Answered step by step

Verified Expert Solution

Question

1 Approved Answer

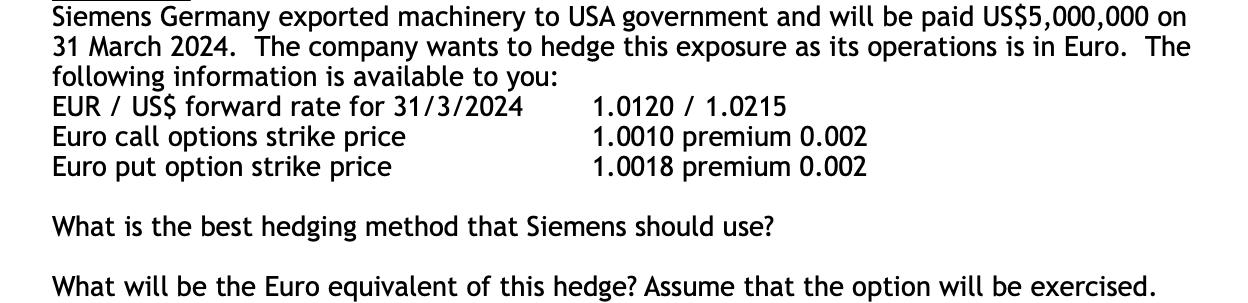

Siemens Germany exported machinery to USA government and will be paid US$5,000,000 on 31 March 2024. The company wants to hedge this exposure as

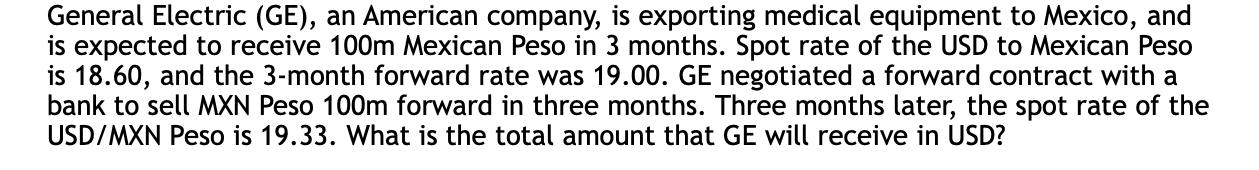

Siemens Germany exported machinery to USA government and will be paid US$5,000,000 on 31 March 2024. The company wants to hedge this exposure as its operations is in Euro. The following information is available to you: EUR / US$ forward rate for 31/3/2024 Euro call options strike price Euro put option strike price What is the best hedging method that Siemens should use? What will be the Euro equivalent of this hedge? Assume that the option will be exercised. 1.0120 / 1.0215 1.0010 premium 0.002 1.0018 premium 0.002 General Electric (GE), an American company, is exporting medical equipment to Mexico, and is expected to receive 100m Mexican Peso in 3 months. Spot rate of the USD to Mexican Peso is 18.60, and the 3-month forward rate was 19.00. GE negotiated a forward contract with a bank to sell MXN Peso 100m forward in three months. Three months later, the spot rate of the USD/MXN Peso is 19.33. What is the total amount that GE will receive in USD?

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the best hedging method for Siemens to protect against the US5000000 payment it will re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started