Answered step by step

Verified Expert Solution

Question

1 Approved Answer

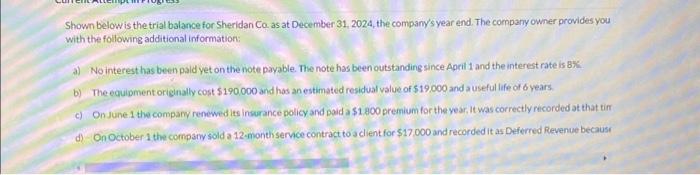

Shown below is the trial balance for Sheridan Co. as at December 31, 2024, the company's year end. The company owner provides you with the

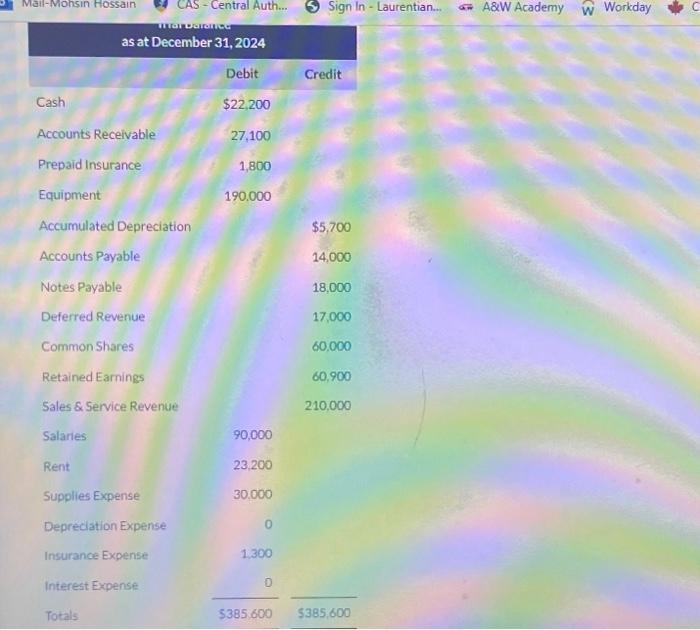

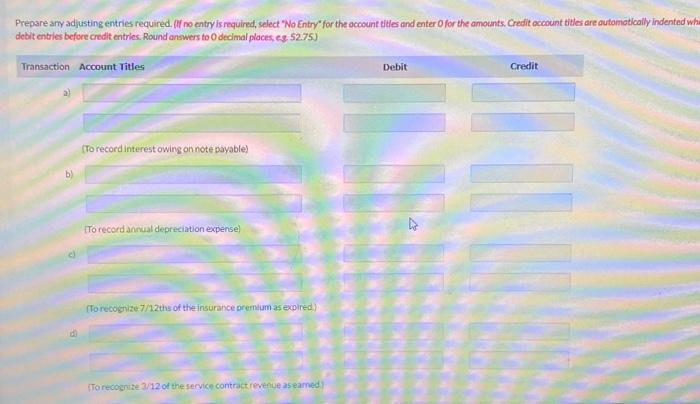

Shown below is the trial balance for Sheridan Co. as at December 31, 2024, the company's year end. The company owner provides you with the following additional information: a) No interest has been paid yet on the note payable. The note has been outstanding since April 1 and the interest rate is 8%. b) The equipment originally cost $190,000 and has an estimated residual value of $19,000 and a useful life of 6 years. c) On June 1 the company renewed its insurance policy and paid a $1,800 premium for the year. It was correctly recorded at that tim d) On October 1 the company sold a 12-month service contract to a client for $17.000 and recorded it as Deferred Revenue because

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started