Answered step by step

Verified Expert Solution

Question

1 Approved Answer

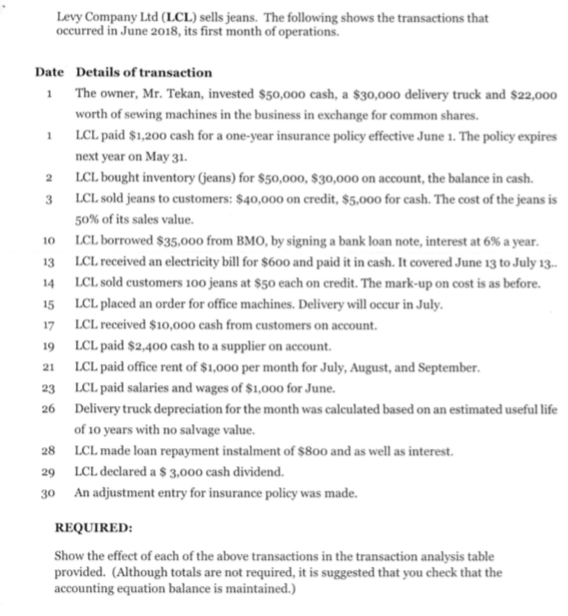

show the excel spreadsheet and calculation Levy Company Ltd (LCL) sells jeans. The following shows the transactions that occurred in June 2018, its first month

show the excel spreadsheet and calculation

Levy Company Ltd (LCL) sells jeans. The following shows the transactions that occurred in June 2018, its first month of operations. Date Details of transaction The owner, Mr. Tekan, invested $50,000 cash, a $30,000 delivery truck and $22,000 worth of sewing machines in the business in exchange for common shares. 1LCL paid $1,200 cash for a one-year insurance policy effective June 1. The policy expires next year on May 31 2LCL bought inventory (jeans) for $50,0o0, $30,000 on account, the balance in cash. 3 LCL. sold jeans to customers: $40,000 on credit, $5.00o for cash. The cost of the jeans is 50% of its sales value. 10 LCL borrowed $35,000 from BMO, by signing a bank loan note, interest at 6% a year 13 LCL received an electricity bill for $600 and paid it in cash.It covered June 13 to July 13 4 LCL sold customers 1o0 jeans at $50 each on credit. The mark-up on cost is as before 5 LCL placed an order for office machines. Delivery will occur in July 7LCL received $10,000 cash from customers on account. 19 LCL paid $2,400 cash to a supplier on account. 1 LCL paid office rent of $1,00o per month for July, August, and September 23 LCL paid salaries and wages of $1,00o for June. 6 Delivery truck depreciation for the month was calculated based on an estimated useful life of 1o years with no salvage value. 28 LCL made loan repayment instalment of $800 and as well as interest 29 LCL declared a $3,000 cash dividend. 0 An adjustment entry for insurance policy was made. REQUIRED Show the effect of each of the above transactions in the transaction analysis table provided. (Although totals are not required, it is suggested that you check that the accounting equation balance is maintained.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started