Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sime Darby Berhad and Boustead Berhad are listed under Main Market in Bursa Malaysia. A retirement fund manager from Employees Provident Fund (EPF; Malay:

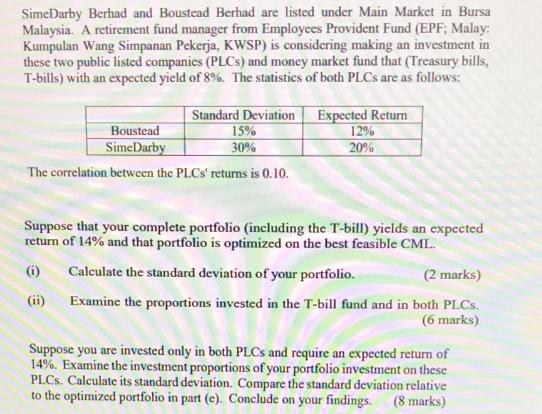

Sime Darby Berhad and Boustead Berhad are listed under Main Market in Bursa Malaysia. A retirement fund manager from Employees Provident Fund (EPF; Malay: Kumpulan Wang Simpanan Pekerja, KWSP) is considering making an investment in these two public listed companies (PLCs) and money market fund that (Treasury bills, T-bills) with an expected yield of 8%. The statistics of both PLCs are as follows: Standard Deviation Expected Return Boustead Sime Darby 15% 30% 12% 20% The correlation between the PLCs' returns is 0.10. Suppose that your complete portfolio (including the T-bill) yields an expected return of 14% and that portfolio is optimized on the best feasible CML. (i) Calculate the standard deviation of your portfolio. (2 marks) (ii) Examine the proportions invested in the T-bill fund and in both PLCs. (6 marks) Suppose you are invested only in both PLCs and require an expected return of 14%. Examine the investment proportions of your portfolio investment on these PLCs. Calculate its standard deviation. Compare the standard deviation relative to the optimized portfolio in part (e). Conclude on your findings. (8 marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the standard deviation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started