Question

Show all work. 1. What is: a) the Operating Cash Flow for 2016? b) the change in Net Working Capital for 2016? c) Capital Spending

Show all work.

1. What is:

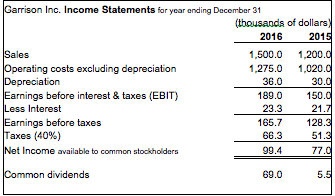

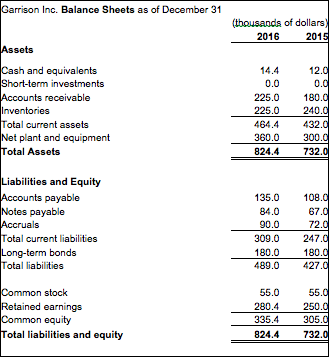

a) the Operating Cash Flow for 2016?

b) the change in Net Working Capital for 2016?

c) Capital Spending for 2016?

d) the Free Cash Flow (or Cash Flow from Assets) for 2016?

2. Calculate the financial ratio for Garrison Inc. for 16. The industry standard is provided in brackets. Also please comment on how Garrison Inc. fairs to the industry average.

a) Quick Ratio (Acid Test) {Industry average 1.3}

b) Day Sales in Receivables (also known as Average Collection Period) {Industry average 42}

c) Profit Margin {Industry average 5%}

d) Return on Common Equity (ROE) {Industry average 17%}

n Inc. Income Statements for year ending December 31 (thousands of dollans 2016 201 1,500.0 1,200 1,275.0 1,020 rating costs excluding depreciation preciation 36.0 189.0 23.3 165.7 66.3 99.4 s before interest& taxes (EBIT) 150 21 128 51 ess Interest s before taxes axes (40%) t Income available to common stockholders n dividends 69.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started