Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show working ne Pocus on Dedsion Making 2.29 Income Taxes and Cost-Volume Profit Analysis Study Appendix 2B. Suppose Meola Security Company has a 20% income

show working

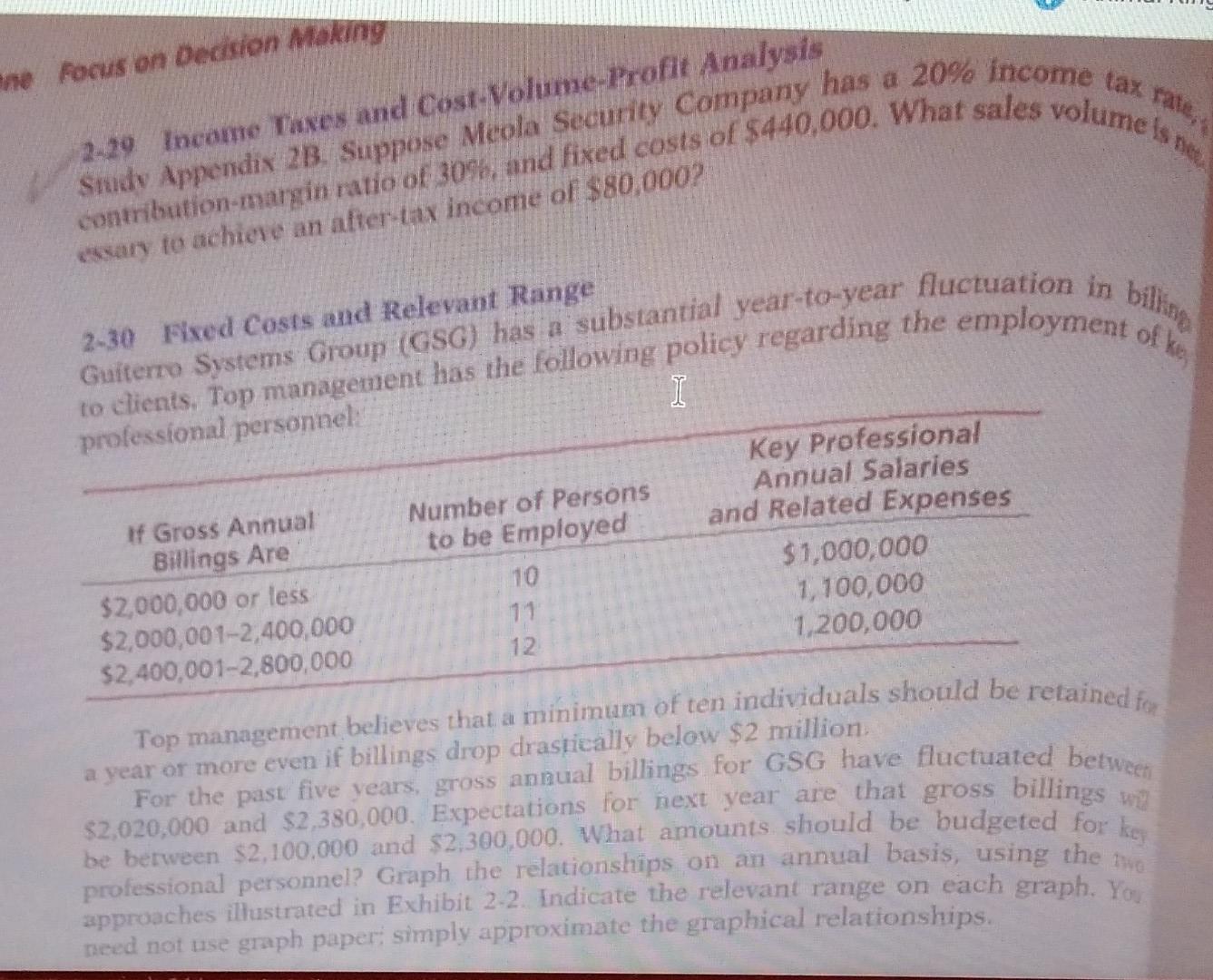

ne Pocus on Dedsion Making 2.29 Income Taxes and Cost-Volume Profit Analysis Study Appendix 2B. Suppose Meola Security Company has a 20% income tax rate, contribution-margin ratio of 3096, and fixed costs of $440,000. What sales volume essary to achieve an after-tax income of $80,0002 2-30 Fixed Costs and Relevant Range to clients. Top management has the following policy regarding the employment of ko Guiterzo Systems Group (GSG) has a substantial year-to-year fluctuation in billing professional personnel I Key Professional If Gross Annual Number of Persons Annual Salaries Billings Are to be Employed and Related Expenses $2,000,000 or less 10 $1,000,000 $2,000,00 1-2,400,000 1,100,000 $2,400,001-2,800,000 122 1,200,000 Top management believes that a minimum of ten individuals should be retained for a year or more even if billings drop drastically below $2 million For the past five years, gross annual billings for GSG have fluctuated between $2,020,000 and $2,380,000. Expectations for next year are that gross billings we be between $2,100,000 and $2,300,000. What amounts should be budgeted for key professional personnel? Graph the relationships on an annual basis, using the approaches illustrated in Exhibit 2-2. Indicate the relevant range on each graph. Yo need not use graph paper: simply approximate the graphical relationshipsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started