Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all works and answers A 13 t5-year matunity zeto-coupon bond selling at a yield to maturity of 8% (effective annual yieto) has convexity of

show all works and answers

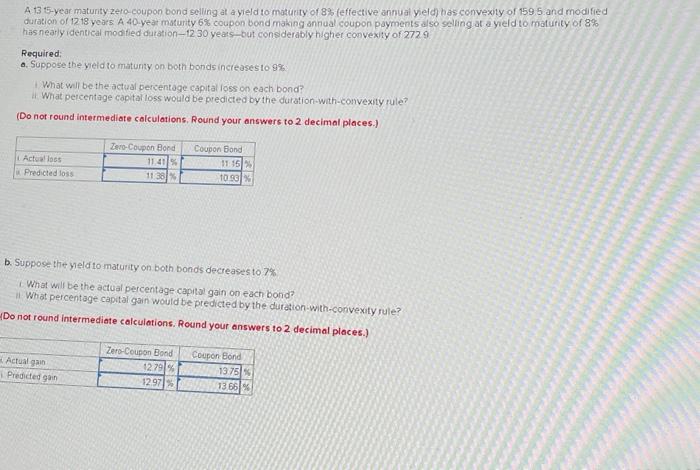

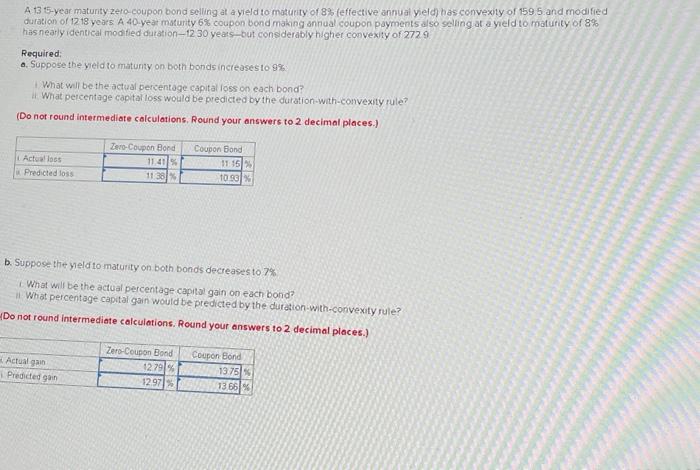

A 13 t5-year matunity zeto-coupon bond selling at a yield to maturity of 8% (effective annual yieto) has convexity of 159.5 and modified duration of 12+18 years. A 40 year maturty 6% coupon bond making annual coupon payments a so selfing at a yiefd to maturity of 8% has nearly identical modied dutation-1230 years-but consderably higher convexity of 2729 Required: a. Suppose the yeld to maturity on both bonds increases 109% What wil be the actual percentoge capital ioss on each bond? 11. What percentage capital loss would be predicted by the duration-with-convexity rule? (Do not round intermediate colculations, Round your answers to 2 decimal places.) b. Suppose the yeld to maturity on both bonds decreases to 7% 1. What will be the actual percentage capitol gain on each band? il What percentage capital gain would be predicted by the durotion-with-convexity rule? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started