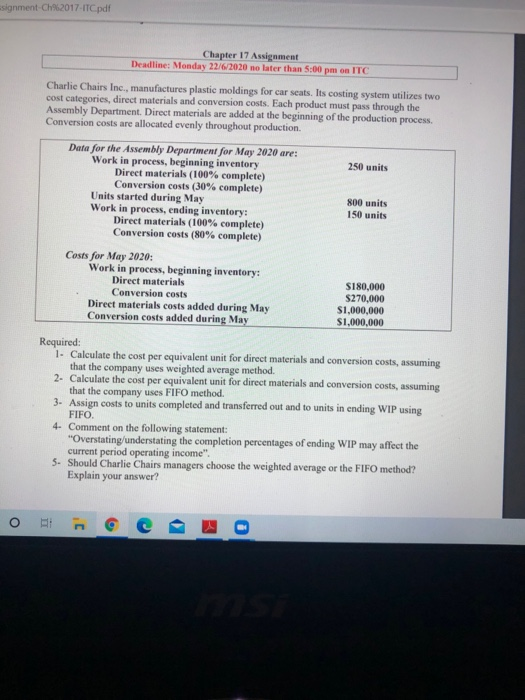

signment-Ch%2017-ITCpdf Chapter 17 Assignment Deadline: Monday 22/6/2020 no later than 5:00 pm on ITC Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production Data for the Assembly Department for May 2020 are: Work in process, beginning inventory 250 units Direct materials (100% complete) Conversion costs (30% complete) Units started during May 800 units Work in process, ending inventory: 150 units Direct materials (100% complete) Conversion costs (80% complete) Costs for May 2020: Work in process, beginning inventory: Direct materials S180,000 Conversion costs $270,000 Direct materials costs added during May $1,000,000 Conversion costs added during May $1,000,000 Required: 1. Calculate the cost per equivalent unit for direct materials and conversion costs, assuming that the company uses weighted average method. 2. Calculate the cost per equivalent unit for direct materials and conversion costs, assuming that the company uses FIFO method. 3. Assign costs to units completed and transferred out and to units in ending WIP using FIFO 4. Comment on the following statement: "Overstating understating the completion percentages of ending WIP may affect the current period operating income". 5. Should Charlie Chairs managers choose the weighted average or the FIFO method? Explain your answer? O signment-Ch%2017-ITCpdf Chapter 17 Assignment Deadline: Monday 22/6/2020 no later than 5:00 pm on ITC Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production Data for the Assembly Department for May 2020 are: Work in process, beginning inventory 250 units Direct materials (100% complete) Conversion costs (30% complete) Units started during May 800 units Work in process, ending inventory: 150 units Direct materials (100% complete) Conversion costs (80% complete) Costs for May 2020: Work in process, beginning inventory: Direct materials S180,000 Conversion costs $270,000 Direct materials costs added during May $1,000,000 Conversion costs added during May $1,000,000 Required: 1. Calculate the cost per equivalent unit for direct materials and conversion costs, assuming that the company uses weighted average method. 2. Calculate the cost per equivalent unit for direct materials and conversion costs, assuming that the company uses FIFO method. 3. Assign costs to units completed and transferred out and to units in ending WIP using FIFO 4. Comment on the following statement: "Overstating understating the completion percentages of ending WIP may affect the current period operating income". 5. Should Charlie Chairs managers choose the weighted average or the FIFO method? Explain your answer? O