Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all with calculation and working in details Question 1 1. An investment centre in a manufacturing group produced the following results in the previous

Show all with calculation and working in details

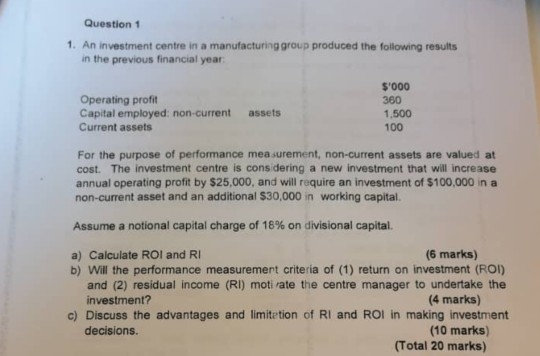

Question 1 1. An investment centre in a manufacturing group produced the following results in the previous financial year s'000 360 1,500 100 Operating profit Capital employed: non-current assets Current assets For the purpose of performance mea surement, non-current assets are valued at cost. The investment centre is cons dering a new investment that will increase annual operating profit by $25,000, and will require an investment of $100,000 in a non-current asset and an additional $30,000 in working capital. Assume a notional capital charge of 18% on divisional capital. (6 marks) a) Calculate ROI and RI b) Will the performance measuremert criteria of (1) return on investment (ROI) and (2) residual income (RI) moti rate the centre manager to undertake the investment? (4 marks) c) Discuss the advantages and limitetion of RI and ROI in making investment (10 marks) (Total 20 marks) decisions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started