Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show working out please The company you work for, Cowl Communications is investing into new start-up companies in an effort to diversify their portfolio. As

show working out please

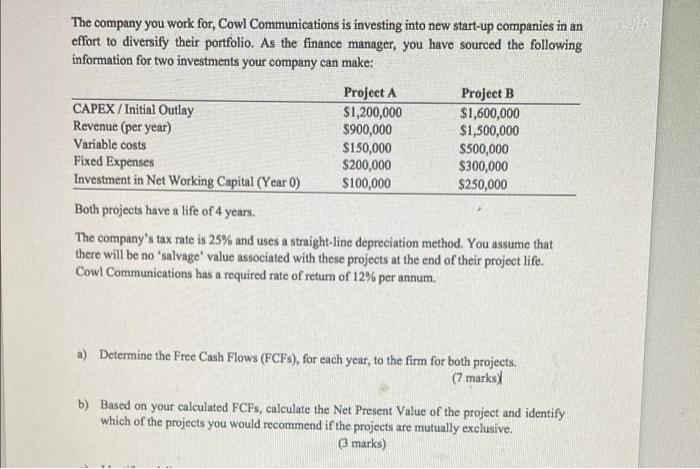

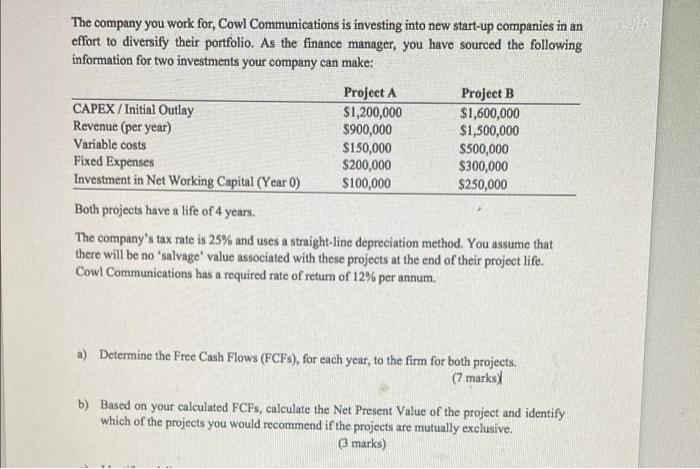

The company you work for, Cowl Communications is investing into new start-up companies in an effort to diversify their portfolio. As the finance manager, you have sourced the following information for two investments your company can make: Both projects have a life of 4 years. The company's tax rate is 25% and uses a straight-line depreciation method. You assume that there will be no 'salvage' value associated with these projects at the end of their project life. Cowl Communications has a required rate of return of 12% per annum. a) Determine the Free Cash Flows (FCFs), for each year, to the firm for both projects. (7 marks) b) Based on your calculated FCFs, calculate the Net Preseat Value of the project and identify which of the projects you would recommend if the projects are mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started