Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Siemens and ABB with different ratings wish to borrow 10 million for five years and have been offered the following rates. How must the

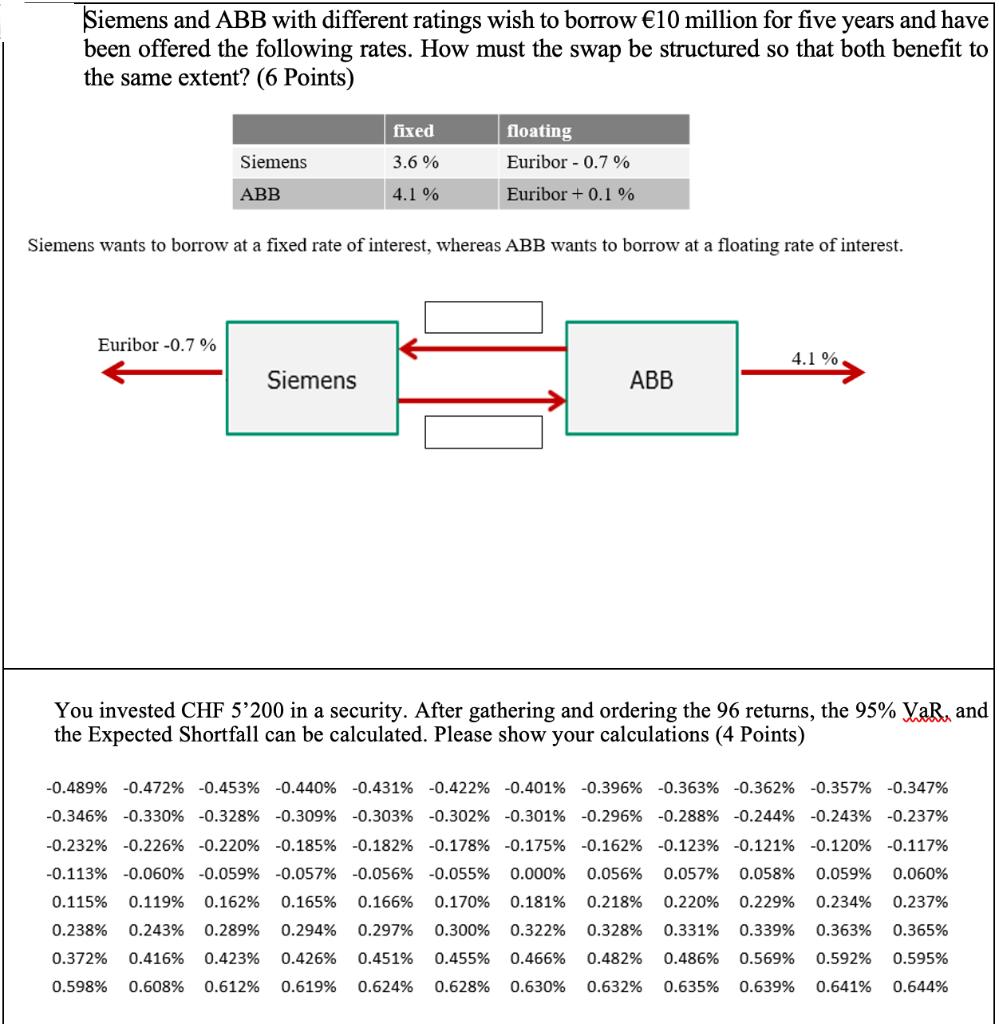

Siemens and ABB with different ratings wish to borrow 10 million for five years and have been offered the following rates. How must the swap be structured so that both benefit to the same extent? (6 Points) Siemens ABB Euribor -0.7 % fixed 3.6% 4.1% Siemens wants to borrow at a fixed rate of interest, whereas ABB wants to borrow at a floating rate of interest. Siemens floating Euribor 0.7% Euribor + 0.1 % ABB 4.1% You invested CHF 5'200 in a security. After gathering and ordering the 96 returns, the 95% VaR, and the Expected Shortfall can be calculated. Please show your calculations (4 Points) -0.309% -0.363% -0.362% -0.357% -0.347% -0.288% -0.244% -0.243% -0.237% -0.123% -0.121 % -0.120 % -0.117% -0.185 % 0.060% -0.489% -0.472% -0.453% -0.440 % -0.431% -0.422 % -0.401% -0.396 % -0.346% -0.330% -0.328% -0.303% -0.302% -0.301% -0.296 % -0.232% -0.226% -0.220 % -0.182 % -0.178% -0.175% -0.162 % -0.113% -0.060% -0.059% -0.057% -0.056% -0.055% 0.000% 0.056% 0.057% 0.058% 0.059% 0.115% 0.119% 0.162% 0.165% 0.166% 0.170% 0.181% 0.218% 0.220% 0.229% 0.234% 0.238% 0.243% 0.289% 0.294% 0.297% 0.328% 0.331% 0.339% 0.363% 0.372% 0.416% 0.423% 0.426% 0.451% 0.455% 0.466% 0.482% 0.486% 0.569% 0.592% 0.598% 0.608% 0.612% 0.619% 0.624% 0.628% 0.630% 0.237% 0.300% 0.322% 0.365% 0.595% 0.632% 0.635% 0.639% 0.641% 0.644%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started