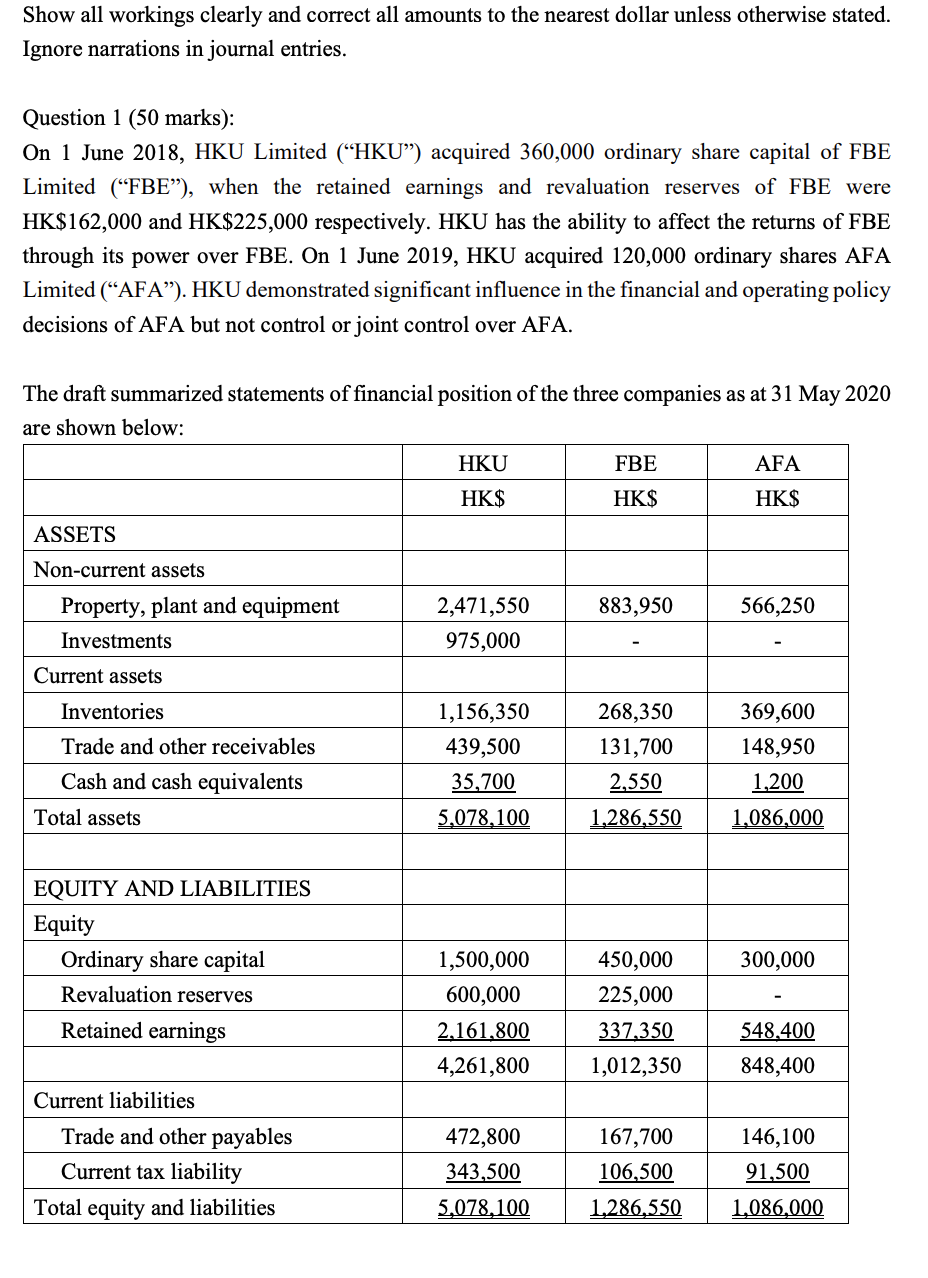

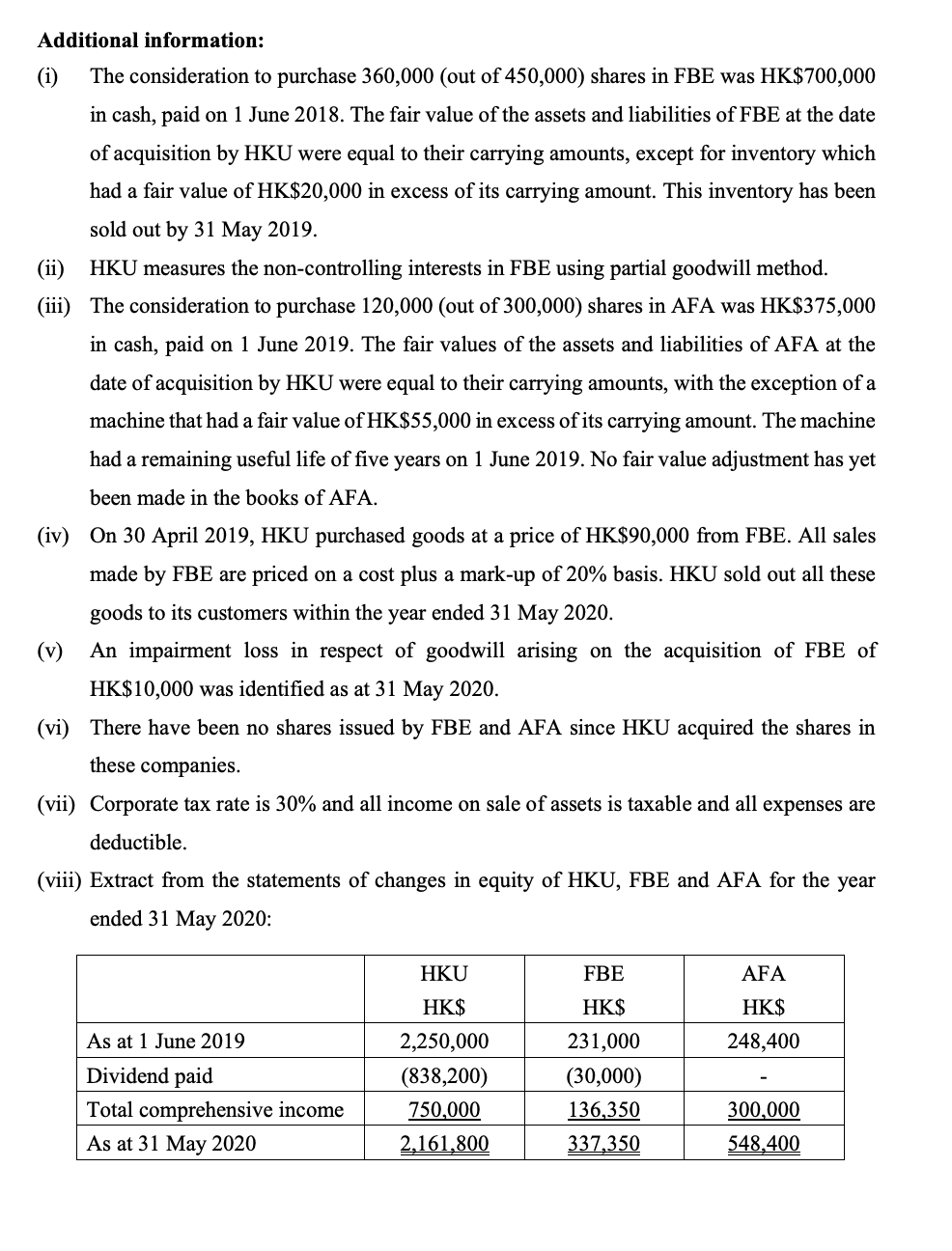

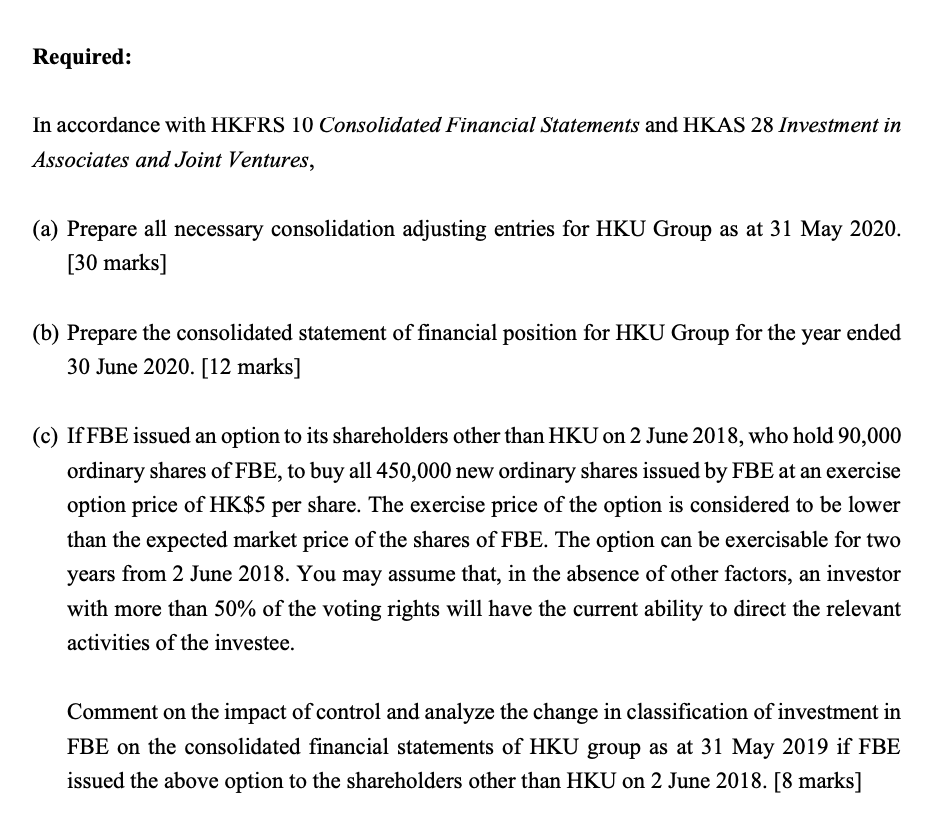

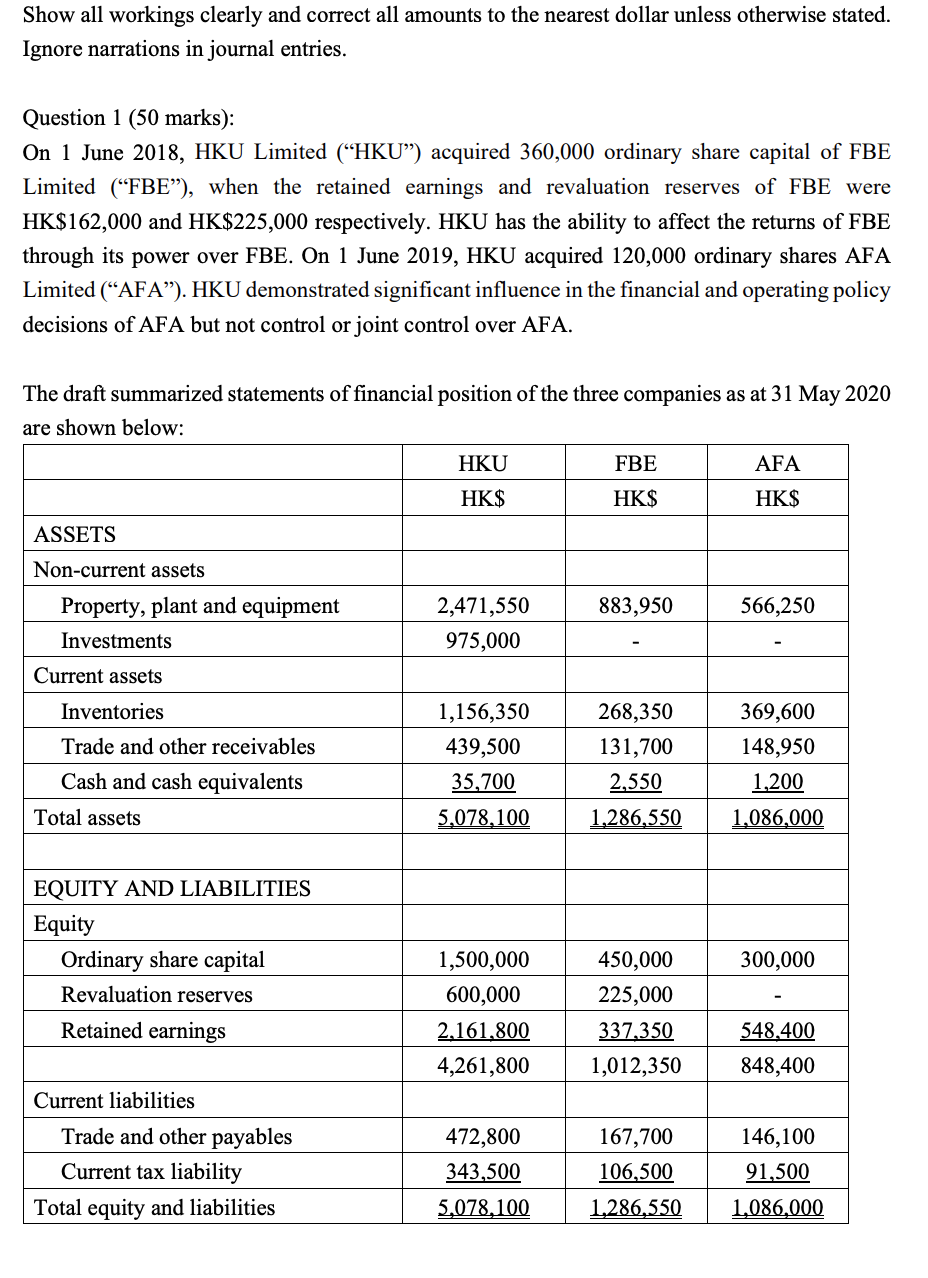

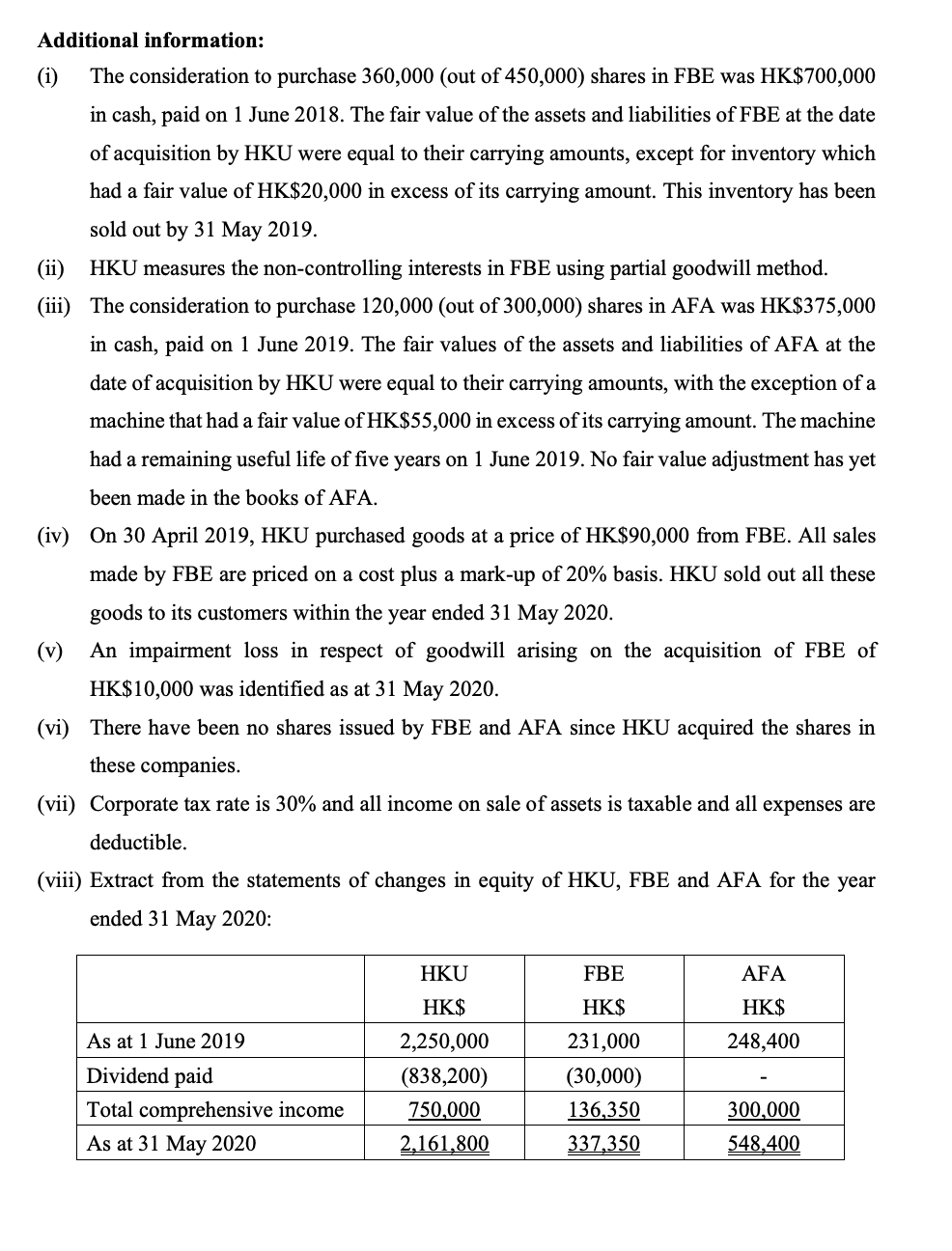

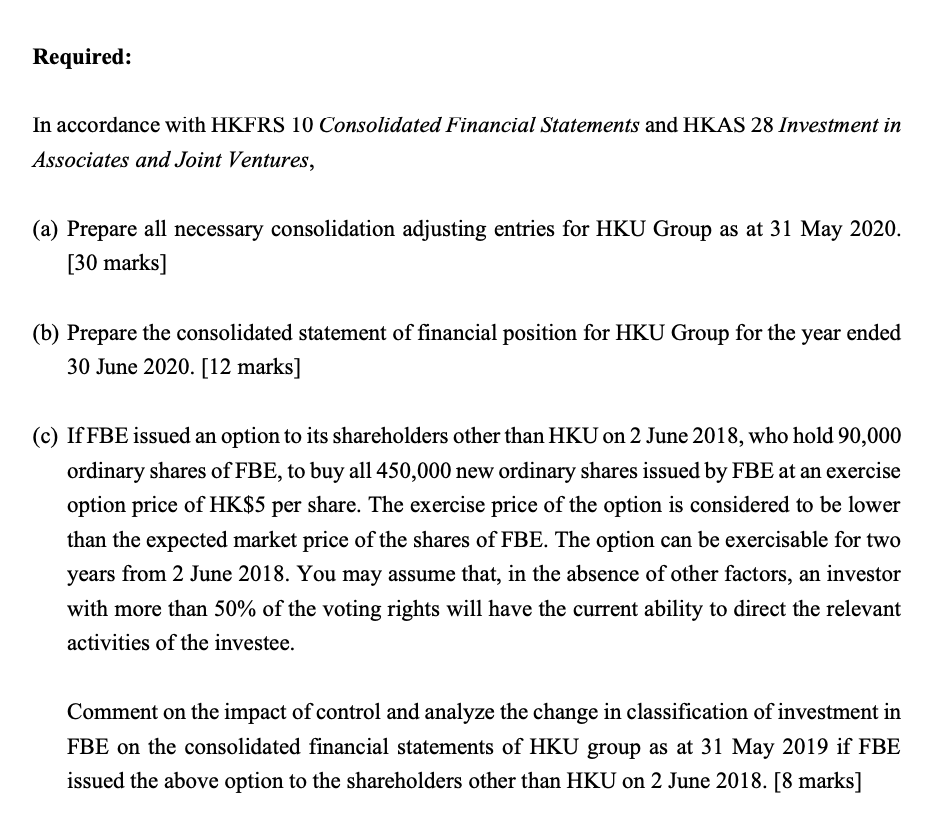

Show all workings clearly and correct all amounts to the nearest dollar unless otherwise stated. Ignore narrations in journal entries. Question 1 (50 marks): On 1 June 2018, HKU Limited (HKU) acquired 360,000 ordinary share capital of FBE Limited (FBE), when the retained earnings and revaluation reserves of FBE were HK$162,000 and HK$225,000 respectively. HKU has the ability to affect the returns of FBE through its power over FBE. On 1 June 2019, HKU acquired 120,000 ordinary shares AFA Limited (AFA). HKU demonstrated significant influence in the financial and operating policy decisions of AFA but not control or joint control over AFA. The draft summarized statements of financial position of the three companies as at 31 May 2020 are shown below: FBE AFA HKU HK$ HK$ HK$ ASSETS Non-current assets Property, plant and equipment Investments 883,950 566,250 2,471,550 975,000 Current assets Inventories Trade and other receivables 1,156,350 439,500 35,700 5,078,100 268,350 131,700 2,550 1,286,550 369,600 148,950 1,200 1,086,000 Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Revaluation reserves Retained earnings 300,000 1,500,000 600,000 2,161,800 4,261,800 450,000 225,000 337,350 548,400 848,400 1,012,350 Current liabilities Trade and other payables Current tax liability Total equity and liabilities 472,800 343,500 5,078,100 167,700 106,500 1,286,550 146,100 91,500 1,086,000 Additional information: (i) The consideration to purchase 360,000 (out of 450,000) shares in FBE was HK$700,000 in cash, paid on 1 June 2018. The fair value of the assets and liabilities of FBE at the date of acquisition by HKU were equal to their carrying amounts, except for inventory which had a fair value of HK$20,000 in excess of its carrying amount. This inventory has been sold out by 31 May 2019. (ii) HKU measures the non-controlling interests in FBE using partial goodwill method. (iii) The consideration to purchase 120,000 (out of 300,000) shares in AFA was HK$375,000 in cash, paid on 1 June 2019. The fair values of the assets and liabilities of AFA at the date of acquisition by HKU were equal to their carrying amounts, with the exception of a machine that had a fair value of HK$55,000 in excess of its carrying amount. The machine had a remaining useful life of five years on 1 June 2019. No fair value adjustment has yet been made in the books of AFA. (iv) On 30 April 2019, HKU purchased goods at a price of HK$90,000 from FBE. All sales made by FBE are priced on a cost plus a mark-up of 20% basis. HKU sold out all these goods to its customers within the year ended 31 May 2020. (v) An impairment loss in respect of goodwill arising on the acquisition of FBE of HK$10,000 was identified as at 31 May 2020. (vi) There have been no shares issued by FBE and AFA since HKU acquired the shares in these companies. (vii) Corporate tax rate is 30% and all income on sale of assets is taxable and all expenses are deductible. (viii) Extract from the statements of changes in equity of HKU, FBE and AFA for the year ended 31 May 2020: FBE HKU HK$ AFA HK$ HK$ As at 1 June 2019 248,400 Dividend paid Total comprehensive income As at 31 May 2020 2,250,000 (838,200) 750,000 2,161,800 231,000 (30,000) 136,350 337,350 300,000 548,400 Required: In accordance with HKFRS 10 Consolidated Financial Statements and HKAS 28 Investment in Associates and Joint Ventures, (a) Prepare all necessary consolidation adjusting entries for HKU Group as at 31 May 2020. [30 marks] (b) Prepare the consolidated statement of financial position for HKU Group for the year ended 30 June 2020. [12 marks] (c) IfFBE issued an option to its shareholders other than HKU