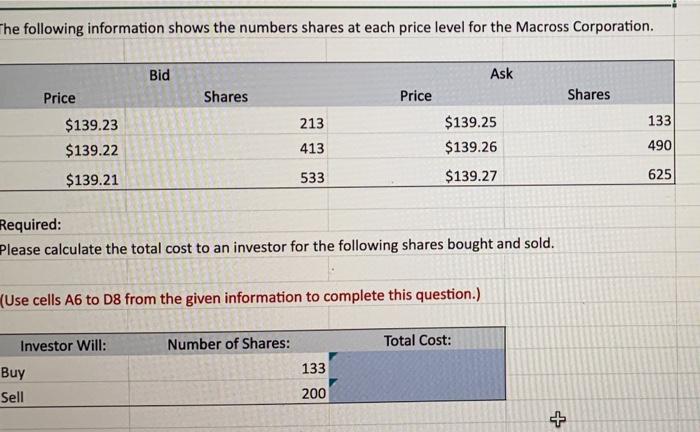

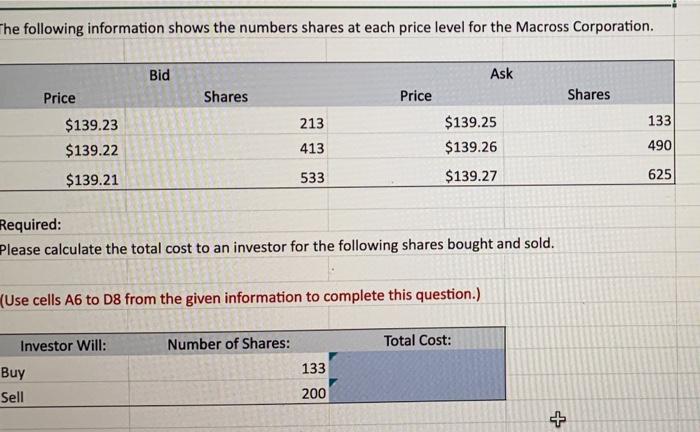

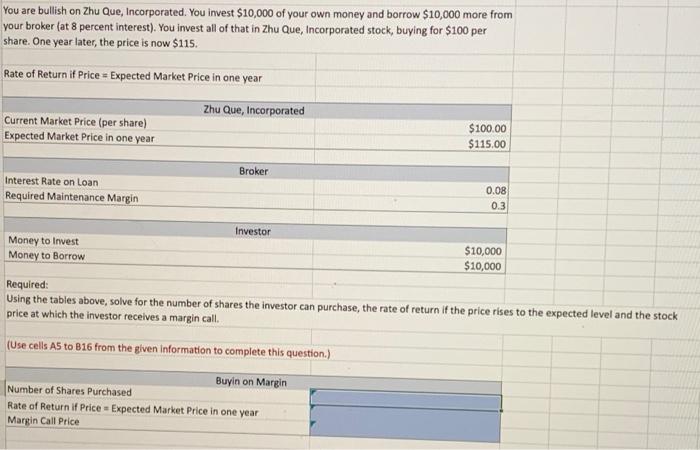

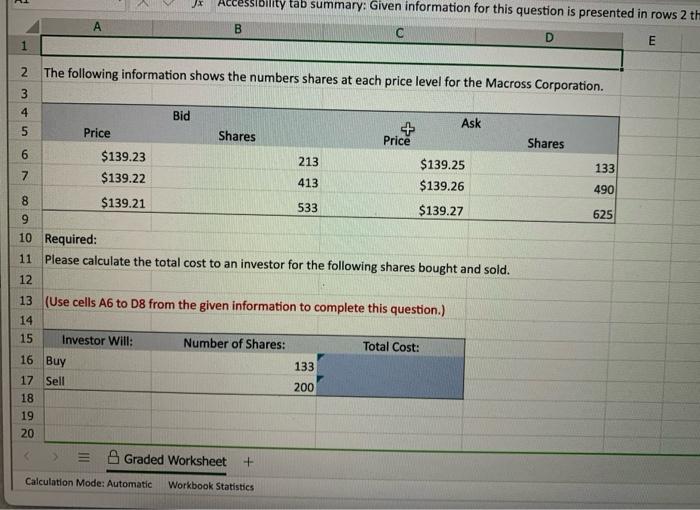

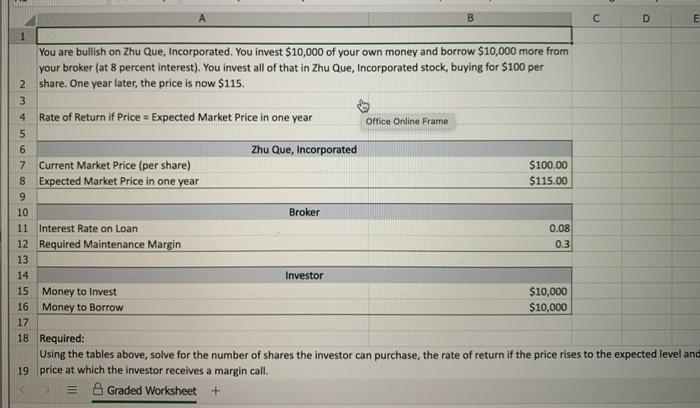

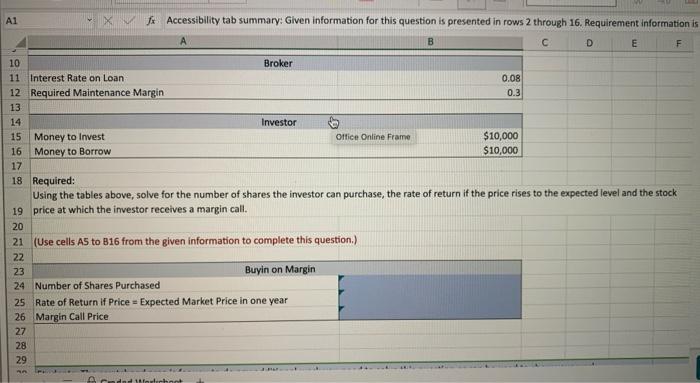

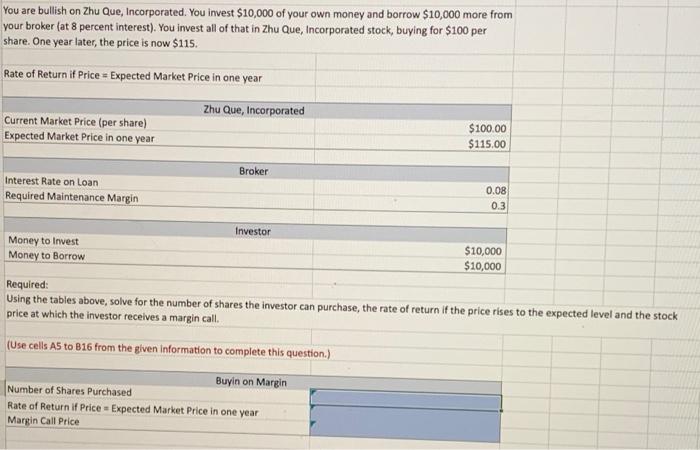

The following information shows the numbers shares at each price level for the Macross Corporation. Bid Ask Price Shares Price Shares $139.23 213 $139.25 133 490 $139.22 413 $139.26 $139.21 533 $139.27 625 Required: Please calculate the total cost to an investor for the following shares bought and sold. (Use cells A6 to D8 from the given information to complete this question.) Investor Will: Number of Shares: Total Cost: 133 200 Buy Sell + You are bullish on Zhu Que, Incorporated. You invest $10,000 of your own money and borrow $10,000 more from your broker (at 8 percent interest). You invest all of that in Zhu Que, Incorporated stock, buying for $100 per share. One year later, the price is now $115. Rate of Return if Price Expected Market Price in one year Zhu Que, Incorporated Current Market Price (per share) $100.00 $115.00 Expected Market Price in one year Broker Interest Rate on Loan 0.08 0.3 Required Maintenance Margin Investor Money to Invest $10,000 $10,000 Money to Borrow Required: Using the tables above, solve for the number of shares the investor can purchase, the rate of return if the price rises to the expected level and the stock price at which the investor receives a margin call. (Use cells A5 to 816 from the given information to complete this question.) Buyin on Margin Number of Shares Purchased Rate of Return if Price Expected Market Price in one year Margin Call Price Jx Accessibility tab summary: Given information for this question is presented in rows 2 th A B C D E 1 2 The following information shows the numbers shares at each price level for the Macross Corporation. 