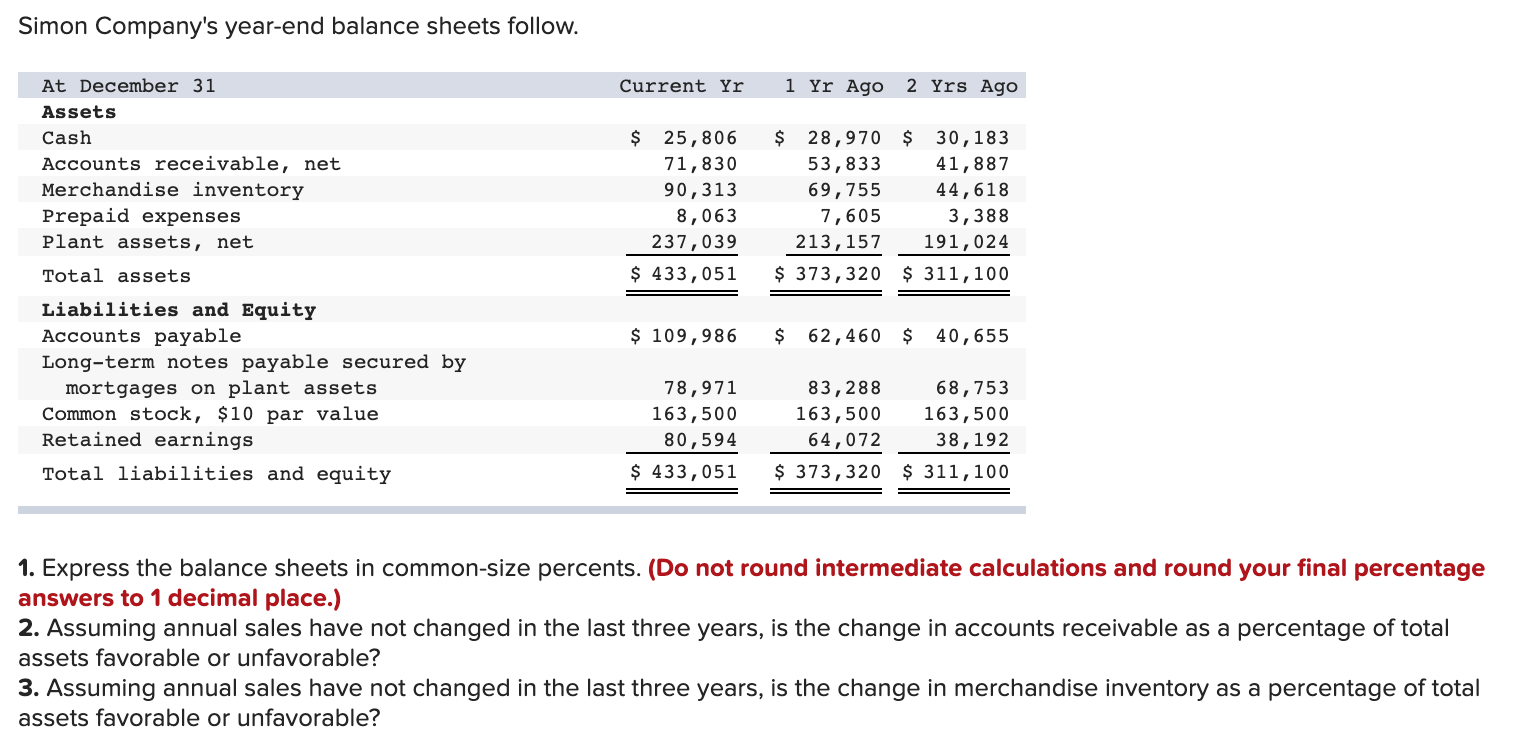

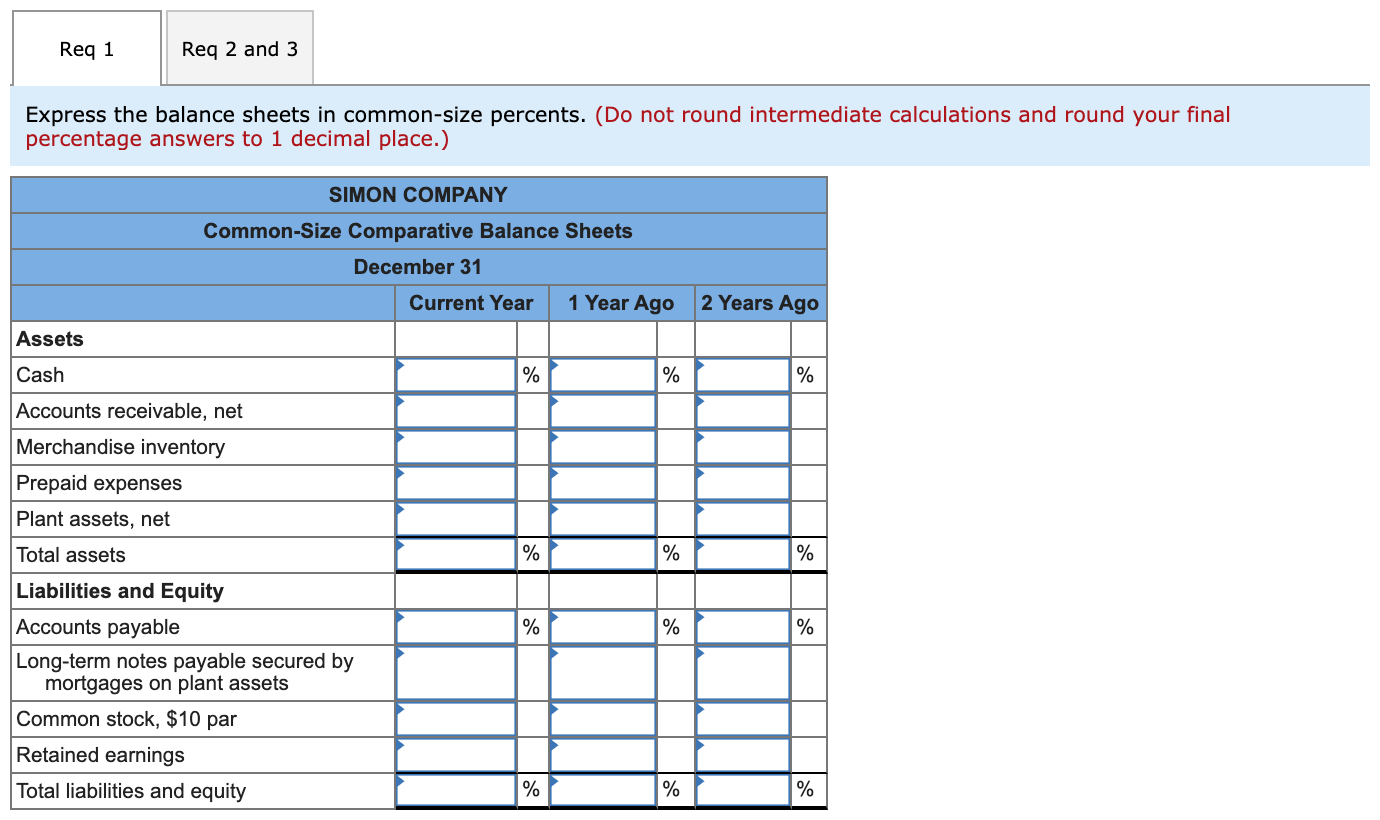

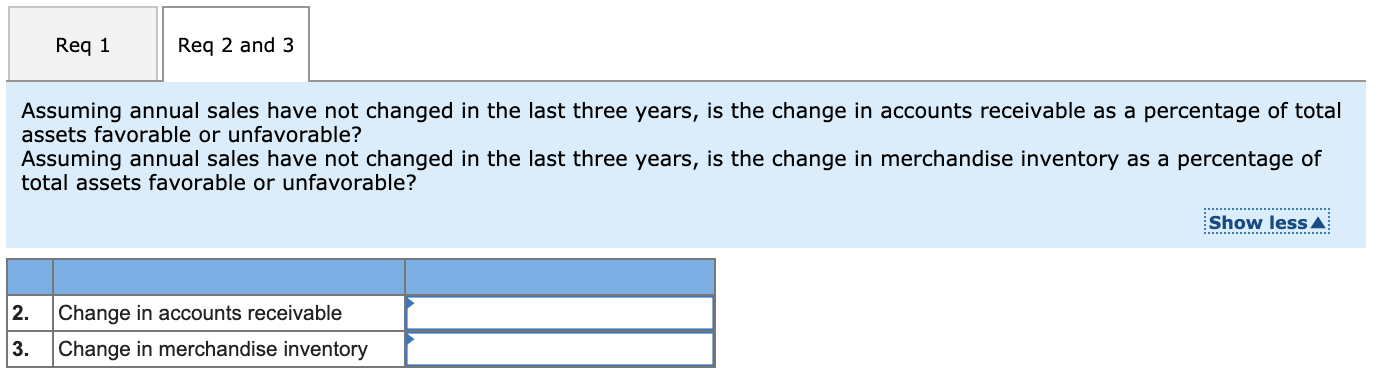

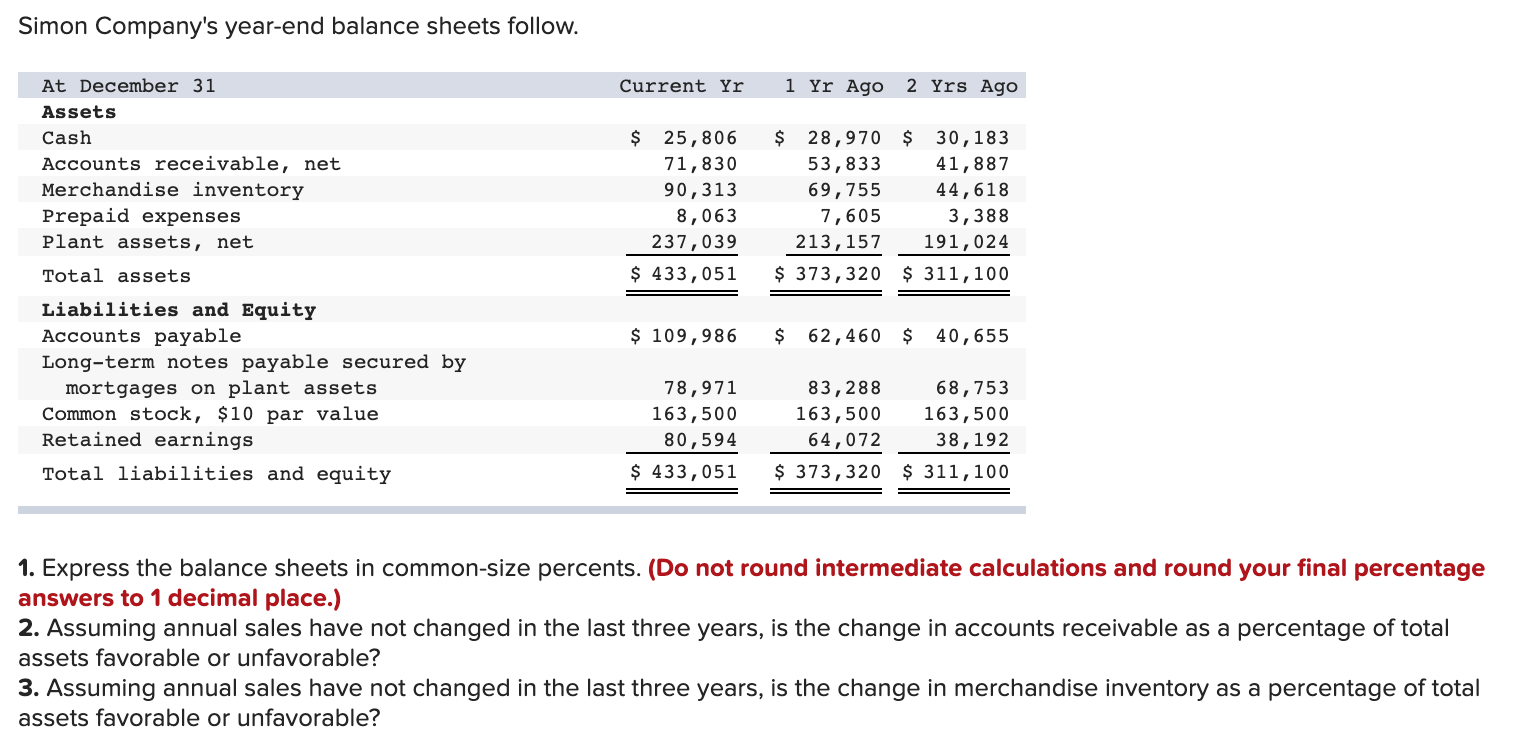

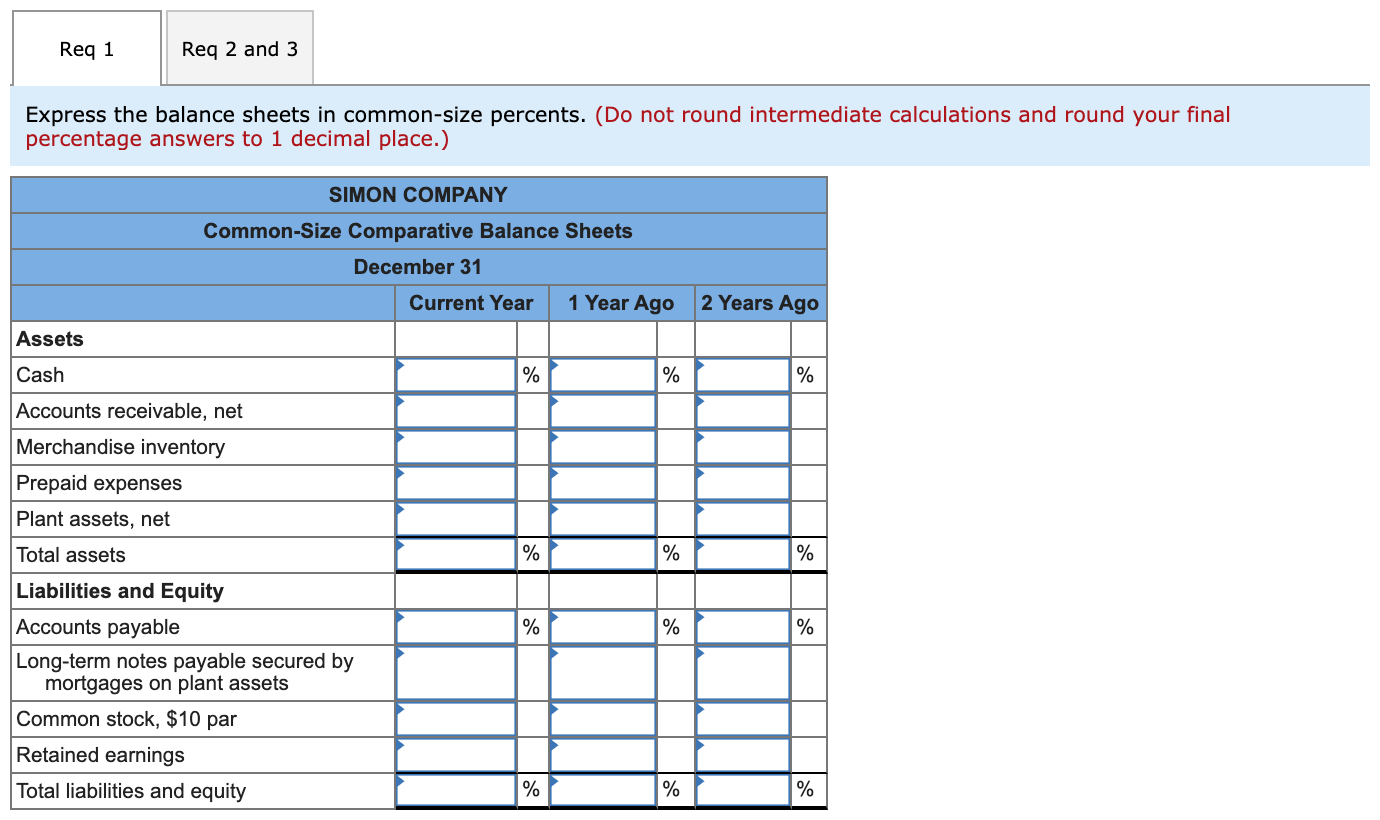

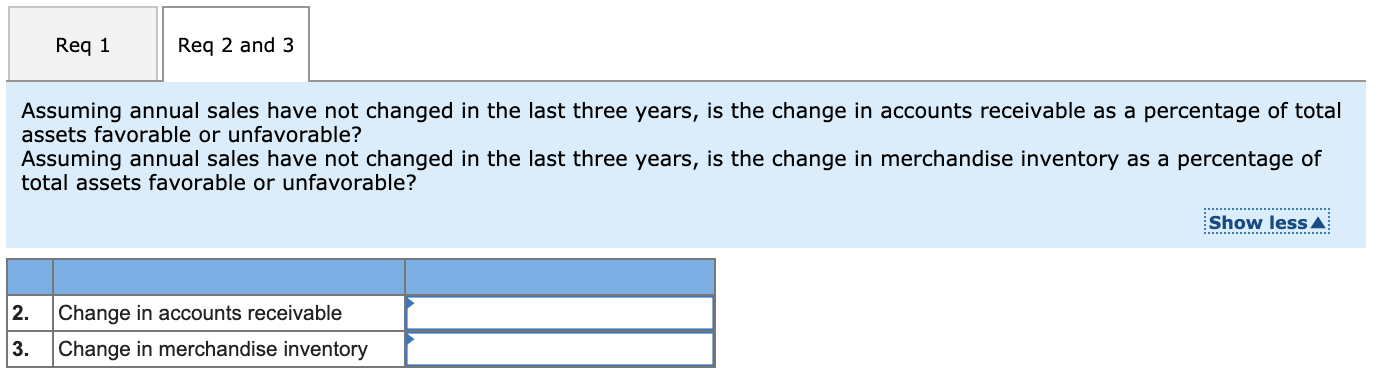

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 25, 806 71,830 90,313 8,063 237,039 $ 433,051 $ 28,970 $ 30,183 53,833 41,887 69,755 44,618 7,605 3,388 213,157 191,024 $ 373,320 $ 311,100 Total assets $ 109,986 $ 62,460 $ 40,655 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 78,971 163,500 80,594 $ 433,051 83,288 68,753 163,500 163,500 64,072 38,192 $ 373,320 $ 311,100 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Req 1 Reg 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash % % % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % % % % % % Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % % % Req 1 Reg 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts receivable Change in merchandise inventory 3