Answered step by step

Verified Expert Solution

Question

1 Approved Answer

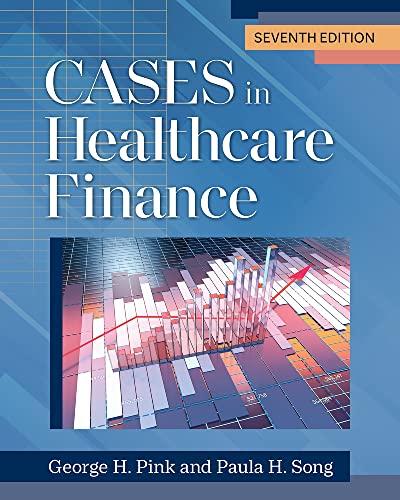

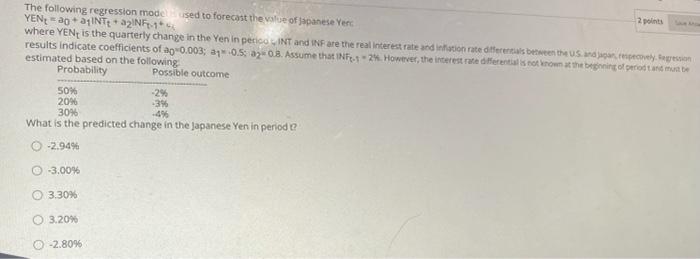

show your work keep it simple please The following regression modesed to forecast the value of Japanese Yerc 2 points YEN-aoa4INTE + a2INF.17 where YEN

