Answered step by step

Verified Expert Solution

Question

1 Approved Answer

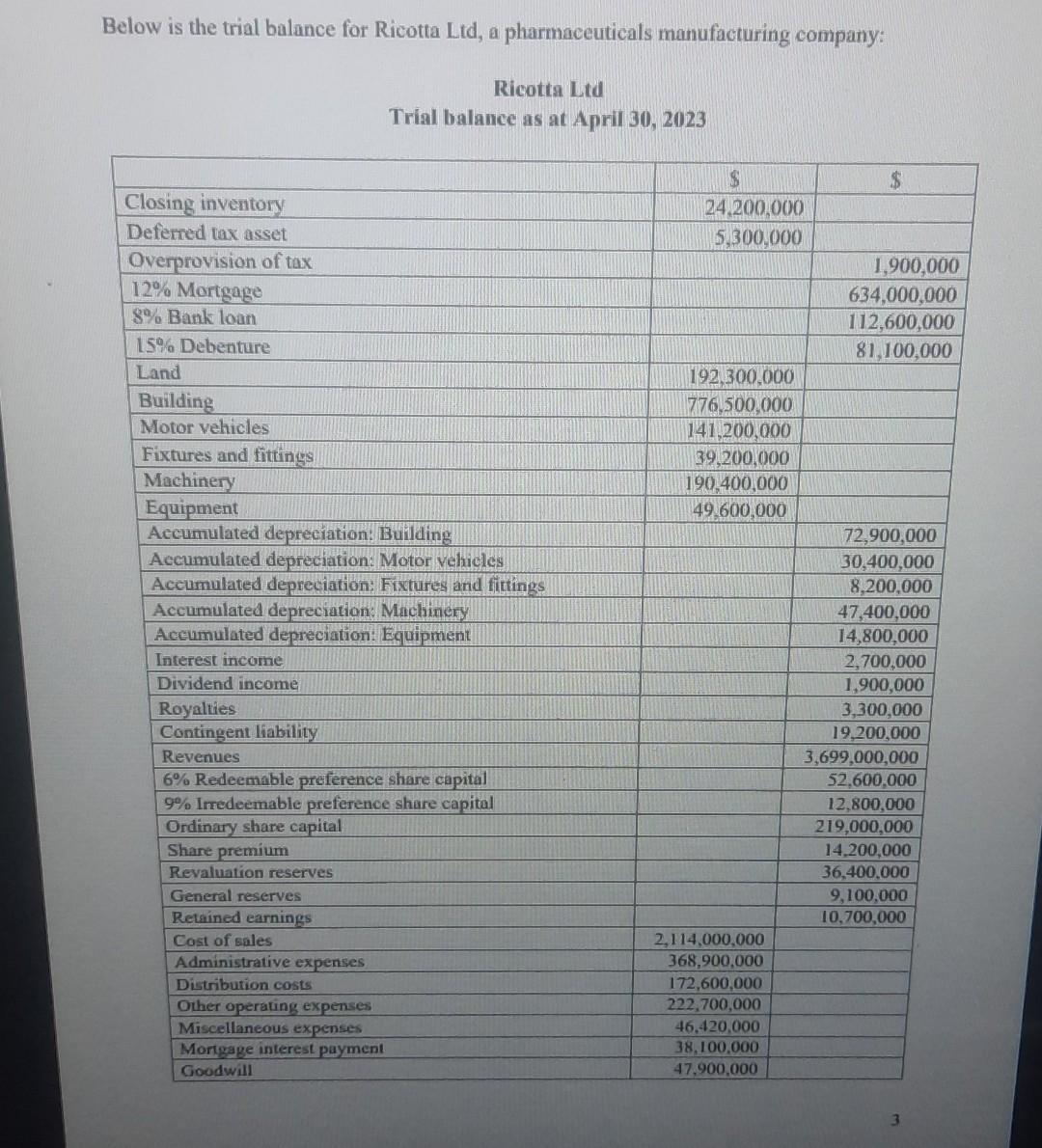

show all workings and journal entries for all Below is the trial balance for Ricotta Ltd, a pharmaceuticals manufacturing company: Property, plant and equipment After

