Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show-Off, Inc. sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's

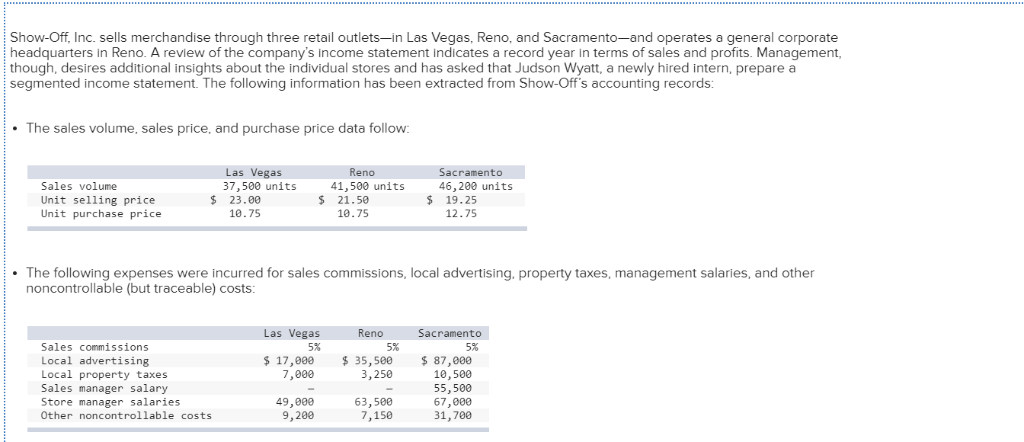

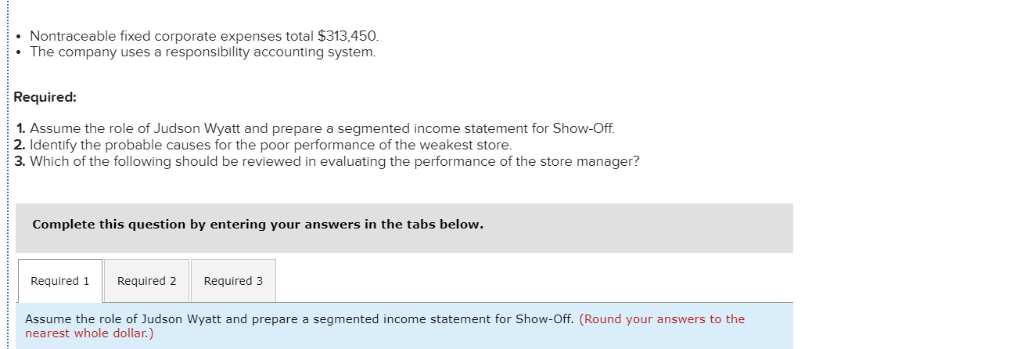

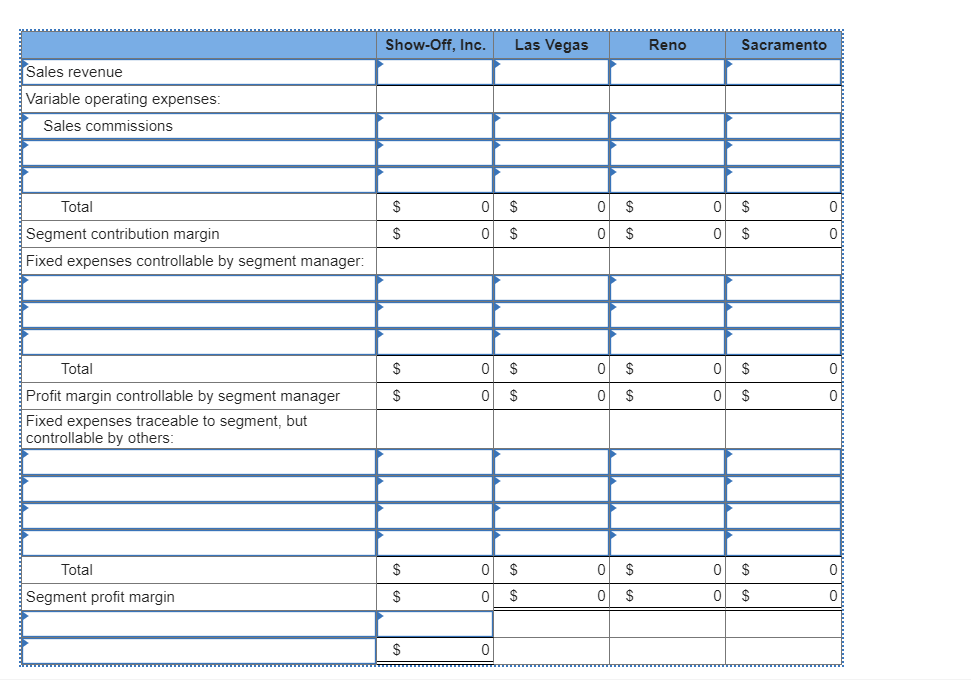

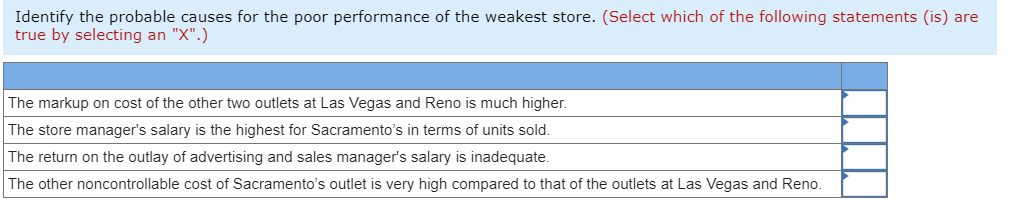

Show-Off, Inc. sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management, though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newly hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records The sales volume, sales price, and purchase price data follow: Sales volume Unit selling price Unit purchase price Las Vegas 37,500 units 23.00 10.75 Reno 41,500 units $ 21.50 10.75 Sacramento 46,200 units 19.25 12.75 $ $ The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: Las Vegas Sacramento 5% $ 17,900 7,000 Reno 5% $ 35,500 3,250 Sales commissions Local advertising Local property taxes Sales manager salary Store manager salaries Other noncontrollable costs $ 87,000 10,500 55,500 67,000 31,700 49,000 9,200 63,500 7,150 Nontraceable fixed corporate expenses total $313.450. The company uses a responsibility accounting system. Required: 1. Assume the role of Judson Wyatt and prepare a segmented income statement for Show-Off. 2. Identify the probable causes for the poor performance of the weakest store. 3. Which of the following should be reviewed in evaluating the performance of the store manager? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume the role of Judson Wyatt and prepare a segmented income statement for Show-Off. (Round your answers to the nearest whole dollar.) Show-Off, Inc. Las Vegas Reno Sacramento Sales revenue Variable operating expenses: Sales commissions Total $ 0 0 $ $ 0 0 $ $ 0 0 $ $ Segment contribution margin Fixed expenses controllable by segment manager: $ $ 0 0 $ $ 0 0 $ $ 0 0 $ $ Total Profit margin controllable by segment manager Fixed expenses traceable to segment, but controllable by others: $ Total Segment profit margin 0 0 $ $ 0 0 $ $ 0 0 $ $ $ 0 Identify the probable causes for the poor performance of the weakest store. (Select which of the following statements (is) are true by selecting an "X".) The markup on cost of the other two outlets at Las Vegas and Reno is much higher. The store manager's salary is the highest for Sacramento's in terms of units sold. The return on the outlay of advertising and sales manager's salary is inadequate. The other noncontrollable cost of Sacramento's outlet is very high compared to that of the outlets at Las Vegas and Reno

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started