Answered step by step

Verified Expert Solution

Question

1 Approved Answer

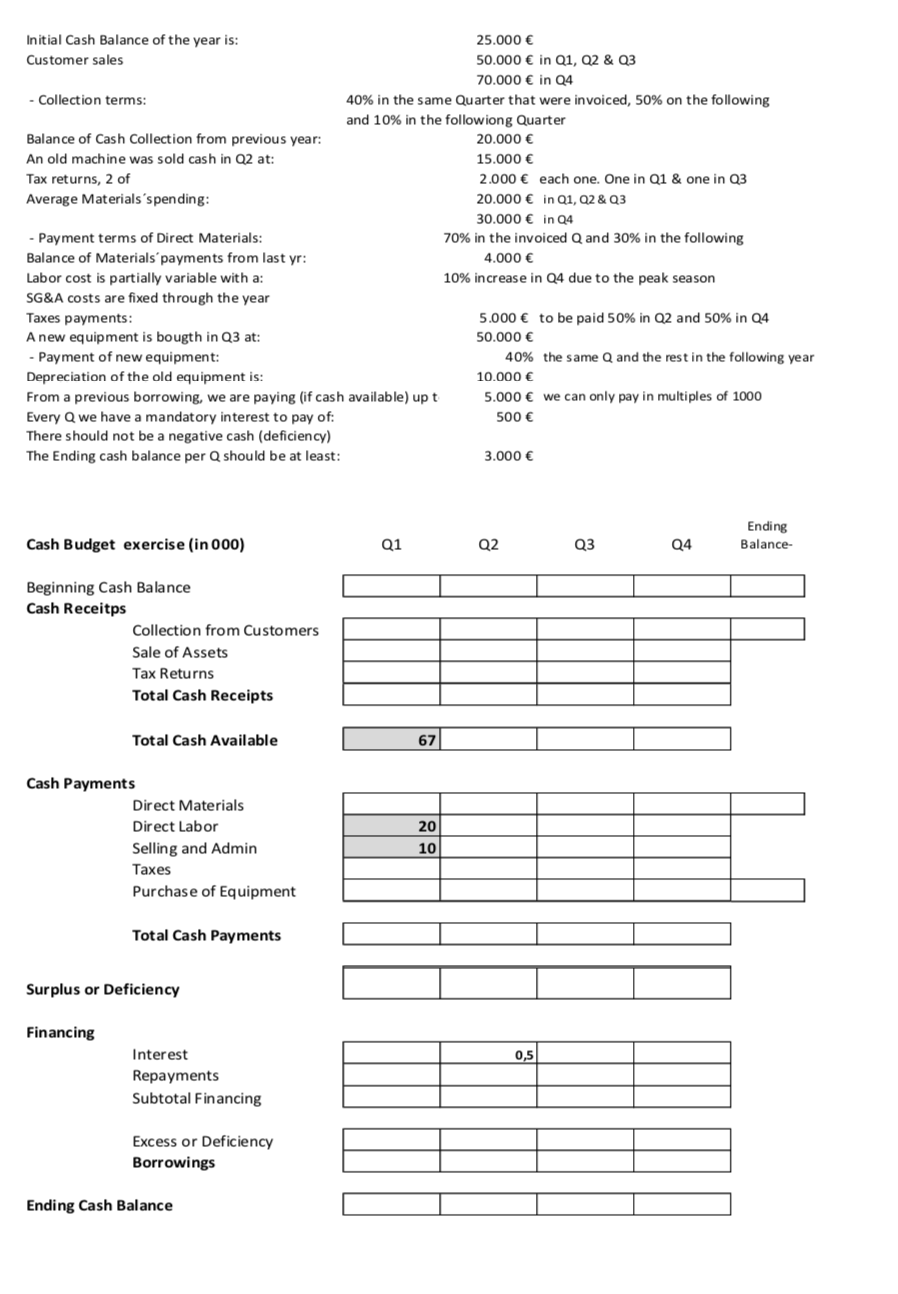

Show work and steps. Initial Cash Balance of the year is: 25.000 Customer sales 50.000 in Q1, Q2 & Q3 70.000 in Q4 - Collection

Show work and steps.

Initial Cash Balance of the year is: 25.000 Customer sales 50.000 in Q1, Q2 & Q3 70.000 in Q4 - Collection terms: 40% in the same Quarter that were invoiced, 50% on the following and 10% in the followiong Quarter Balance of Cash Collection from previous year: 20.000 An old machine was sold cash in Q2 at: 15.000 Tax returns, 2 of 2.000 each one. One in Q1 & one in Q3 Average Materials spending: 20.000 in Q1, Q2 & Q3 30.000 in 24 - Payment terms of Direct Materials: 70% in the invoiced Q and 30% in the following Balance of Materials' payments from last yr: 4.000 Labor cost is partially variable with a: 10% increase in Q4 due to the peak season SG&A costs are fixed through the year Taxes payments: 5.000 to be paid 50% in Q2 and 50% in Q4 A new equipment is bougth in Q3 at: 50.000 - Payment of new equipment: 40% the same Q and the rest in the following year Depreciation of the old equipment is: 10.000 From a previous borrowing, we are paying (if cash available) up t 5.000 we can only pay in multiples of 1000 Every Q we have a mandatory interest to pay of: 500 There should not be a negative cash (deficiency) The Ending cash balance per should be at least: 3.000 Ending Balance- Cash Budget exercise (in 000) Q1 Q2 Q3 Q4 Beginning Cash Balance Cash Receitps Collection from Customers Sale of Assets Tax Returns Total Cash Receipts Total Cash Available 67 20 Cash Payments Direct Materials Direct Labor Selling and Admin Taxes Purchase of Equipment 10 Total Cash Payments Surplus or Deficiency Financing 0,5 Interest Repayments Subtotal Financing Excess or Deficiency Borrowings Ending Cash BalanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started