show all workings and journal entries for all

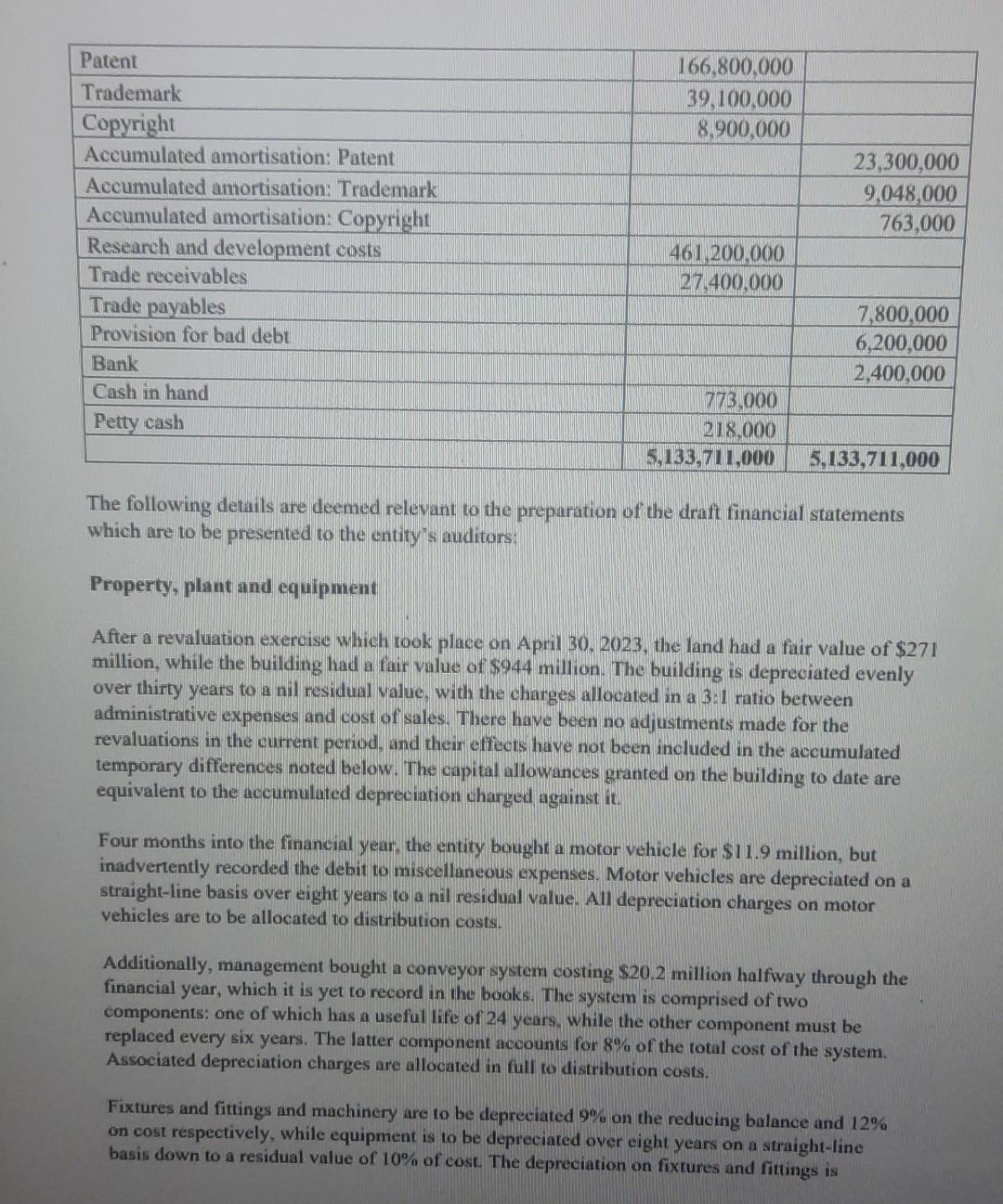

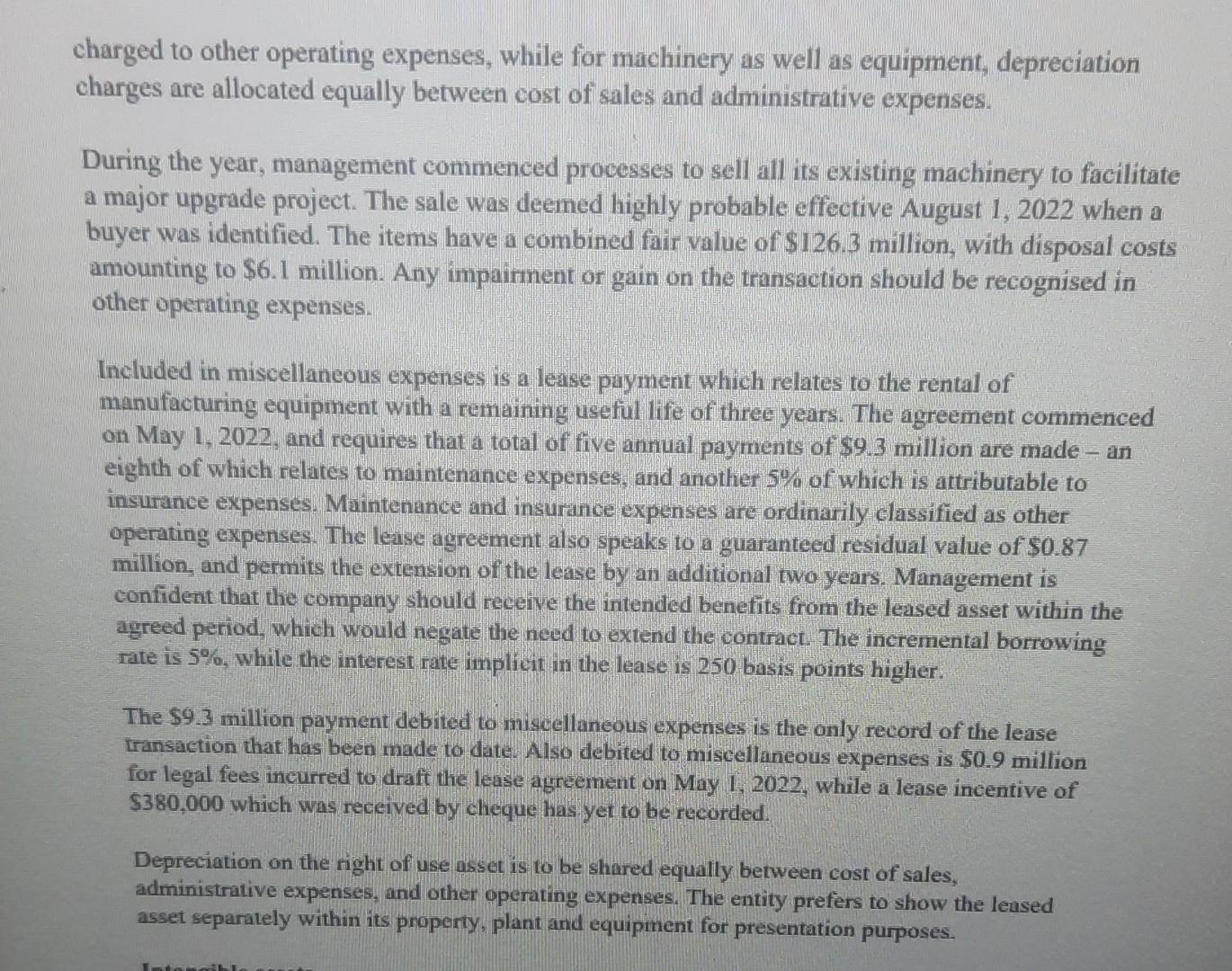

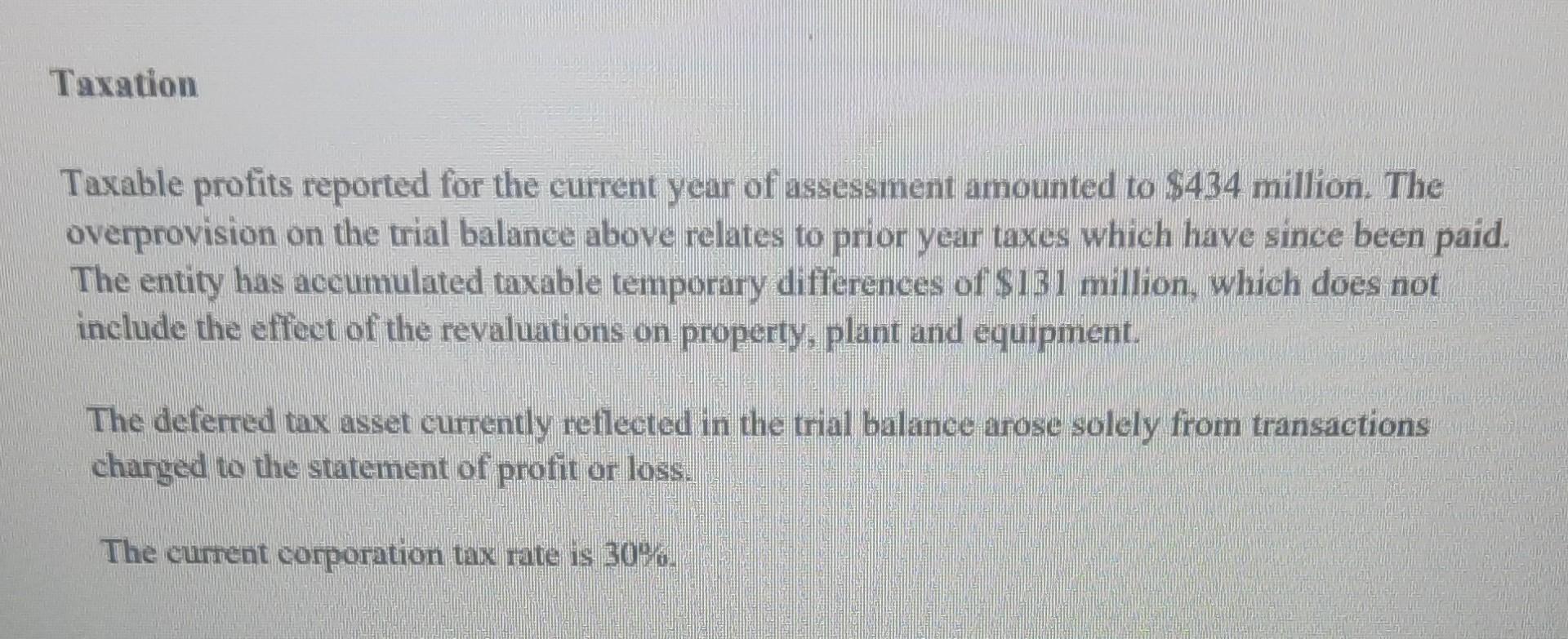

Below is the trial balance for Ricotta Ltd, a pharmaceuticals manufacturing company: Property, plant and equipment After a revaluation excercise which took place on April 30, 2023, the land had a fair value of $271 million, while the building had a fair value of $944 million. The building is depreciated evenly over thirty years to a nil residual value, with the charges allocated in a 3:1 ratio between administrative expenses and cost of sales. There have been no adjustments made for the revaluations in the current period, and their effects have not been included in the accumulated temporary differences noted below. The capital allowances granted on the building to date are equivalent to the accumulated depreciation charged against it. Four months into the financial year, the entity bought a motor vehicle for $11.9 million, but inadvertently recorded the debit to miscellaneous expenses. Motor vehicles are depreciated on a straight-line basis over eight years to a nil residual value. All depreciation charges on motor vehicles are to be allocated to distribution costs. Additionally, management bought a conveyor system costing \$20.2 million halfivay through the financial year, which it is yet to record in the books. The system is comprised of two components: one of which has a useful life of 24 years, while the other component must be replaced every six years. The