Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show detail work A motorized cultivator with a first cost of $28,000 and salvage value of 25% of the first cost is depreciated by the

show detail work

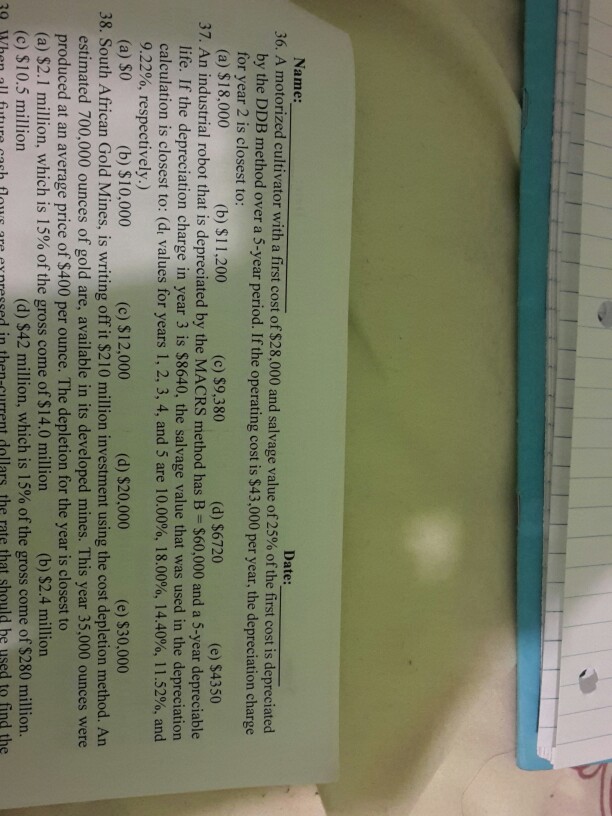

A motorized cultivator with a first cost of $28,000 and salvage value of 25% of the first cost is depreciated by the DDB method over a 5-year period. If the operating cost is $43,000 per year, the depreciation charge for year 2 is closest to: $ 18,000 $ 11, 200 $9, 380 $6720 $4350 An industrial robot that is depreciated by the MACRS method has B $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8640, the salvage value that was used in the depreciation calculation is closest to: (d_t values for years 1, 2, 3, 4, and 5 are 10,00%, 18,00%, 14, 40%, 11, 52%, and 9, 22%. respectively.) $0 $10.000 $ 12,000 $20,000 $30,000 South African Gold Mines, is writing off it $210 million investment using the cost depletion method. An estimated 700,000 ounces of gold are, available in its developed mines. This year 35,000 ounces were produced at an average price of $400 per ounce. The depletion for the year is closest to $2.1 million, which is 15% of the gross come of $14.0 million $2.4 million $ 10.5 million $42 million, which is 15% of the gross come of $280 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started