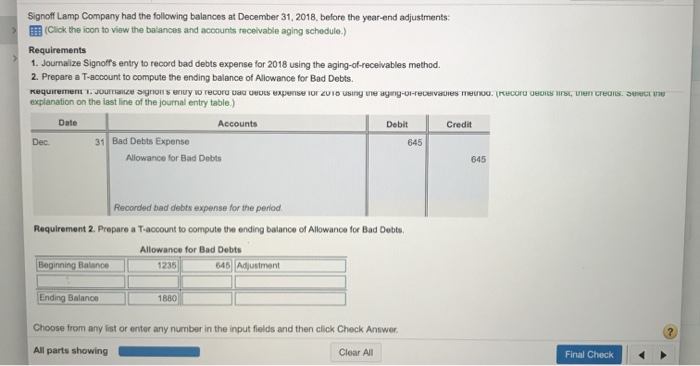

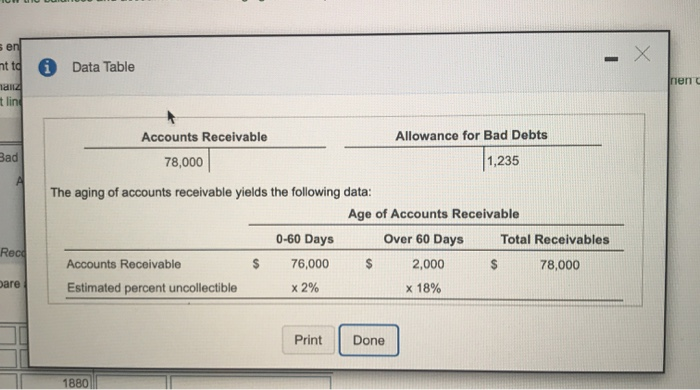

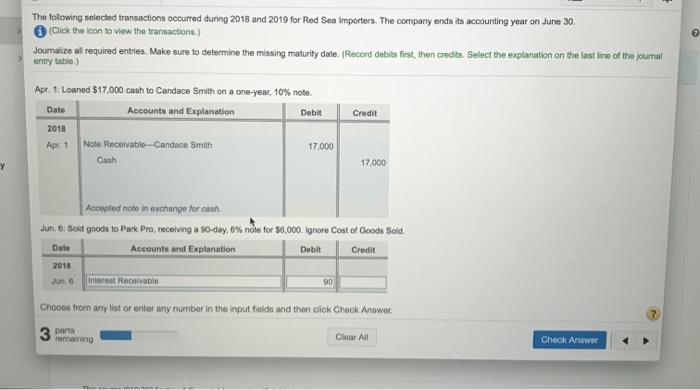

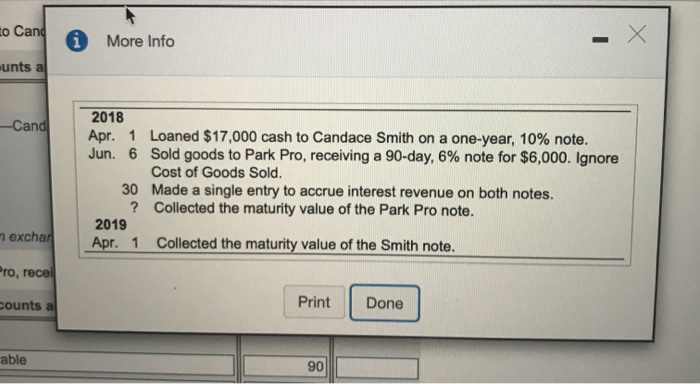

Signoff Lamp Company had the following balances at December 31, 2018, before the year-end adjustments (Click the icon to view the balances and accounts receivable aging schedule.) O RECORD DEDISSERTTECTES, S E Requirements 1. Journalize Signoff's entry to record bad debts expense for 2018 using the aging-of-receivables method. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement. Jorgegnonsen TT DU DUS Expense or UIO Using meng-OHIVOS explanation on the last line of the journal entry table) Date Accounts Debit Credit Dec. 31 Bad Debts Expense Allowance for Bad Debts 645 645 Recorded bad debts expense for the period Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts Allowance for Bad Debts 1235 645 Adjustment Beginning Balance Ending Balance Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Final Check Data Table ser nt to nalla t line Accounts Receivable 78,000 Allowance for Bad Debts 1,235 Bad The aging of accounts receivable yields the following data: Age of Accounts Receivable 0-60 Days Over 60 Days Total Receivables Accounts Receivable $ 76,000 $ 2,000 $ 78,000 Estimated percent uncollectible x 2% x 18% Rece are Print Done 1880 The following selected transactions occurred during 2018 and 2019 for Red Sea Importers. The company ends its accounting year on June 30. (Click the icon to view the transactions.) Journalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Apr. 1: Loaned $17.000 cash to Candace Smith on a one-year, 10% note Date Accounts and Explanation Debit Credit 2018 Apr 1 17.000 Note Receivable-Candace Smith Cash 17.000 Accepted note in exchange for cash Jun. 8: Sold goods to Park Pro, receiving a 90-day, 6% nole for $6,000. Ignore Cost of Goods Sold. Date Accounts and Explanation Debit Credit 2018 Interest Receivable Choose from any list or enter any number in the input folds and then click Check Answer 2 parts S emaining Clear All Check Answer Lo Can More Info unts a Cand 2018 Apr. 1 Loaned $17,000 cash to Candace Smith on a one-year, 10% note. Jun. 6 Sold goods to Park Pro, receiving a 90-day, 6% note for $6,000. Ignore Cost of Goods Sold. 30 Made a single entry to accrue interest revenue on both notes. ? Collected the maturity value of the Park Pro note. 2019 Apr. 1 Collected the maturity value of the Smith note exchan ro, recei counts a Print Done able