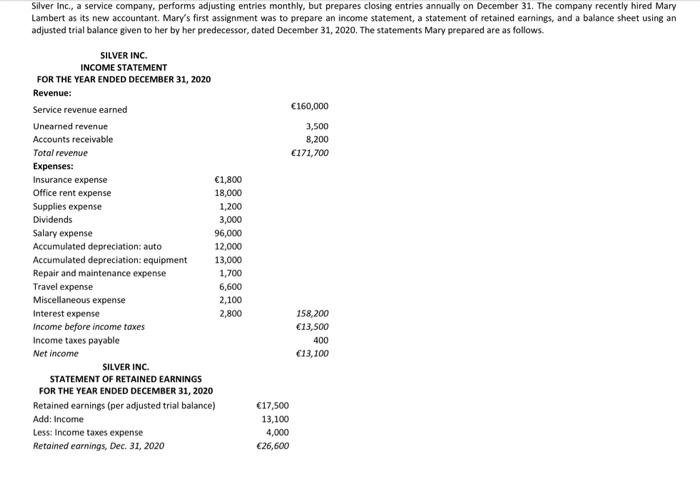

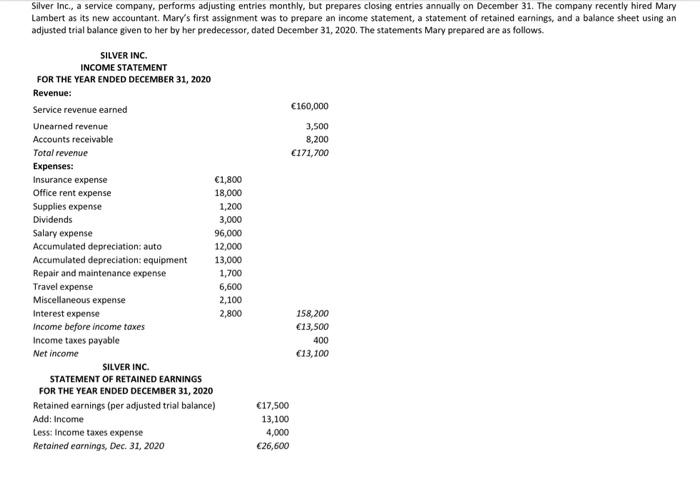

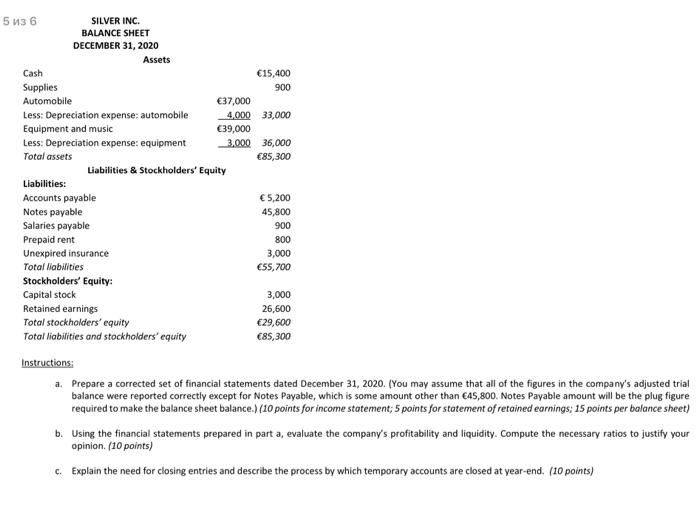

Silver Inc., a service company, performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Mary Lambert as its new accountant. Mary's first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to her by her predecessor, dated December 31, 2020. The statements Mary prepared are as follows. 160,000 3,500 8,200 171,700 SILVER INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Revenue: Service revenue earned Unearned revenue Accounts receivable Total revenue Expenses: Insurance expense 1,800 Office rent expense 18,000 Supplies expense 1,200 Dividends 3,000 Salary expense 96,000 Accumulated depreciation: auto 12,000 Accumulated depreciation: equipment 13,000 Repair and maintenance expense 1,700 Travel expense 6,600 Miscellaneous expense 2,100 Interest expense Income before income taxes Income taxes payable Net income SILVER INC. STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 Retained earnings (per adjusted trial balance) Add: Income Less: Income taxes expense Retained earnings, Dec. 31, 2020 2,800 158,200 13,500 400 13,100 17,500 13,100 4,000 26,600 Silver Inc., a service company, performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Mary Lambert as its new accountant. Mary's first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to her by her predecessor, dated December 31, 2020. The statements Mary prepared are as follows. 160,000 3,500 8,200 171,700 SILVER INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Revenue: Service revenue earned Unearned revenue Accounts receivable Total revenue Expenses: Insurance expense 1,800 Office rent expense 18,000 Supplies expense 1,200 Dividends 3,000 Salary expense 96,000 Accumulated depreciation: auto 12,000 Accumulated depreciation equipment 13,000 Repair and maintenance expense 1,700 Travel expense 6,600 Miscellaneous expense 2,100 Interest expense Income before income taxes Income taxes payable Net income SILVER INC. STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 Retained earnings (per adjusted trial balance) Add: Income Less: Income taxes expense Retained earnings, Dec. 31, 2020 2,800 158,200 13,500 400 13,100 17,500 13,100 4,000 26,600 900 5 6 SILVER INC. BALANCE SHEET DECEMBER 31, 2020 Assets Cash 15,400 Supplies 900 Automobile 37,000 Less: Depreciation expense automobile 4,000 33,000 Equipment and music (39,000 Less: Depreciation expense: equipment 3.000 36,000 Total assets 85,300 Liabilities & Stockholders' Equity Liabilities: Accounts payable 5,200 Notes payable 45,800 Salaries payable Prepaid rent 800 Unexpired insurance 3,000 Total liabilities 55,700 Stockholders' Equity: Capital stock 3,000 Retained earnings 26,600 Total stockholders' equity 29,600 Total liabilities and stockholders' equity 85,300 Instructions: a. Prepare a corrected set of financial statements dated December 31, 2020. (You may assume that all of the figures in the company's adjusted trial balance were reported correctly except for Notes Payable, which is some amount other than 45,800. Notes Payable amount will be the plug figure required to make the balance sheet balance.) (10 points for income statement; 5 points for statement of retained earnings: 15 points per balance sheet) b. Using the financial statements prepared in part a, evaluate the company's profitability and liquidity. Compute the necessary ratios to justify your opinion. (10 points) c. Explain the need for closing entries and describe the process by which temporary accounts are closed at year-end. (10 points) Silver Inc., a service company, performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Mary Lambert as its new accountant. Mary's first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to her by her predecessor, dated December 31, 2020. The statements Mary prepared are as follows. 