Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show step by step. please help Ty. (Expected rate of return) James Fromboltz is considering whether to invest in a newly formed investment fund. The

show step by step. please help Ty.

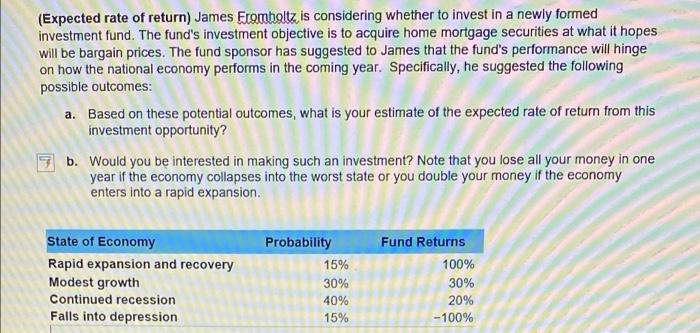

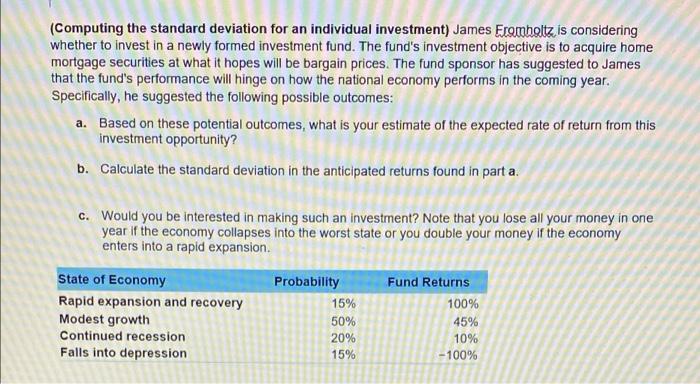

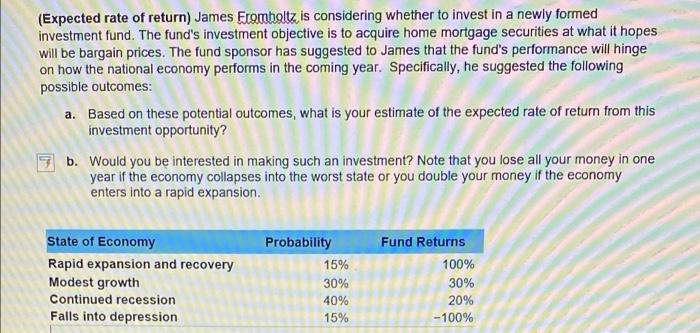

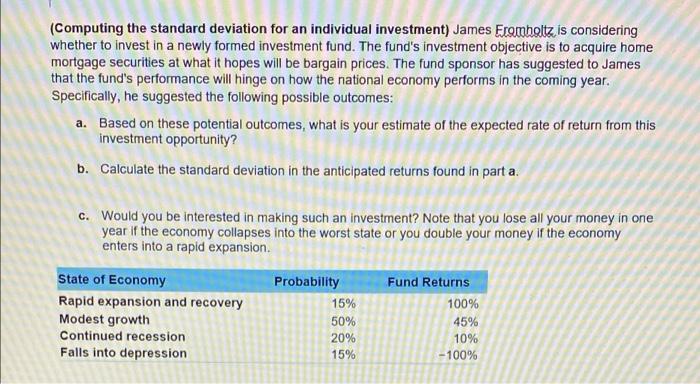

(Expected rate of return) James Fromboltz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion State of Economy Rapid expansion and recovery Modest growth Continued recession Falls into depression Probability 15% 30% 40% 15% Fund Returns 100% 30% 20% -100% (Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the anticipated returns found in part a. C. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion State of Economy Probability Fund Returns Rapid expansion and recovery 15% 100% Modest growth 50% 45% Continued recession 20% 10% Falls into depression 15% -100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started