Answered step by step

Verified Expert Solution

Question

1 Approved Answer

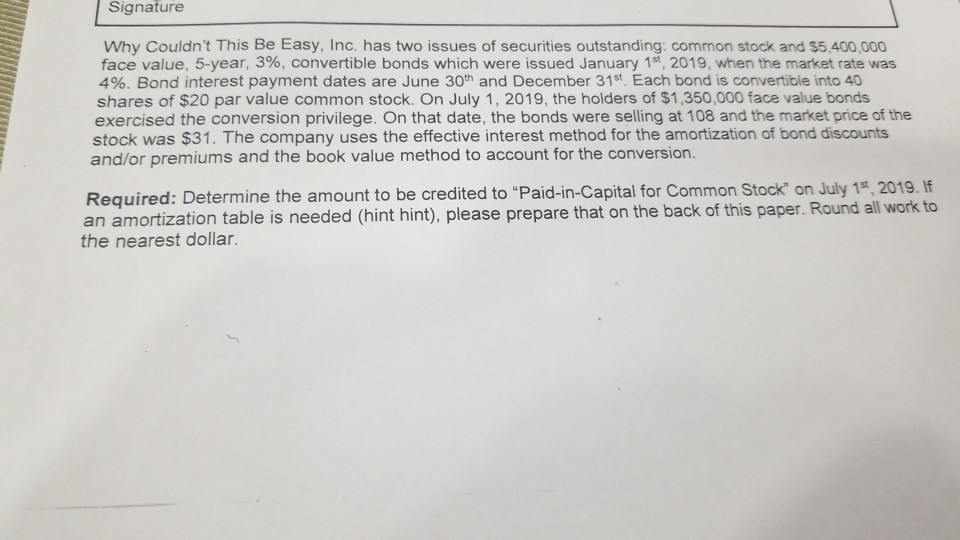

Signature Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $5,400,000 face value, 5-year, 3%, convertible bonds which were

Signature Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $5,400,000 face value, 5-year, 3%, convertible bonds which were issued January 1st, 2019, when the market rate was 4%. Bond interest payment dates are June 30th and December 31st. Each bond is convertible into 40 shares of $20 par value common stock. On July 1, 2019, the holders of $1,350,000 face value bonds exercised the conversion privilege. On that date, the bonds were selling at 108 and the market price of the stock was $31. The company uses the effective interest method for the amortization of bond discounts and/or premiums and the book value method to account for the conversion. Required: Determine the amount to be credited to "Paid-in-Capital for Common Stock' on July 1, 2019. If an amortization table is needed (hint hint), please prepare that on the back of this paper. Round all work to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started