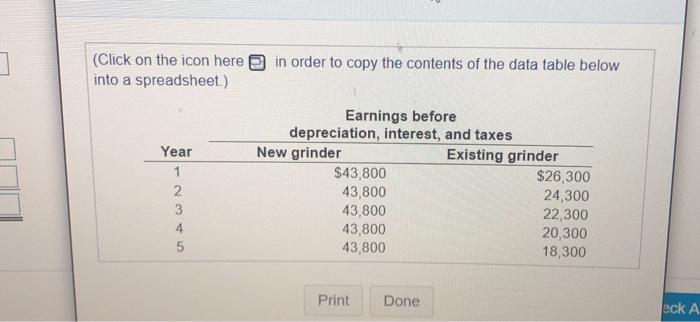

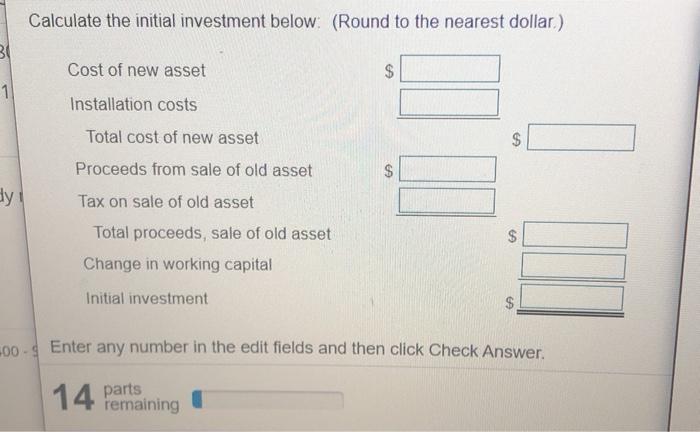

Similar to) Question Help Integrative-Determining relevant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the signing the custing grinder was purch years ago at an inted cost of 952 200 was being deprecated under MACRS a 5 year recovery period. The grede is expected to have a use of more years the new grinde costs $104000 and requires 35.400 in instalaton costs has a 5 year and would be depreciated under MACRS Unga 5 per recovery mod Lombard can cumlyse grinder $71,000 without nung any removal oceanup costs to support the case business resulting from purchase of the nowdercounts receivable would case by $39.00 vetones by and copy by 58.500 Armend of 5 years the stond would have a market value of 2000, the newer would be sold tot 528 300 herremoval cup costs and before the time subedo txote The estimated earings before depreciation, interests over the years for both the where were the following able to the MAC decin percentages a. Calculate the incided with the place of the therwone b. Determine the prochained with the proposed Besure code derechos you) c. Determine the cash flow expected at the end of years from proposed replace d. Depict on a time in the rochowstod with the propos de placa de (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year 1 2 3 4 Earnings before depreciation, interest, and taxes New grinder Existing grinder $43,800 $26,300 43,800 24,300 43,800 22,300 43,800 20,300 43,800 18,300 Print Done eck A Calculate the initial investment below (Round to the nearest dollar) Cost of new asset $ CA 1 Installation costs Total cost of new asset $ Proceeds from sale of old asset $ dy Tax on sale of old asset $ Total proceeds, sale of old asset Change in working capital Initial investment $ -00 - Enter any number in the edit fields and then click Check Answer. 14 parts remaining Integrative-Determining relevant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder H The existing grinder was purchased 2 years ago at an installed cost of $62200, was being depreciated under MACRS using a 5-year recovery period The existing grinder is expected to have a usable life of 5 more years. The new grinder costs $104,000 and requires $5 400 in installation costs, it has a 5-year usable life and would be deprecated under MACRS using a 5-year recovery ponod Lombard can currently sell the existing under for $71000 without incurring any comoval or cleanup costs to support the increased business resulting from purchase of the new grinder accounts receivablo would increase by 539,000, inventorios by $30 600, and 02 accounts payable by $58,500 At the end of 5 years, the existing grinder would have a market value of zero the new grinder would be sold to net $28 300 after removal and cleanup costs and before taxes. The firm is subject a 40% laktato The estimated earrings before depreciation, interest and taxes over the years for both the 54 new and the existing ginder are shown in the following table Table contains the applicato MACRS depreciation percentages) 2 a. Calculate the initial investment associated with the replacement of the stinger by the new one b. Determine the operating can undows associated with the proposed grinder replacement (Noto Be sure to consider the depreciation in your ) kwi c. Determine the terminal cash flow expected at the end of year from the proposed hodet replacement d. Depict on a timeline the relevant cash flows associated with the proposed Grinder replacement decision a. Calculate the star investment associated with replacement of the old machine by the new Calculate the mi investment below (Round to the newest dollar 5104 Cost of new asset station costs Total cost of asset Proces trom sale of old asset