Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all work. Trying to study and learn from this. Please explain: Taxpayer A Transfers Land Adj Basis $20,000 -FMV $100,000 In Exchange for: 100%

Show all work. Trying to study and learn from this. Please explain:

Taxpayer A Transfers Land Adj Basis $20,000 -FMV $100,000

In Exchange for: 100% of New Corp Stock (NC) Plus - $ 20,000 Cash - $ 20,000 Other Property

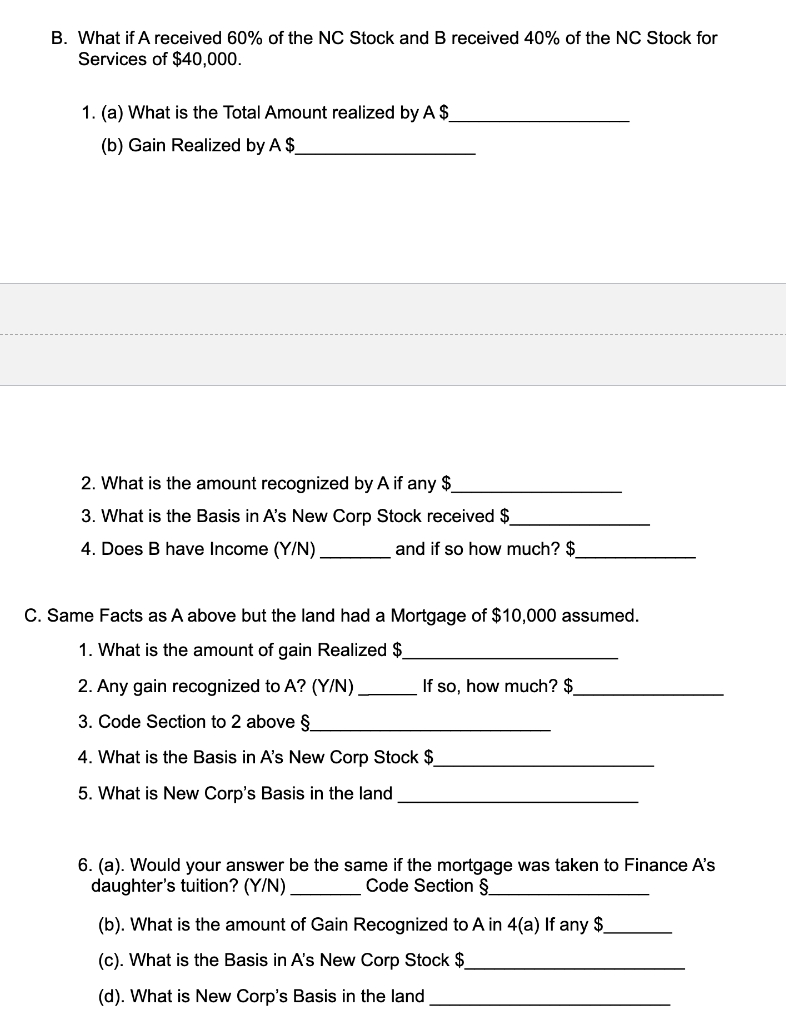

B. What if A received 60% of the NC Stock and B received 40% of the NC Stock for Services of $40,000. 1. (a) What is the Total Amount realized by A$ (b) Gain Realized by A$ 2. What is the amount recognized by A if any $ 3. What is the Basis in A's New Corp Stock received \$ 4. Does B have Income (Y/N) and if so how much? \$ C. Same Facts as A above but the land had a Mortgage of $10,000 assumed. 1. What is the amount of gain Realized $ 2. Any gain recognized to A ? (Y/N) If so, how much? \$ 3. Code Section to 2 above 4. What is the Basis in A's New Corp Stock \$ 5. What is New Corp's Basis in the land 6. (a). Would your answer be the same if the mortgage was taken to Finance A's daughter's tuition? ( Y/N) Code Section (b). What is the amount of Gain Recognized to A in 4(a) If any $ (c). What is the Basis in A's New Corp Stock \$ (d). What is New Corp's Basis in the land B. What if A received 60% of the NC Stock and B received 40% of the NC Stock for Services of $40,000. 1. (a) What is the Total Amount realized by A$ (b) Gain Realized by A$ 2. What is the amount recognized by A if any $ 3. What is the Basis in A's New Corp Stock received \$ 4. Does B have Income (Y/N) and if so how much? \$ C. Same Facts as A above but the land had a Mortgage of $10,000 assumed. 1. What is the amount of gain Realized $ 2. Any gain recognized to A ? (Y/N) If so, how much? \$ 3. Code Section to 2 above 4. What is the Basis in A's New Corp Stock \$ 5. What is New Corp's Basis in the land 6. (a). Would your answer be the same if the mortgage was taken to Finance A's daughter's tuition? ( Y/N) Code Section (b). What is the amount of Gain Recognized to A in 4(a) If any $ (c). What is the Basis in A's New Corp Stock \$ (d). What is New Corp's Basis in the land

B. What if A received 60% of the NC Stock and B received 40% of the NC Stock for Services of $40,000. 1. (a) What is the Total Amount realized by A$ (b) Gain Realized by A$ 2. What is the amount recognized by A if any $ 3. What is the Basis in A's New Corp Stock received \$ 4. Does B have Income (Y/N) and if so how much? \$ C. Same Facts as A above but the land had a Mortgage of $10,000 assumed. 1. What is the amount of gain Realized $ 2. Any gain recognized to A ? (Y/N) If so, how much? \$ 3. Code Section to 2 above 4. What is the Basis in A's New Corp Stock \$ 5. What is New Corp's Basis in the land 6. (a). Would your answer be the same if the mortgage was taken to Finance A's daughter's tuition? ( Y/N) Code Section (b). What is the amount of Gain Recognized to A in 4(a) If any $ (c). What is the Basis in A's New Corp Stock \$ (d). What is New Corp's Basis in the land B. What if A received 60% of the NC Stock and B received 40% of the NC Stock for Services of $40,000. 1. (a) What is the Total Amount realized by A$ (b) Gain Realized by A$ 2. What is the amount recognized by A if any $ 3. What is the Basis in A's New Corp Stock received \$ 4. Does B have Income (Y/N) and if so how much? \$ C. Same Facts as A above but the land had a Mortgage of $10,000 assumed. 1. What is the amount of gain Realized $ 2. Any gain recognized to A ? (Y/N) If so, how much? \$ 3. Code Section to 2 above 4. What is the Basis in A's New Corp Stock \$ 5. What is New Corp's Basis in the land 6. (a). Would your answer be the same if the mortgage was taken to Finance A's daughter's tuition? ( Y/N) Code Section (b). What is the amount of Gain Recognized to A in 4(a) If any $ (c). What is the Basis in A's New Corp Stock \$ (d). What is New Corp's Basis in the land Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started