on 2 June 2018, who hold 90,000 ordinary shares of FBE, to buy all 450,000 new ordinary shares issued by FBE at an exercise option price of HK$5 per share. The exercise price of the option is considered to be lower than the expected market price of the shares of FBE. The option can be exercisable for two years from 2 June 2018. You may assume that, in the absence of other factors, an investor with more than 50% of the voting rights will have the current ability to direct the relevant activities of the investee. Comment on the impact of control and analyze the change in classification of investment in FBE on the consolidated financial statements of HKU group as at 31 May 2019 if FBE issued the above option to the shareholders other than HKU on 2 June 2018. [8 marks] Show all workings clearly and correct all amounts to the nearest dollar unless otherwise stated. Ignore narrations in journal entries. Question 1 (50 marks): On 1 June 2018, HKU Limited (HKU) acquired 360,000 ordinary share capital of FBE Limited (FBE), when the retained earnings and revaluation reserves of FBE were HK$162,000 and HK$225,000 respectively. HKU has the ability to affect the returns of FBE through its power over FBE. On 1 June 2019, HKU acquired 120,000 ordinary shares AFA Limited (AFA). HKU demonstrated significant influence in the financial and operating policy decisions of AFA but not control or joint control over AFA. The draft summarized statements of financial position of the three companies as at 31 May 2020 are shown below: FBE AFA HKU HK$ HK$ HK$ ASSETS Non-current assets Property, plant and equipment Investments 883,950 566,250 2,471,550 975,000 Current assets Inventories Trade and other receivables 1,156,350 439,500 35,700 5,078,100 268,350 131,700 2,550 1,286,550 369,600 148,950 1,200 1,086,000 Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Revaluation reserves Retained earnings 300,000 1,500,000 600,000 2,161,800 4,261,800 450,000 225,000 337,350 548,400 848,400 1,012,350 Current liabilities Trade and other payables Current tax liability Total equity and liabilities 472,800 343,500 5,078,100 167,700 106,500 1,286,550 146,100 91,500 1,086,000 Additional information: (i) The consideration to purchase 360,000 (out of 450,000) shares in FBE was HK$700,000 in cash, paid on 1 June 2018. The fair value of the assets and liabilities of FBE at the date of acquisition by HKU were equal to their carrying amounts, except for inventory which had a fair value of HK$20,000 in excess of its carrying amount. This inventory has been sold out by 31 May 2019. (ii) HKU measures the