Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all work/explanations for full credit ! Tom's gross pay for the week is $800. Tom's yearly pay is under the limit for OASDI. Assume

Show all work/explanations for full credit !

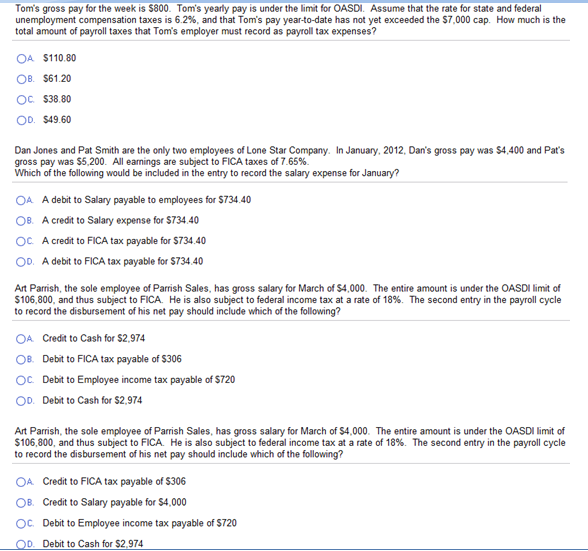

Tom's gross pay for the week is $800. Tom's yearly pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6.2%, and that Tom's pay year-to-date has not yet exceeded the $7,000 cap. How much is the total amount of payroll taxes that Tom's employer must record as payroll tax expenses? $110.80 $61.20 $38.80 $49.60 Dan Jones and Pat Smith are the only two employees of Lone Star Company. In January, 2012, Dan's gross pay was $4,400 and Pat's gross pay was $5,200. All earnings are subject to FICA taxes of 7.65%. Which of the following would be included in the entry to record the salary expense for January? A debit to Salary payable to employees for $734.40 A credit to Salary expense for $734.40 A credit to FICA tax payable for $734.40 A debit to FICA tax payable for $734.40 Art Parrish, the sole employee of Parrish Sales, has gross salary for March of $4,000. The entire amount is under the OASDI limit of $106,800, and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. The second entry in the payroll cycle to record the disbursement of his net pay should include which of the following? Credit to Cash for $2,974 Debit to FICA tax payable of $306 Debit to Employee income tax payable of $720 Debit to Cash for $2,974 Art Parrish, the sole employee of Parrish Sales, has gross salary for March of $4,000. The entire amount is under the OASDI limit of $106,800, and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. The second entry in the payroll cycle to record the disbursement of his net pay should include which of the following? Credit to FICA tax payable of $306 Credit to Salary payable for $4,000 Debit to Employee income tax payable of $720 Debit to Cash for $2,974Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started