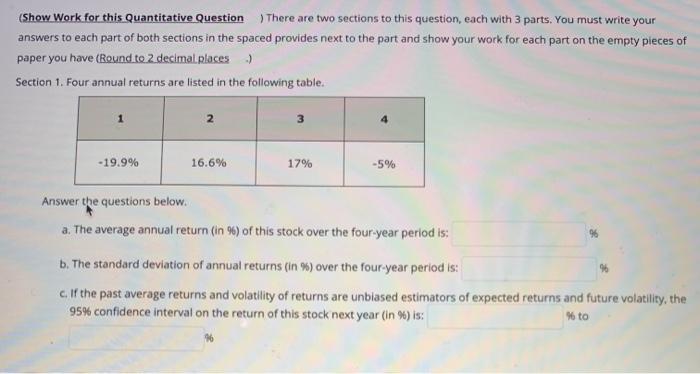

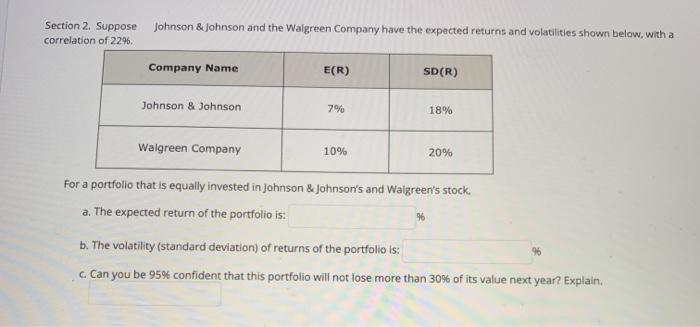

(Show Work for this Quantitative Question ) There are two sections to this question, each with 3 parts. You must write your answers to each part of both sections in the spaced provides next to the part and show your work for each part on the empty pieces of paper you have (Round to 2 decimal places.) Section 1. Four annual returns are listed in the following table. 2 3 4 -19.9% 16.6% 17% -5% Answer the questions below. a. The average annual return (in %) of this stock over the four-year period is; b. The standard deviation of annual returns (in %) over the four-year period is: c. If the past average returns and volatility of returns are unbiased estimators of expected returns and future volatility, the 95% confidence interval on the return of this stock next year (in %) is: % to Section 2. Suppose correlation of 22% Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown below, with a Company Name E(R) SD(R) Johnson & Johnson 7% 18% Walgreen Company 10% 20% For a portfolio that is equally invested in Johnson & Johnson's and Walgreen's stock, a. The expected return of the portfolio is: b. The volatility (standard deviation) of returns of the portfolio is: c. Can you be 95% confident that this portfolio will not lose more than 30% of its value next year? Explain. (Show Work for this Quantitative Question ) There are two sections to this question, each with 3 parts. You must write your answers to each part of both sections in the spaced provides next to the part and show your work for each part on the empty pieces of paper you have (Round to 2 decimal places.) Section 1. Four annual returns are listed in the following table. 2 3 4 -19.9% 16.6% 17% -5% Answer the questions below. a. The average annual return (in %) of this stock over the four-year period is; b. The standard deviation of annual returns (in %) over the four-year period is: c. If the past average returns and volatility of returns are unbiased estimators of expected returns and future volatility, the 95% confidence interval on the return of this stock next year (in %) is: % to Section 2. Suppose correlation of 22% Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown below, with a Company Name E(R) SD(R) Johnson & Johnson 7% 18% Walgreen Company 10% 20% For a portfolio that is equally invested in Johnson & Johnson's and Walgreen's stock, a. The expected return of the portfolio is: b. The volatility (standard deviation) of returns of the portfolio is: c. Can you be 95% confident that this portfolio will not lose more than 30% of its value next year? Explain