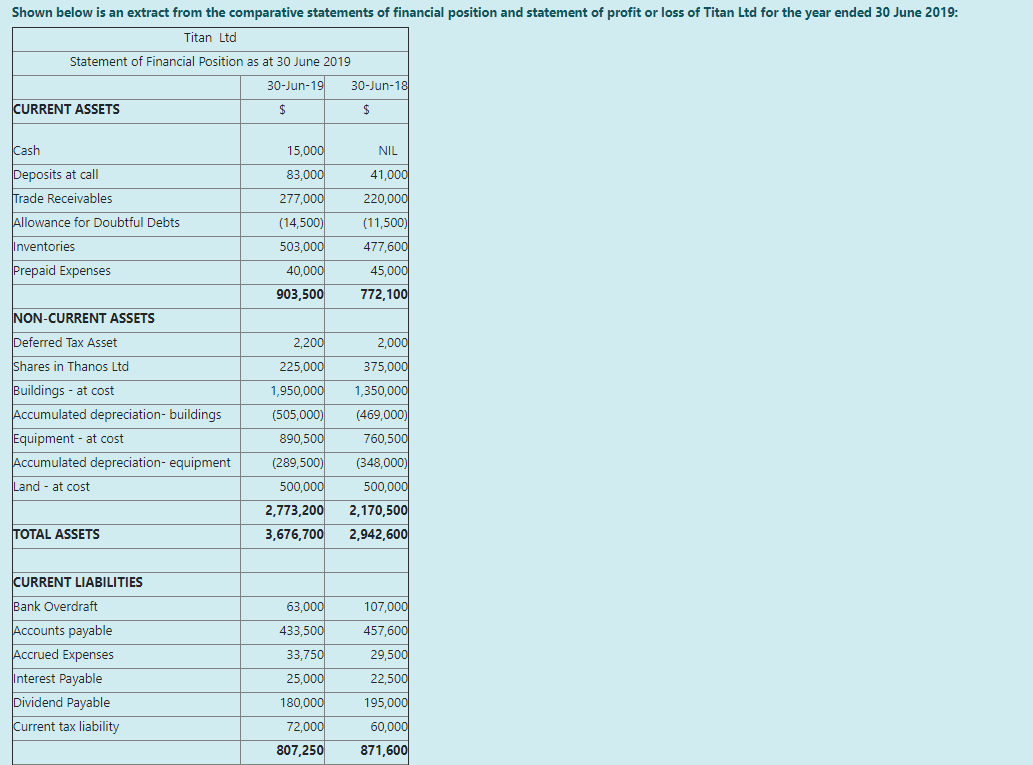

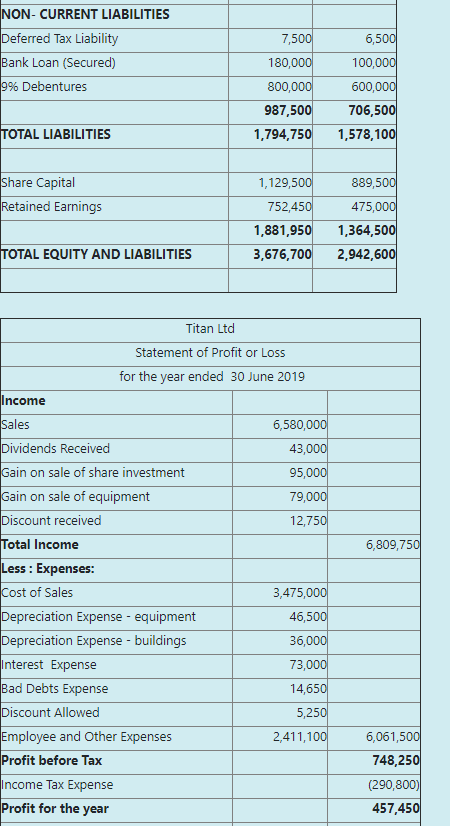

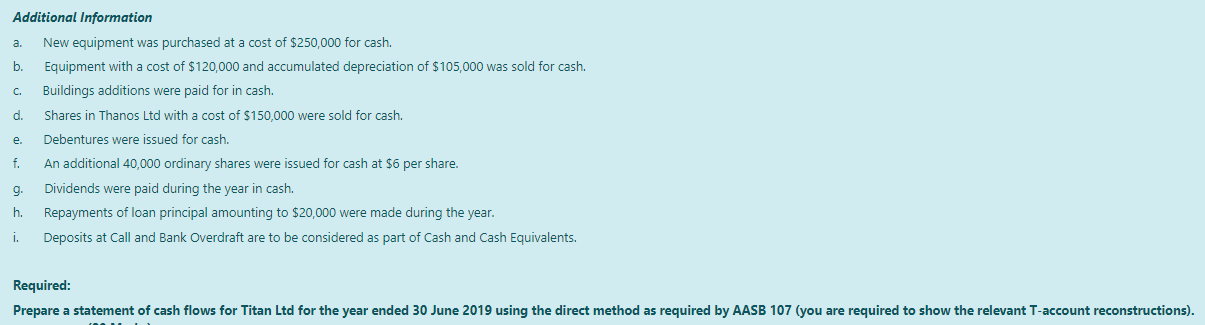

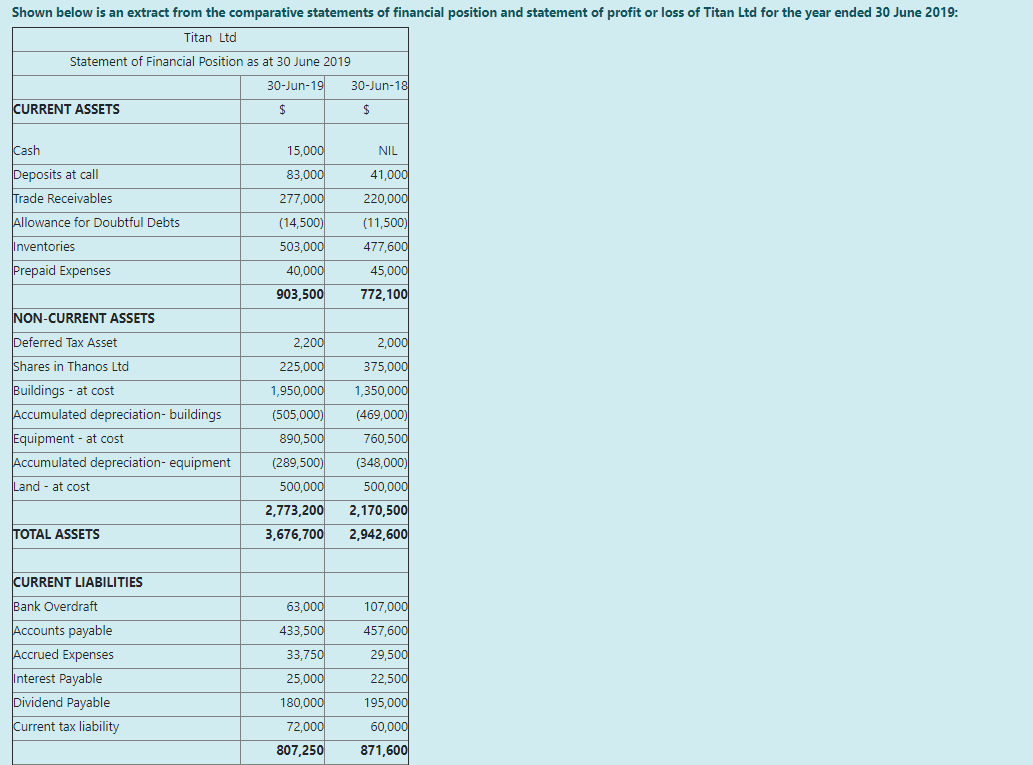

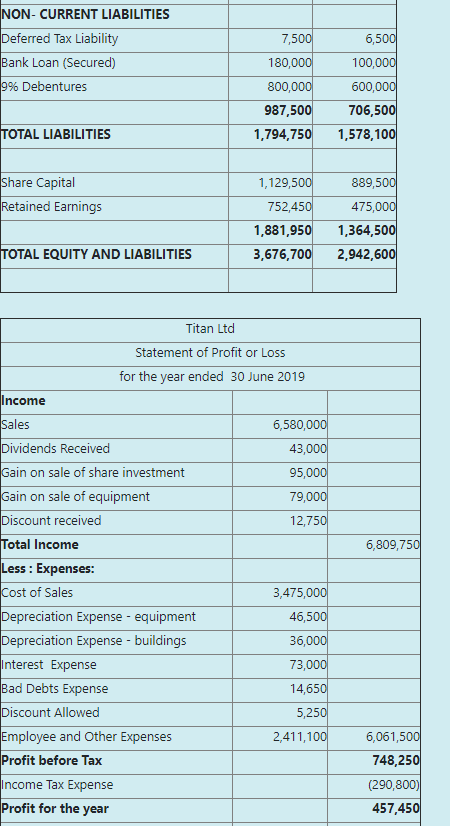

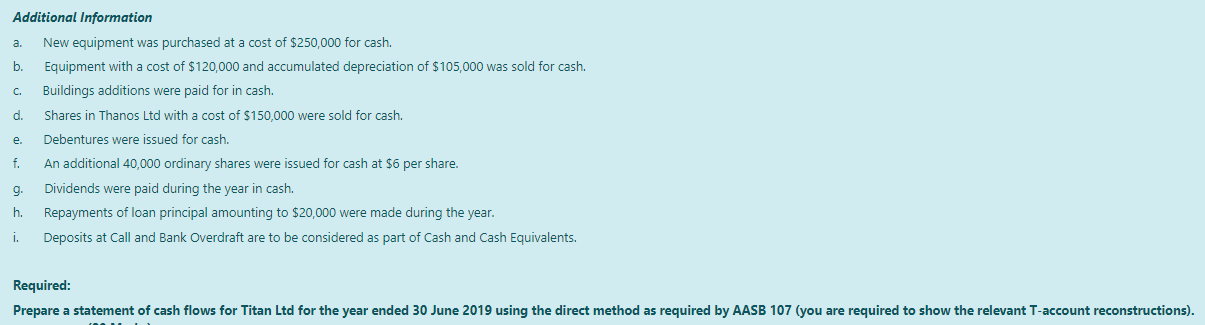

Shown below is an extract from the comparative statements of financial position and statement of profit or loss of Titan Ltd for the year ended 30 June 2019: Titan Ltd Statement of Financial Position as at 30 June 2019 30-Jun-19 30-Jun-18 CURRENT ASSETS $ $ 15,000 NIL 83,000 41,000 277,000 Cash Deposits at call Trade Receivables Allowance for Doubtful Debts Inventories Prepaid Expenses (14,500) 220,000 (11,500) 477,600 503,000 40,000 45,000 903,500 772,100 NON-CURRENT ASSETS 2,200 2,000 375,000 225,000 1,950,000 Deferred Tax Asset Shares in Thanos Ltd Buildings - at cost Accumulated depreciation-buildings Equipment - at cost Accumulated depreciation-equipment Land - at cost (505,000) 890,500 1,350,000 (469,000) 760,500 (289,500) 500.000 (348,000) 