non-controlling interests in FBE using partial goodwill method. (iii) The consideration to purchase 120,000 (out of 300,000) shares in AFA was HK$375,000 in cash, paid on 1 June 2019. The fair values of the assets and liabilities of AFA at the date of acquisition by HKU were equal to their carrying amounts, with the exception of a machine that had a fair value of HK$55,000 in excess of its carrying amount. The machine had a remaining useful life of five years on 1 June 2019. No fair value adjustment has yet been made in the books of AFA. (iv) On 30 April 2019, HKU purchased goods at a price of HK$90,000 from FBE. All sales made by FBE are priced on a cost plus a mark-up of 20% basis. HKU sold out all these goods to its customers within the year ended 31 May 2020. (v) An impairment loss in respect of goodwill arising on the acquisition of FBE of HK$10,000 was identified as at 31 May 2020. (vi) There have been no shares issued by FBE and AFA since HKU acquired the shares in these companies. (vii) Corporate tax rate is 30% and all income on sale of assets is taxable and all expenses are deductible. (viii) Extract from the statements of changes in equity of HKU, FBE and AFA for the year ended 31 May 2020: FBE HKU HK$ AFA HK$ HK$ As at 1 June 2019 248,400 Dividend paid Total comprehensive income As at 31 May 2020 2,250,000 (838,200) 750,000 2,161,800 231,000 (30,000) 136,350 337,350 300,000 548,400 Required: In accordance with HKFRS 10 Consolidated Financial Statements and HKAS 28 Investment in Associates and Joint Ventures, (a) Prepare all necessary consolidation adjusting entries for HKU Group as at 31 May 2020. [30 marks] (b) Prepare the consolidated statement of financial position for HKU Group for the year ended 30 June 2020. [12 marks] (c) IfFBE issued an option to its shareholders other than HKU on 2 June 2018, who hold 90,000 ordinary shares of FBE, to buy all 450,000 new ordinary shares issued by FBE at an exercise option price of HK$5 per share. The exercise price of the option is considered to be lower than the expected market price of the shares of FBE. The option can be exercisable for two years from 2 June 2018. You may assume that, in the absence of other factors, an investor with more than 50% of the voting rights will have the current ability to direct the relevant activities of the investee. Comment on the impact of control and analyze the change in classification of investment in FBE on the consolidated financial statements of HKU group as at 31 May 2019 if FBE issued the above option to the shareholders other than HKU on 2 June 2018. [8 marks]