3 Bid Ask 5 + Price Price Shares Shares 6 $139.23 213 $139.25 133 490 7 $139.22 413 $139.26 8 $139.21 533 $139.27 625 9 10 Required: 11 Please calculate the total cost to an investor for the following shares bought and sold. 12 13 (Use cells A6 to D8 from the given information to complete this question.) 14 Investor Will: Number of Shares: Total Cost: 133 200 34 4 567892 15 16 Buy 17 Sell 18 19 20 Graded Worksheet + Calculation Mode: Automatic Workbook Statistics B C You are bullish on Zhu Que, Incorporated. You invest $10,000 of your own money and borrow $10,000 more from your broker (at 8 percent interest). You invest all of that in Zhu Que, Incorporated stock, buying for $100 per share. One year later, the price is now $115. Rate of Return if Price = Expected Market Price in one year Office Online Frame Zhu Que, Incorporated 7 Current Market Price (per share) $100.00 $115.00 8 Expected Market Price in one year 9 10 Broker 11 Interest Rate on Loan 0.08 0.3 12 Required Maintenance Margin 13 14 Investor 15 Money to Invest $10,000 $10,000 16 Money to Borrow 17 18 Required: Using the tables above, solve for the number of shares the investor can purchase, the rate of return if the price rises to the expected level and 19 price at which the investor receives a margin call. X Graded Worksheet + 234567 D E fx Accessibility tab summary: Given information for this question is presented in rows 2 through 16. Requirement information is B C D E F 10 Broker 11 Interest Rate on Loan 0.08 12 Required Maintenance Margin 0.3 13 14 Investor 15 Money to Invest Office Online Frame $10,000 $10,000 16 Money to Borrow 17 18 Required: Using the tables above, solve for the number of shares the investor can purchase, the rate of return if the price rises to the expected level and the stock 19 price at which the investor receives a margin call. 20 21 (Use cells A5 to 816 from the given information to complete this question.) 22 23 Buyin on Margin 24 Number of Shares Purchased 25 Rate of Return if Price Expected Market Price in one year 26 Margin Call Price 27 28 29 30 adad Mostechnot A1