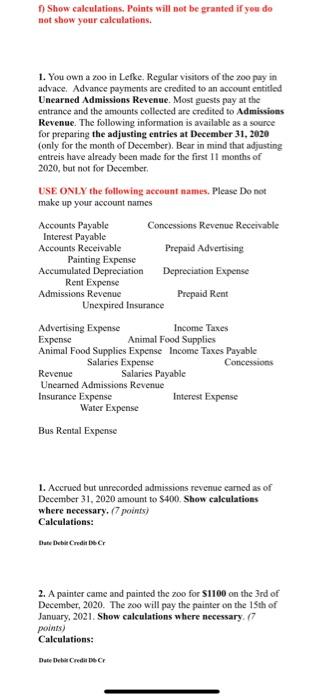

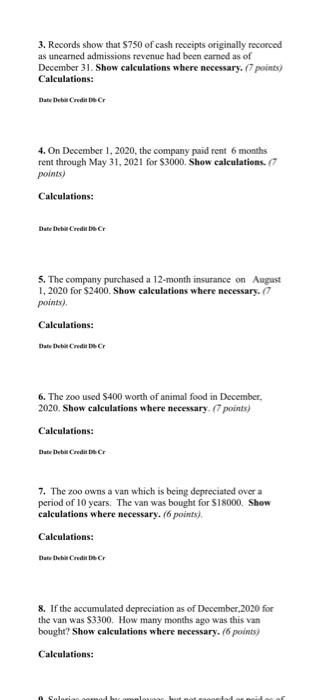

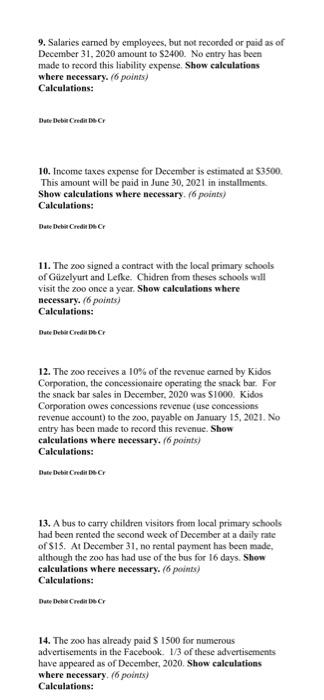

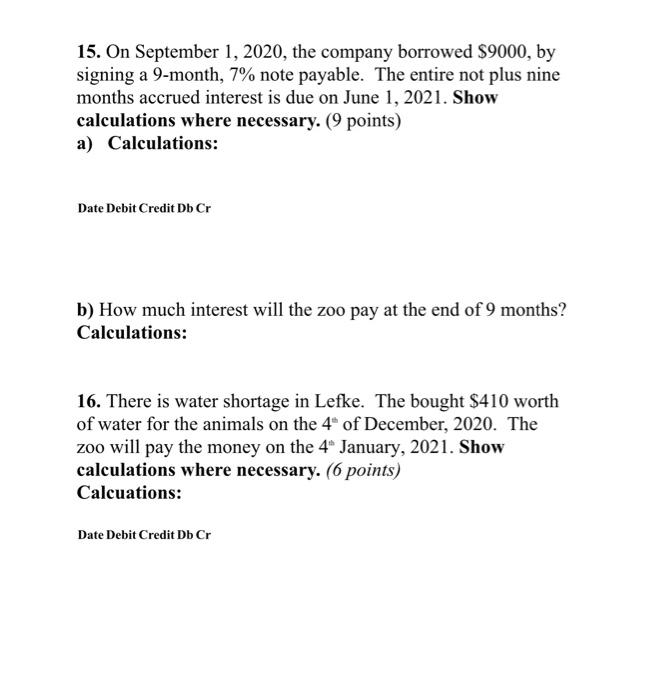

Show calculations. Points will not be granted if you do not show your calculations. 1. You own a zoo in Lefke. Regular visitors of the 200 pay in advace. Advance payments are credited to an account entitled Unearned Admissions Revenue. Most guests pay at the entrance and the amounts collected are credited to Admissions Revenue. The following information is available as a source for preparing the adjusting entries at December 31, 2020 (only for the month of December). Bear in mind that adjusting entreis have already been made for the first 11 months of 2020, but not for December USE ONLY the following account names. Please Do not make up your account names Accounts Payable Concessions Revenue Receivable Interest Payable Accounts Receivable Prepaid Advertising Painting Expense Accumulated Depreciation Depreciation Expense Rent Expense Admissions Revenue Prepaid Rent Unexpired Insurance Advertising Expense Income Taxes Expense Animal Food Supplies Animal Food Supplies Expense Income Taxes Payable Salaries Expense Concessions Revenue Salaries Payable Unearned Admissions Revenue Insurance Expense Interest Expense Water Expense Bus Rental Expense 1. Accrued but unrecorded admissions revenue camned as of December 31, 2020 amount to $400. Show calculations where necessary. (7 points) Calculations: Bate Duble Credit 2. A painter came and painted the zoo for $1100 on the 3rd of December, 2020. The zoo will pay the painter on the 15th of January, 2021. Show calculations where necessary. (7 points) Calculations: Date Des Credit 3. Records show that $750 of cash receipts originally recorced as unearned admissions revenue had been earned as of December 31. Show calculations where necessary. (7 points) Calculations: Date Debit Credit 4. On December 1, 2020, the company paid rent 6 months rent through May 31, 2021 for $3000. Show calculations. points) Calculations: Date Debit Credit C 5. The company purchased a 12-month insurance on August 1, 2020 for $2400. Show calculations where necessary. points) Calculations: Dale Date Credit 6. The zoo used $400 worth of animal food in December 2020. Show calculations where necessary. (points) Calculations: Date Dubai Credit 7. The zoo owns a van which is being depreciated over a period of 10 