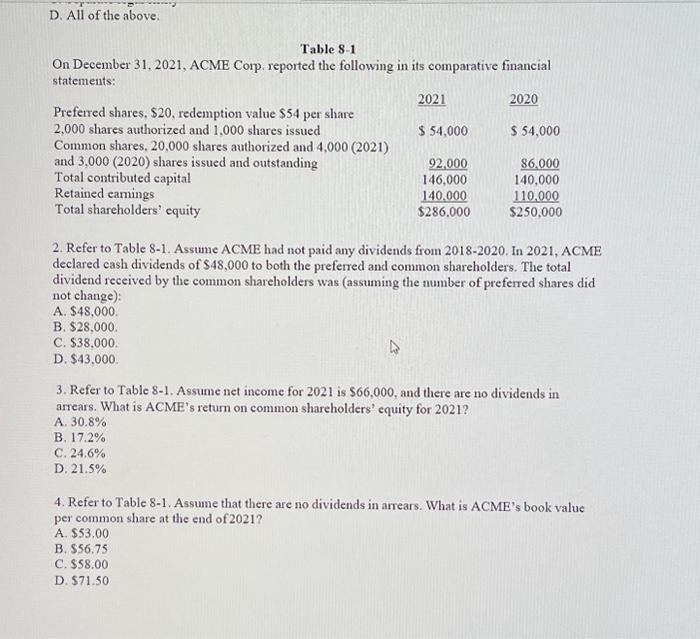

Table 8-1 On December 31, 2021, ACME Corp. reported the following in its comparative financial statements: 2. Refer to Table 8-1. Assume ACME had not paid any dividends from 2018-2020. In 2021, ACME declared cash dividends of $48,000 to both the preferred and common shareholders. The total dividend received by the common shareholders was (assuming the number of preferred shares did not change): A. $48,000. B. $28,000. C. $38,000. D. $43,000. 3. Refer to Table 81. Assume net income for 2021 is $66,000, and there are no dividends in arrears. What is ACME's return on common shareholders' equity for 2021 ? A. 30.8% B. 17.2% C. 24.6% D. 21.5% 4. Refer to Table 8-1. Assume that there are no dividends in arrears. What is ACME's book value per common share at the end of 2021 ? A. $53.00 B. $56.75 C. $58.00 D. $71.50 5. A company had 1,000 common shares outstanding. The shares had been originally issued for $30 each. The current market price is quoted at $33 per share. However, the company paid $35 per share to repurchase 200 of its shares. The impact of this transaction on total shareholders' equity is: A. increase by $2,000 B. decrease by $7,000 C. decrease by $7,400 D. increase by $1,400 6. Which of the following transactions decreases shareholders' equity? A. A two-for-one stock split B. Payment of a cash dividend C. Declaration of a cash dividend D. A 20% stock dividend 7. The journal entry to record the distribution of a stock dividend would include all of the following except: A. Retained Earnings, debit. B. Common Shares, credit. C. Contributed Surplus, credit. D. the market value of the shares at the date of declaration. 8. Which one of the following statements is true? A. A stock dividend increases the number of shares issued, but a stock split does not. B. A stock split reduces the market price of the shares, but a stock dividend does not. C. A stock split does not decrease the book value of the shares, but a stock dividend does. D. Both stock splits and stock dividends have no effect on total shareholders' equity. 9. Which of the following is not an advantage of the corporate form of organization? A. continuous life and transferability of ownership B. limited liability C. separate legal entity D. none of the above 10. All of the following transactions would be reported on the balance sheet. Which one does not affect cash? A. Declaration of a cash dividend B. Repurchase of shares above book value C. Issuance of preferred shares D. Payment of a cash dividend