show your work keep it simple please

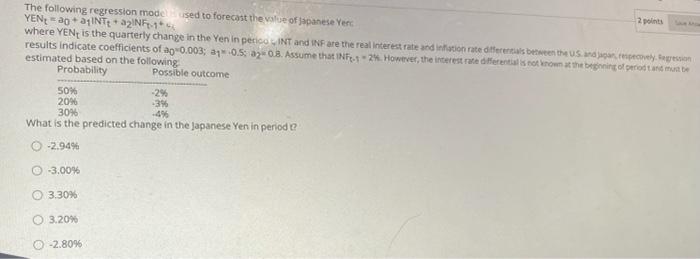

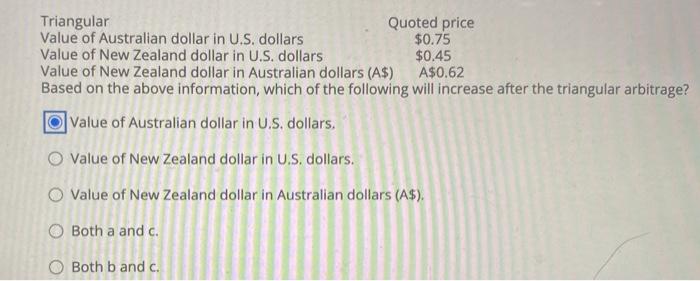

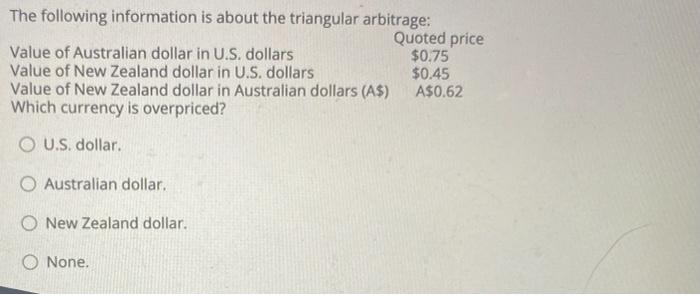

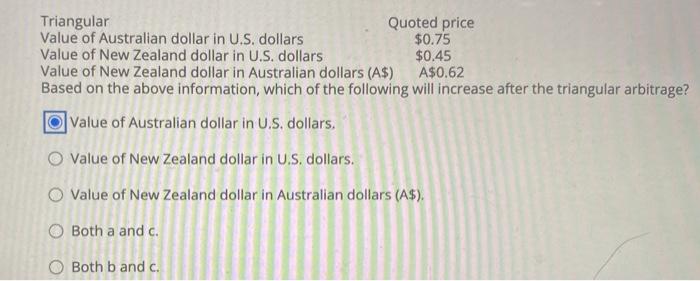

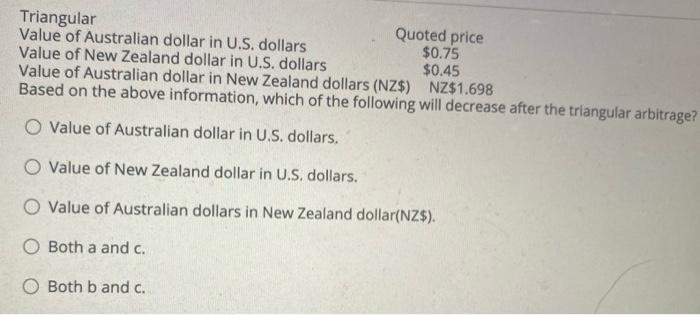

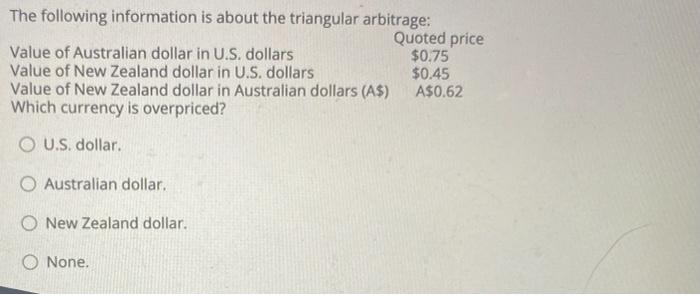

The following regression modesed to forecast the value of Japanese Yerc 2 points YEN-aoa4INTE + a2INF.17 where YEN is the quarterly change in the Yen in perico,INT and NF are the real interest rate and nation rate diferents between the US antepecovely.ee results indicate coefficients of ao 0.003; 30.5: 320.8. Assume that INF: 12. However, the interest rate offerential to the beginning of rotan munte estimated based on the following Probability Possible outcome 50% 20% -3% 30% -4% What is the predicted change in the Japanese Yen in periode? -24 -2.94% -3.00% 3.30% 0 3.20% -2.80% Triangular Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of New Zealand dollar in Australian dollars (A$) A$0.62 Based on the above information, which of the following will increase after the triangular arbitrage? Value of Australian dollar in U.S. dollars, O Value of New Zealand dollar in U.S. dollars. O Value of New Zealand dollar in Australian dollars (A$). O Both a and c. Both b and c. Triangular Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of Australian dollar in New Zealand dollars (NZ$) NZ$1.698 Based on the above information, which of the following will decrease after the triangular arbitrage? O Value of Australian dollar in U.S. dollars. O Value of New Zealand dollar in U.S. dollars. O Value of Australian dollars in New Zealand dollar(NZ$). Both a and c. a Both band c. The following information is about the triangular arbitrage: Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of New Zealand dollar in Australian dollars (A$) A$0.62 Which currency is overpriced? O U.S. dollar. O Australian dollar. O New Zealand dollar. O None. The following regression modesed to forecast the value of Japanese Yerc 2 points YEN-aoa4INTE + a2INF.17 where YEN is the quarterly change in the Yen in perico,INT and NF are the real interest rate and nation rate diferents between the US antepecovely.ee results indicate coefficients of ao 0.003; 30.5: 320.8. Assume that INF: 12. However, the interest rate offerential to the beginning of rotan munte estimated based on the following Probability Possible outcome 50% 20% -3% 30% -4% What is the predicted change in the Japanese Yen in periode? -24 -2.94% -3.00% 3.30% 0 3.20% -2.80% Triangular Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of New Zealand dollar in Australian dollars (A$) A$0.62 Based on the above information, which of the following will increase after the triangular arbitrage? Value of Australian dollar in U.S. dollars, O Value of New Zealand dollar in U.S. dollars. O Value of New Zealand dollar in Australian dollars (A$). O Both a and c. Both b and c. Triangular Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of Australian dollar in New Zealand dollars (NZ$) NZ$1.698 Based on the above information, which of the following will decrease after the triangular arbitrage? O Value of Australian dollar in U.S. dollars. O Value of New Zealand dollar in U.S. dollars. O Value of Australian dollars in New Zealand dollar(NZ$). Both a and c. a Both band c. The following information is about the triangular arbitrage: Quoted price Value of Australian dollar in U.S. dollars $0.75 Value of New Zealand dollar in U.S. dollars $0.45 Value of New Zealand dollar in Australian dollars (A$) A$0.62 Which currency is overpriced? O U.S. dollar. O Australian dollar. O New Zealand dollar. O None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started