Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all work 4. (7 pts) BSM Option Pricing Model and Hedging. Assume that you are an option market marker and hold a short position

show all work

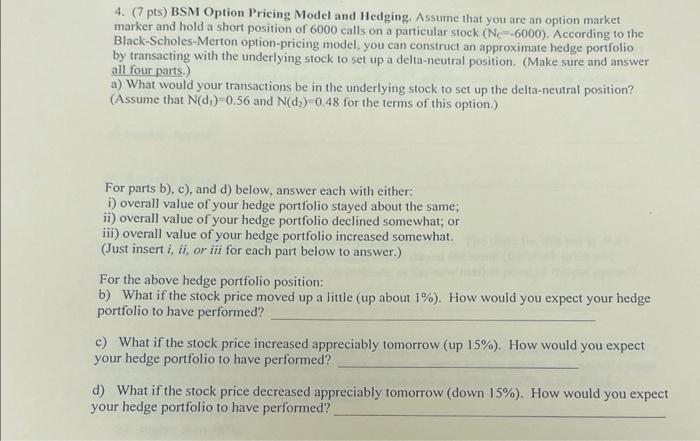

4. (7 pts) BSM Option Pricing Model and Hedging. Assume that you are an option market marker and hold a short position of 6000 calls on a particular stock (NC=6000). According to the Black-Scholes-Merton option-pricing model, you can construct an approximate hedge portfolio by transacting with the underlying stock to set up a delta-neutral position. (Make sure and answer all four parts.) a) What would your transactions be in the underlying stock to set up the delta-neutral position? (Assume that N(d1)=0.56 and N(d2)=0.48 for the terms of this option.) For parts b), c), and d) below, answer each with either: i) overall value of your hedge portfolio stayed about the same; ii) overall value of your hedge portfolio declined somewhat; or iii) overall value of your hedge portfolio increased somewhat. (Just insert i, ii, or iii for each part below to answer.) For the above hedge portfolio position: b) What if the stock price moved up a little (up about 1% ). How would you expect your hedge portfolio to have performed? c) What if the stock price increased appreciably tomorrow (up 15\%). How would you expect your hedge portfolio to have performed? d) What if the stock price decreased appreciably tomorrow (down 15\%). How would you expect your hedge portfolio to have performed? 4. (7 pts) BSM Option Pricing Model and Hedging. Assume that you are an option market marker and hold a short position of 6000 calls on a particular stock (NC=6000). According to the Black-Scholes-Merton option-pricing model, you can construct an approximate hedge portfolio by transacting with the underlying stock to set up a delta-neutral position. (Make sure and answer all four parts.) a) What would your transactions be in the underlying stock to set up the delta-neutral position? (Assume that N(d1)=0.56 and N(d2)=0.48 for the terms of this option.) For parts b), c), and d) below, answer each with either: i) overall value of your hedge portfolio stayed about the same; ii) overall value of your hedge portfolio declined somewhat; or iii) overall value of your hedge portfolio increased somewhat. (Just insert i, ii, or iii for each part below to answer.) For the above hedge portfolio position: b) What if the stock price moved up a little (up about 1% ). How would you expect your hedge portfolio to have performed? c) What if the stock price increased appreciably tomorrow (up 15\%). How would you expect your hedge portfolio to have performed? d) What if the stock price decreased appreciably tomorrow (down 15\%). How would you expect your hedge portfolio to have performed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started