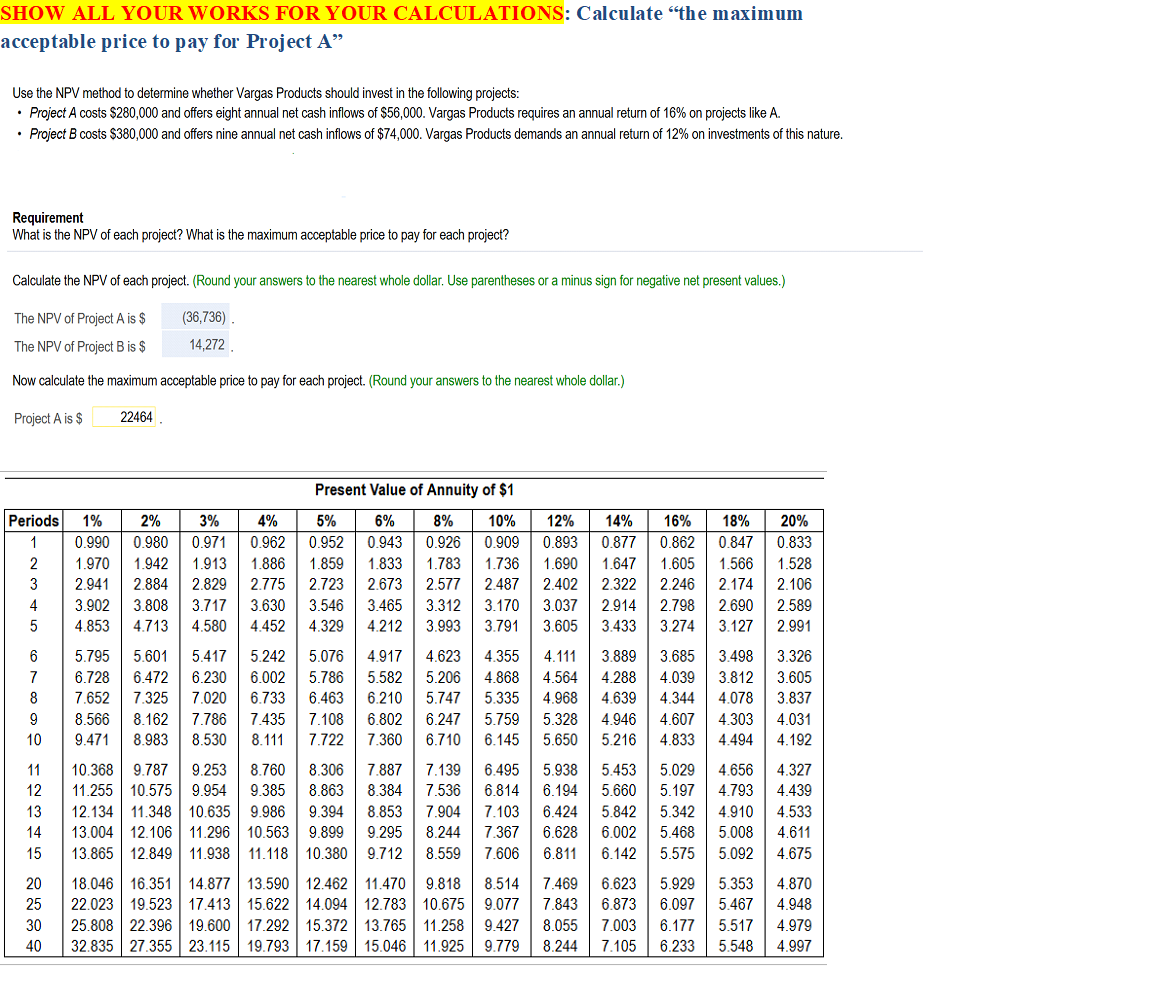

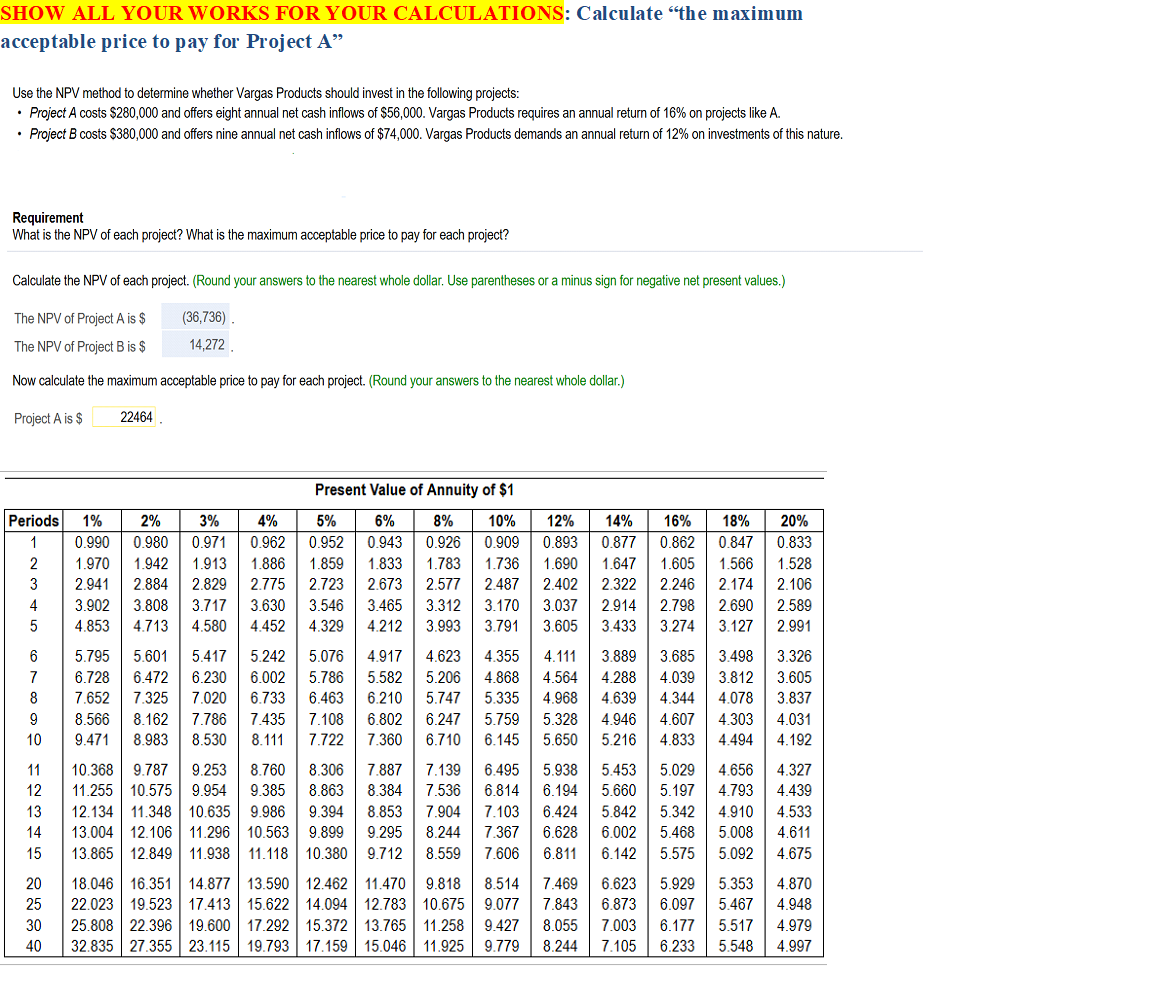

SHOW ALL YOUR WORKS FOR YOUR CALCULATIONS: Calculate the maximum acceptable price to pay for Project A Use the NPV method to determine whether Vargas Products should invest in the following projects: Project A costs $280,000 and offers eight annual net cash inflows of $56,000. Vargas Products requires an annual return of 16% on projects like A. Project B costs $380,000 and offers nine annual net cash inflows of $74,000. Vargas Products demands an annual return of 12% on investments of this nature. Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project A is $ The NPV of Project B is $ (36,736) 14,272 Now calculate the maximum acceptable price to pay for each project. (Round your answers to the nearest whole dollar.) Project A is $ 22464 Periods Ovo ona w 3.326 4.039 Present Value of Annuity of $1 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 1.970 1.942 1.9131.886 1.859 1.833 1.783 1.736 1.647 1.605 2.941 2.884 2.829 2.775 2.723 2673 2.577 2.487 2.402 2.322 2.246 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 6.728 6.472 6.002 5.786 5.582 5.206 4.868 4.564 4.288 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 8.566 8.162 7.786 7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.607 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 4.833 10.368 9.787 | 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 13.004 12.106 | 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5.468 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 5.575 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 22.023 19.523 | 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 25.808 22.396 | 19.600 17.292 15.372 13.765 11.258 9.4278.055 7.003 6.177 32.835 27.355 | 23.115 19.793 17.159 15.046 11.925 9.779 | 8.244 | 7.105 | 6.233 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 3.498 3.812 3.605 4.078 3.837 4.303 4.031 4.494 4.192 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 5.353 4.870 5.467 4.948 5.517 4.979 5.548 | 4.997 MO U 40