Answered step by step

Verified Expert Solution

Question

1 Approved Answer

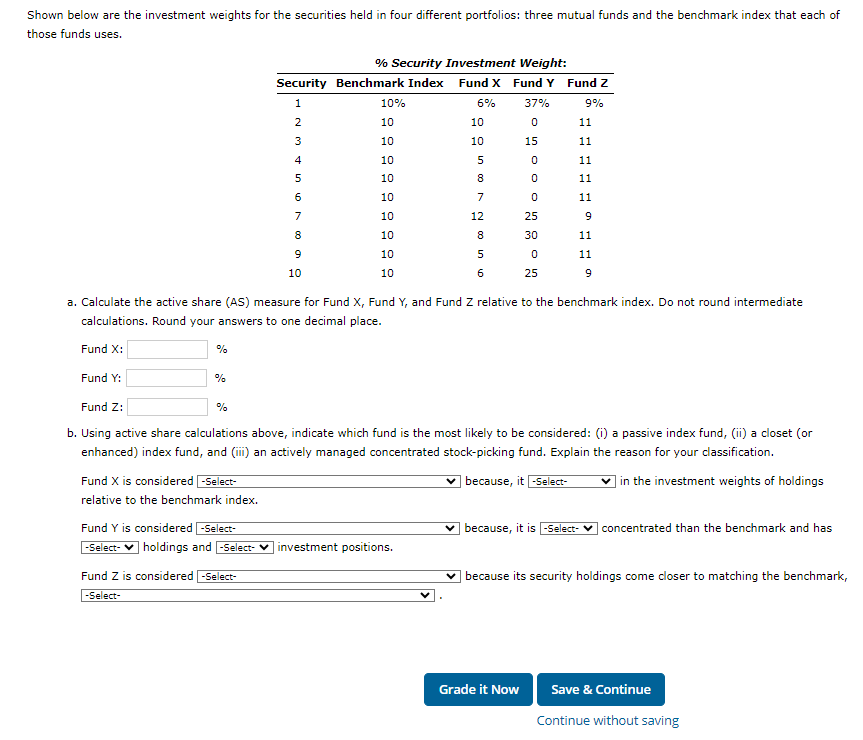

Shown below are the investment weights for the securities held in four different portfolios: three mutual funds and the benchmark index that each of those

Shown below are the investment weights for the securities held in four different portfolios: three mutual funds and the benchmark index that each of those funds uses. a. Calculate the active share (AS) measure for Fund X, Fund Y, and Fund Z relative to the benchmark index. Do not round intermediate calculations. Round your answers to one decimal place. Fund X: % Fund Y: % Fund Z: % b. Using active share calculations above, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification. Fund X is considered [ relative to the benchmark index. Fund Y is considered [ holdings and Fund Z is considered [ ] because, it because, it is investment positions. in the investment weights of holdings concentrated than the benchmark and has because its security holdings come closer to matching the benchmark, Continue without saving

Shown below are the investment weights for the securities held in four different portfolios: three mutual funds and the benchmark index that each of those funds uses. a. Calculate the active share (AS) measure for Fund X, Fund Y, and Fund Z relative to the benchmark index. Do not round intermediate calculations. Round your answers to one decimal place. Fund X: % Fund Y: % Fund Z: % b. Using active share calculations above, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification. Fund X is considered [ relative to the benchmark index. Fund Y is considered [ holdings and Fund Z is considered [ ] because, it because, it is investment positions. in the investment weights of holdings concentrated than the benchmark and has because its security holdings come closer to matching the benchmark, Continue without saving Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started