160,000 3,500 8,200 171,700 SILVER INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Revenue: Service revenue earned Unearned revenue Accounts receivable Total revenue Expenses: Insurance expense 1,800 Office rent expense 18,000 Supplies expense 1,200 Dividends 3,000 Salary expense 96,000 Accumulated depreciation: auto 12,000 Accumulated depreciation: equipment 13,000 Repair and maintenance expense 1,700 Travel expense 6,600 Miscellaneous expense 2,100 Interest expense Income before income taxes Income taxes payable Net income SILVER INC. STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 Retained earnings (per adjusted trial balance) Add: Income Less: Income taxes expense Retained earnings, Dec. 31, 2020 2,800 158,200 13,500 400 13,100 17,500 13,100 4,000 26,600 Silver Inc., a service company, performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Mary Lambert as its new accountant. Mary's first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to her by her predecessor, dated December 31, 2020. The statements Mary prepared are as follows. 160,000 3,500 8,200 171,700 SILVER INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Revenue: Service revenue earned Unearned revenue Accounts receivable Total revenue Expenses: Insurance expense 1,800 Office rent expense 18,000 Supplies expense 1,200 Dividends 3,000 Salary expense 96,000 Accumulated depreciation: auto 12,000 Accumulated depreciation equipment 13,000 Repair and maintenance expense 1,700 Travel expense 6,600 Miscellaneous expense 2,100 Interest expense Income before income taxes Income taxes payable Net income SILVER INC. STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 Retained earnings (per adjusted trial balance) Add: Income Less: Income taxes expense Retained earnings, Dec. 31, 2020 2,800 158,200 13,500 400 13,100 17,500 13,100 4,000 26,600 900 5 6 SILVER INC. BALANCE SHEET DECEMBER 31, 2020 Assets Cash 15,400 Supplies 900 Automobile 37,000 Less: Depreciation expense automobile 4,000 33,000 Equipment and music (39,000 Less: Depreciation expense: equipment 3.000 36,000 Total assets 85,300 Liabilities & Stockholders' Equity Liabilities: Accounts payable 5,200 Notes payable 45,800 Salaries payable Prepaid rent 800 Unexpired insurance 3,000 Total liabilities 55,700 Stockholders' Equity: Capital stock 3,000 Retained earnings 26,600 Total stockholders' equity 29,600 Total liabilities and stockholders' equity 85,300 Instructions: a. Prepare a corrected set of financial statements dated December 31, 2020. (You may assume that all of the figures in the company's adjusted trial balance were reported correctly except for Notes Payable, which is some amount other than 45,800. Notes Payable amount will be the plug figure required to make the balance sheet balance.) (10 points for income statement; 5 points for statement of retained earnings: 15 points per balance sheet) b. Using the financial statements prepared in part a, evaluate the company's profitability and liquidity. Compute the necessary ratios to justify your opinion. (10 points) c. Explain the need for closing entries and describe the process by which temporary accounts are closed at year-end. (10 points)