Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show complete work Long Term Liabihties Problems Group A 32A Journalizing liability transactions and reporting them on the balance sheet Learning Objectives 1, 5 The

Show complete work

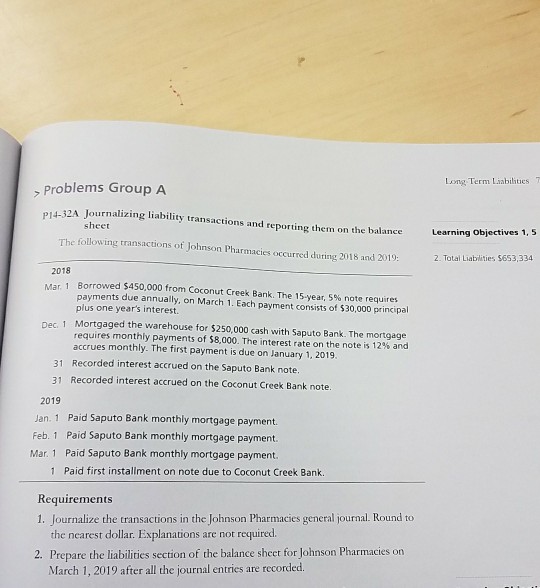

Long Term Liabihties Problems Group A 32A Journalizing liability transactions and reporting them on the balance sheet Learning Objectives 1, 5 The following transactions of Johnson pharmacies occurred during 2018 and 2019 2. Total Liablities $653,334 2018 Borrowed $450,000 from Coconut Creek Bank. The 15-year 5% note requires payments due annually, on March 1. Each payment consists of $30,000 principal plus one years interest. Mortgaged the warehouse for $250,000 cash with Saputo Bank. The mortgage requires monthly payments of $8,000. The interest rate on the note is 12% and accrues monthly. The first payment is due on January 1, 2019. Mar. 1 Dec. 1 31 Recorded interest accrued on the Saputo Bank note. 31 Recorded interest accrued on the Coconut Creek Bank note 2019 Jan. 1 Paid Saputo Bank monthly mortgage payment. Feb. 1 Paid Saputo Bank monthly mortgage payment. Mar. 1 Paid Saputo Bank monthly mortgage payment. 1 Paid first installment on note due to Coconut Creek Bank. Requirements 1. Journalize the transactions in the Johnson Pharmacies general journal. Round to the nearest dollar. Explanations are not required. 2. Prepare the liabilities section of the balance sheet for Johnson Pharmacies on March 1, 2019 after all the journal entries are recordedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started