Answered step by step

Verified Expert Solution

Question

1 Approved Answer

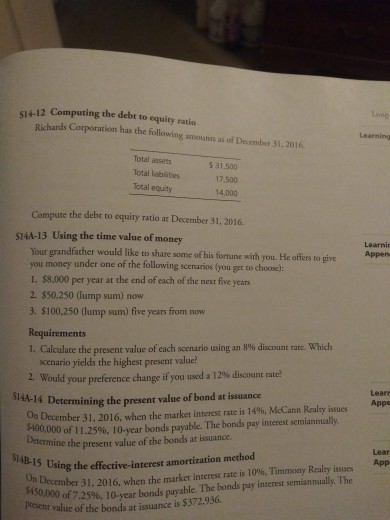

S14A-13 S14-12 Computing the debt to equity ratio ng Richards Corporation has the following amounns as of December 31, 2016 Learning Total assets Total labites

S14A-13

S14-12 Computing the debt to equity ratio ng Richards Corporation has the following amounns as of December 31, 2016 Learning Total assets Total labites Total equity S 31,500 17,500 14,000 Compute the debe to equity ratio at December 31, 2016. S14A-13 Using the time value of money Learnin Appen Your grandfather would like to share some of his fortune with you. He ofters to give you money under one of the following scenarios (you get to choose): 1. $8.000 per year at the end of each of the next five years 2. $50.250 (lump sum) now 3. $100,250 (lump sum) five years from now Requirements 1. Calculate the present value of each scenario using an 8% discount rate which scenario yields the highest present value? Would your preference change if you used a 12% discount rate 14 Determining the present value of bond at issuance 2. Lear App 1400000f11.25%, 10-yearbondspayable. Thebondspayinterest semiannually. On December 31, 2016, when the ptesent value of the bonds at issuance is $372.936. on December 31,2016, when the market interest ate is 14% McCann Realty issues Determine the present value of the bonds at isuance. 5 Using the effective-interest amortization method Lear App market interest rate is 10%, Timmony Realty issues of 7.25%, 10-year bonds payable. The bonds pay interest semiannually. TheStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started