500,000 2,170,500 2,942,600 2,773,200 TOTAL ASSETS 3,676,700 63,000 433,500 107,000 457,600 CURRENT LIABILITIES Bank Overdraft Accounts payable Accrued Expenses Interest Payable Dividend Payable Current tax liability 33,750 29,500 25,000 22,500 180,000 195,000 60,000 72,000 807,250 871,600 7,500 NON-CURRENT LIABILITIES Deferred Tax Liability Bank Loan (Secured) 9% Debentures 180,000 800,000 987,500 1,794,750 6,500 100,000 600,000 706,500 1,578,100 TOTAL LIABILITIES Share Capital Retained Earnings 1,129,500 752,450 1,881,950 3,676,700 889,500 475,000 1,364,500 2,942,600 TOTAL EQUITY AND LIABILITIES Titan Ltd Statement of Profit or Loss for the year ended 30 June 2019 Income 6,580,000 43,000 95,000 79,000 12,750 6,809,750 Sales Dividends Received Gain on sale of share investment Gain on sale of equipment Discount received Total Income Less : Expenses: Cost of Sales Depreciation Expense - equipment Depreciation Expense - buildings Interest Expense Bad Debts Expense Discount Allowed Employee and Other Expenses Profit before Tax Income Tax Expense Profit for the year 3,475,000 46,500 36,000 73,000 14,650 5,250 2,411,100 6,061,500 748,250 (290,800) 457,450 Additional Information a. New equipment was purchased at a cost of $250,000 for cash. b. Equipment with a cost of $120,000 and accumulated depreciation of $105,000 was sold for cash. C. Buildings additions were paid for in cash. d. Shares in Thanos Ltd with a cost of $150,000 were sold for cash. e. Debentures were issued for cash. f. An additional 40,000 ordinary shares were issued for cash at $6 per share. g. Dividends were paid during the year in cash. h. Repayments of loan principal amounting to $20,000 were made during the year. i. Deposits at Call and Bank Overdraft are to be considered as part of Cash and Cash Equivalents. Required: Prepare a statement of cash flows for Titan Ltd for the year ended 30 June 2019 using the direct method as required by AASB 107 (you are required to show the relevant T-account reconstructions)