Show all work

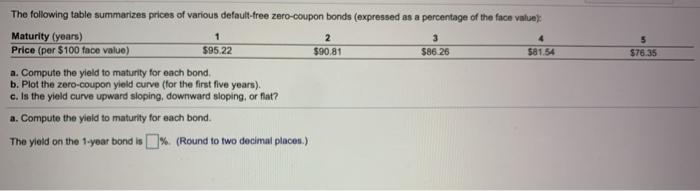

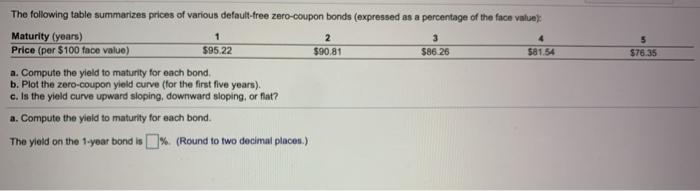

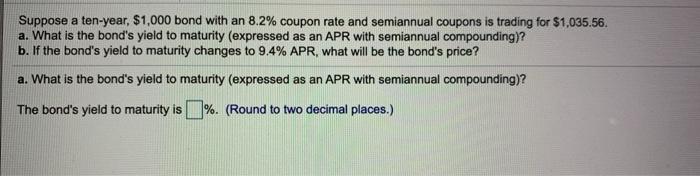

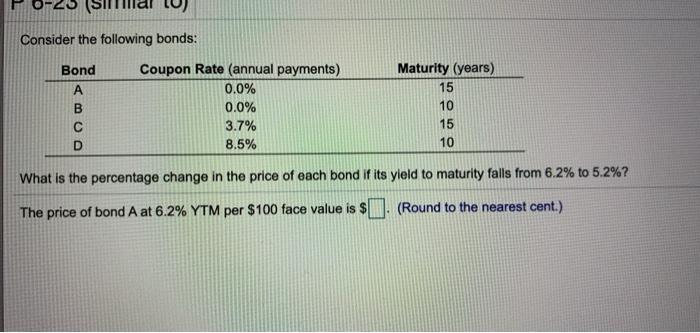

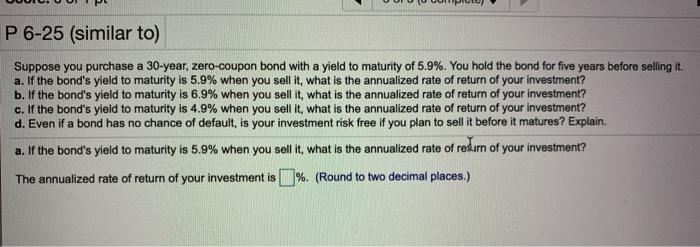

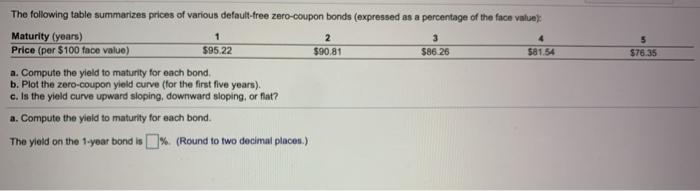

2 3 $81.54 $76.35 The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value); Maturity (years) Price (per $100 face value) $95.22 $90.81 $86.26 a. Compute the yield to maturity for each bond, b. Plot the zero-coupon yield curve (for the first five years) C. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is % (Round to two decimal places) Suppose a ten-year. $1,000 bond with an 8.2% coupon rate and semiannual coupons is trading for $1.035.56. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.4% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The bond's yield to maturity is %. (Round to two decimal places.) Question Help Suppose you purchase a 10-year bond with 6.5% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 5.4% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the annual rate of return of your investment? a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below.) OA. Year 0 1 2 3 Cash Flows -$112.01 $6,50 $6.50 $6.50 $105,51 OB. Year 0 1 2 3 Cash Flows $108.33 $6.50 $6.50 $8.50 $112.01 2 3 4 0 1 O c. Year $6.50 $112.01 Cash Flows $6.50 $6.50 - $108.33 Consider the following bonds: Bond A B D Coupon Rate (annual payments) 0.0% 0.0% 3.7% 8.5% Maturity (years) 15 10 15 10 What is the percentage change in the price of each bond if its yield to maturity falls from 6.2% to 5.2%? The price of bond A at 6.2% YTM per $100 face value is $ (Round to the nearest cent.) P 6-25 (similar to) Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 5.9%. You hold the bond for five years before selling it. a. If the bond's yield to maturity is 5.9% when you sell it, what is the annualized rate of return of your investment? b. If the bond's yield to maturity is 6.9% when you sell it, what is the annualized rate of return of your investment? c. If the bond's yield to maturity is 4.9% when you sell it, what is the annualized rate of return of your investment? d. Even if a bond has no chance of default is your investment risk free if you plan to sell it before it matures? Explain. a. If the bond's yield to maturity is 5.9% when you sell it, what is the annualized rate of return of your investment? The annualized rate of return of your investment is %. (Round to two decimal places.)