Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show how deffered was found please The following facts relate to Splish Corporation. 1. Deferred tax liability, January 1,2020,$46,000. 2. Deferred tax asset, January 1,

show how deffered was found please

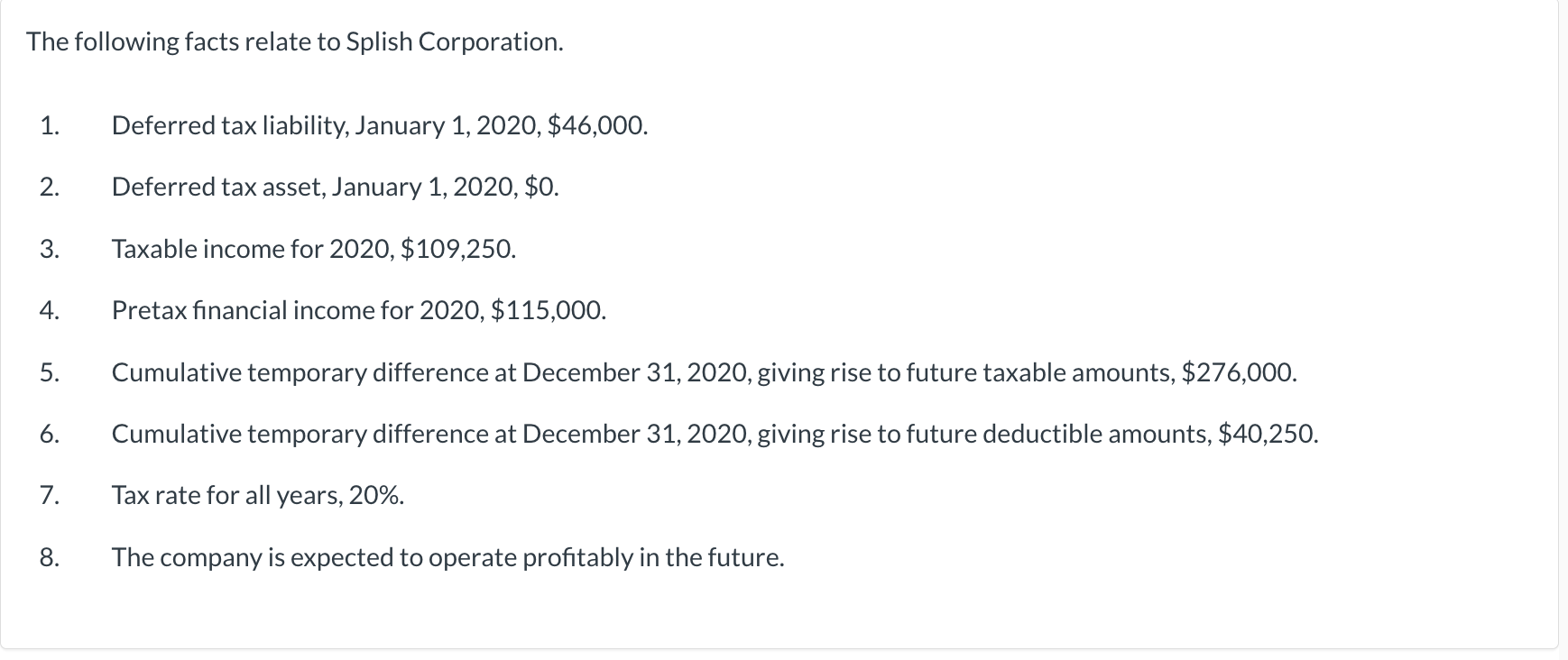

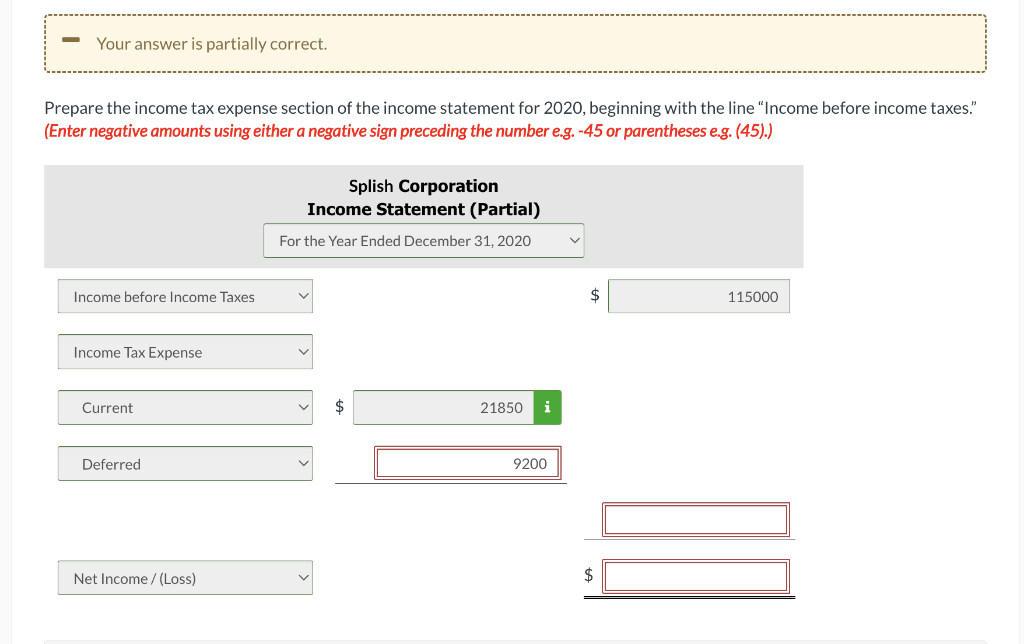

The following facts relate to Splish Corporation. 1. Deferred tax liability, January 1,2020,$46,000. 2. Deferred tax asset, January 1, 2020, \$0. 3. Taxable income for 2020,$109,250. 4. Pretax financial income for 2020,$115,000. 5. Cumulative temporary difference at December 31,2020 , giving rise to future taxable amounts, $276,000. 6. Cumulative temporary difference at December 31,2020 , giving rise to future deductible amounts, $40,250. 7. Tax rate for all years, 20\%. 8. The company is expected to operate profitably in the future. Prepare the income tax expense section of the income statement for 2020 , beginning with the line "Income before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started