latter component accounts for 8% of the total cost of the system. Associated depreciation charges are allocated in full to distribution costs. Fixtures and fittings and machinery are to be depreciated 9% on the reducing balance and 12% on cost respectively, while equipment is to be depreciated over eight years on a straight-line basis down to a residual value of 10% of cost. The depreciation on fixtures and fittings is charged to other operating expenses, while for machinery as well as equipment, depreciation charges are allocated equally between cost of sales and administrative expenses. During the year, management commenced processes to sell all its existing machinery to facilitate a major upgrade project. The sale was deemed highly probable effective August 1, 2022 when a buyer was identified. The items have a combined fair value of $126.3 million, with disposal costs amounting to $6.1 million. Any impairment or gain on the transaction should be recognised in other operating expenses. Included in miscellaneous expenses is a lease payment which relates to the rental of manufacturing equipment with a remaining useful life of three years. The agreement commenced on May 1, 2022, and requires that a total of five annual payments of $9.3 million are made - an eighth of which relates to maintenance expenses, and another 5% of which is attributable to insurance expenses. Maintenance and insurance expenses are ordinarily classified as other operating expenses. The lease agreement also speaks to a guaranteed residual value of $0.87 million, and permits the extension of the lease by an additional two years. Management is confident that the company should reeeive the intended benefits from the leased asset within the agreed period, which would negate the need to extend the contract. The incremental borrowing rate is 5%, while the interest rate implicit in the lease is 250 basis points higher. The $9.3 million payment debited to miscellaneous expenses is the only record of the lease transaction that has been made to date. Also debited to miscellaneous expenses is $0.9 million for legal fees incurred to draft the lease agreement on May 1, 2022, while a lease incentive of $380,000 which was received by cheque has yet to be recorded. Depreciation on the right of use asset is to be shared equally between cost of sales, administrative expenses, and other operating expenses. The entity prefers to show the leased asset separately within its property, plant and equipment for presentation purposes. Taxation Taxable profits reported for the current year of assessment amounted to $434 million. The overprovision on the trial balance above relates to prior year taxes which have since been paid. The entity has accumulated taxable temporary differences of $131 million, which does not include the effect of the revaluations on property, plant and equipment. The deferred tax asset currently reflected in the trial balance arose solely from transactions charged to the statement of profit or loss. The current corporation tax rate is 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started