Answered step by step

Verified Expert Solution

Question

1 Approved Answer

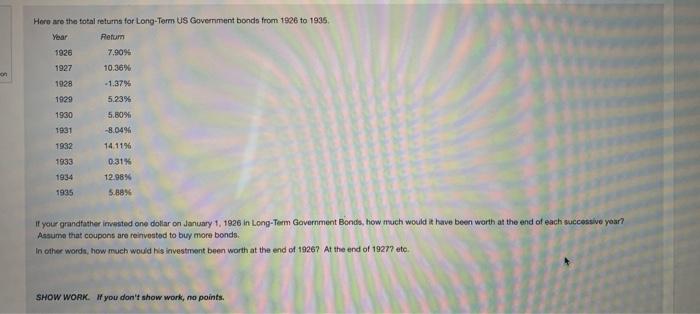

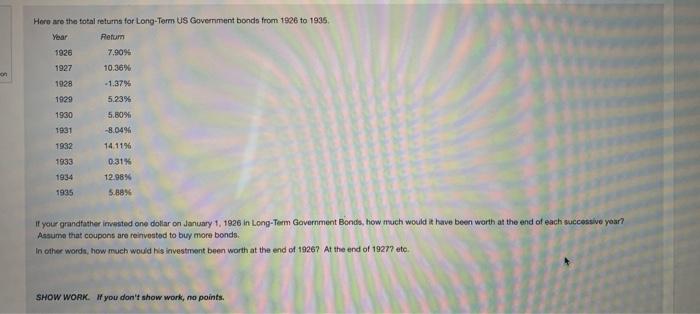

Show the formula and the answer. Its just one long question. Here are the total returns for Long-Term US Government bonds from 1926 to 1935

Show the formula and the answer. Its just one long question.

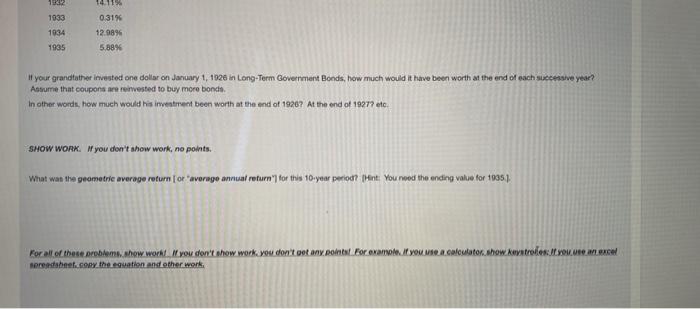

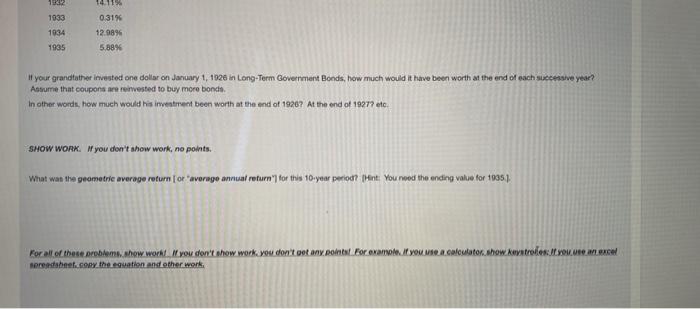

Here are the total returns for Long-Term US Government bonds from 1926 to 1935 Year Refum 1926 7.90% 1927 10.36% 1928 -1.37% 1929 5.23% on 1930 1931 1932 1933 5.809 -8.0496 14.11% 0:31% 1934 1935 12.98% 5.88% If your grandfather invested on dollar on January 1, 1926 in Long-Term Government Bonds, how much would it have been worth at the end of each successive year? Assume that coupons are reinvested to buy more bonds In other words, how much would his investment been worth at the end of 19267 At the end of 19277 ato SHOW WORK. #you don't show work, no points. 14.11 1332 1933 1034 1935 0.319 12.9896 5,88% If your grandfather invested one dollar on January 1, 1926 in Long-Term Government Bonds, how much would it have been worth at the end of each successive year? Assume that coupons are reinvested to buy more bondo In other words, how much would his investment been worth at the end of 1928? At the end of 19277 etc. SHOW WORK. W you don't show work, no points. What wan the geometrie average return por average annual return") for this 10-year period? (Hint: You need the ending value for 1935), For all of these problems.show work you don't show work you don't get any. For example you to contato show atrodeste.com serheet.com.theguation and other work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started