years. The van was bought for $18000. Show calculations where necessary. (6 points) Calculations: Datu Dubai Credit 8. If the accumulated depreciation as of December 2020 for the van was $3300 How many months ago was this van bought? Show calculations where necessary. (6 points) Calculations: 9. Salaries earned by employees, but not recorded or paid as of December 31, 2020 amount to $2400. No entry has been made to record this liability expense. Show calculations where necessary. (6 points) Calculations: Date Deba Credit 10. Income taxes expense for December is estimated at $3500 This amount will be paid in June 30, 2021 in installments Show calculations where necessary. (6 points) Calculations: Date Debit Credit 11. The zoo signed a contract with the local primary schools of Gzelyurt and Lefke. Chidren from theses schools will visit the zoo once a year. Show calculations where necessary. (6 points) Calculations: Date Debt Cred 12. The zoo receives a 10% of the revenue carned by Kidos Corporation, the concessionaire operating the snack bar. For the snack bar sales in December, 2020 was 1000. Kidos Corporation owes concessions revenue (use concessions revenue account) to the zoo, payable on January 15, 2021. No entry has been made to record this revenue. Show calculations where necessary. (6 points) Calculations: Date Dei Credit 13. A bus to carry children visitors from local primary schools had been rented the second week of December at a daily rate of S15. At December 31, no rental payment has been made, although the zoo has had use of the bus for 16 days. Show calculations where necessary. (6 points) Calculations: Date Dehard 14. The 200 has already paid S 1500 for numerous advertisements in the Facebook 1/3 of these advertisements have appeared as of December, 2020. Show calculations where necessary. (6 points) Calculations: 15. On September 1, 2020, the company borrowed $9000, by signing a 9-month, 7% note payable. The entire not plus nine months accrued interest is due on June 1, 2021. Show calculations where necessary. (9 points) a) Calculations: Date Debit Credit Db Cr b) How much interest will the zoo pay at the end of 9 months? Calculations: 16. There is water shortage in Lefke. The bought $410 worth of water for the animals on the 4 of December, 2020. The zoo will pay the money on the 4 January, 2021. Show calculations where necessary. (6 points) Calcuations: Date Debit Credit Db Cr