Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show solution Simon Corporation is evaluating a relaxation of its credit policy. At present, the contribution margin is 50% of sales while gross profit margin

show solution

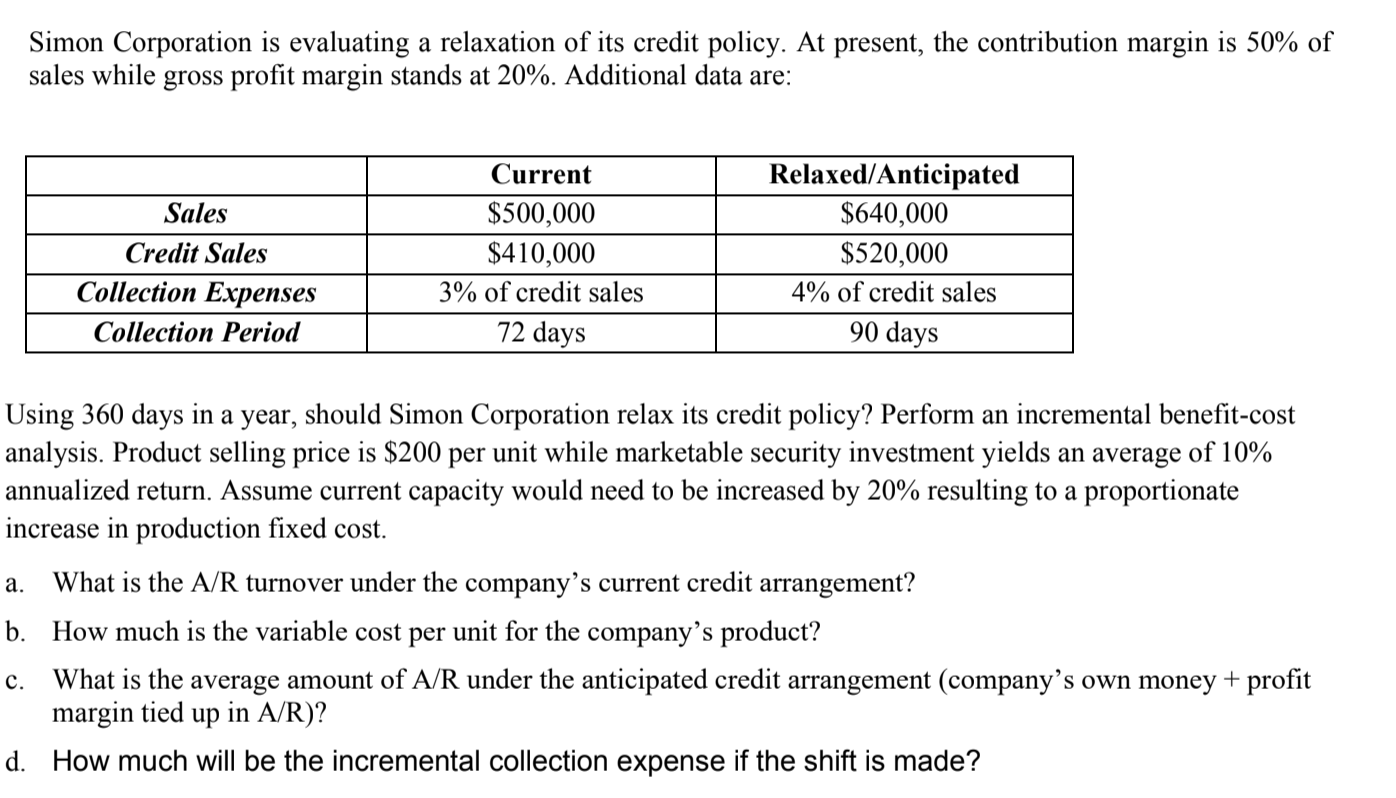

Simon Corporation is evaluating a relaxation of its credit policy. At present, the contribution margin is 50% of sales while gross profit margin stands at 20%. Additional data are: Sales Credit Sales Collection Expenses Collection Period Current $500,000 $410,000 3% of credit sales 72 days Relaxed/Anticipated $640,000 $520,000 4% of credit sales 90 days Using 360 days in a year, should Simon Corporation relax its credit policy? Perform an incremental benefit-cost analysis. Product selling price is $200 per unit while marketable security investment yields an average of 10% annualized return. Assume current capacity would need to be increased by 20% resulting to a proportionate increase in production fixed cost. a. What is the A/R turnover under the company's current credit arrangement? b. How much is the variable cost per unit for the company's product? c. What is the average amount of A/R under the anticipated credit arrangement (company's own money + profit margin tied up in A/R)? d. How much will be the incremental collection expense if the shift is madeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started