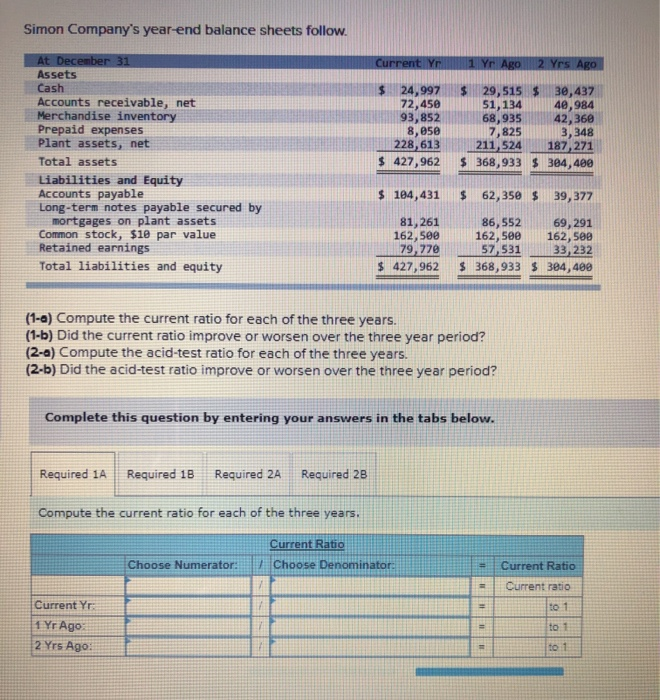

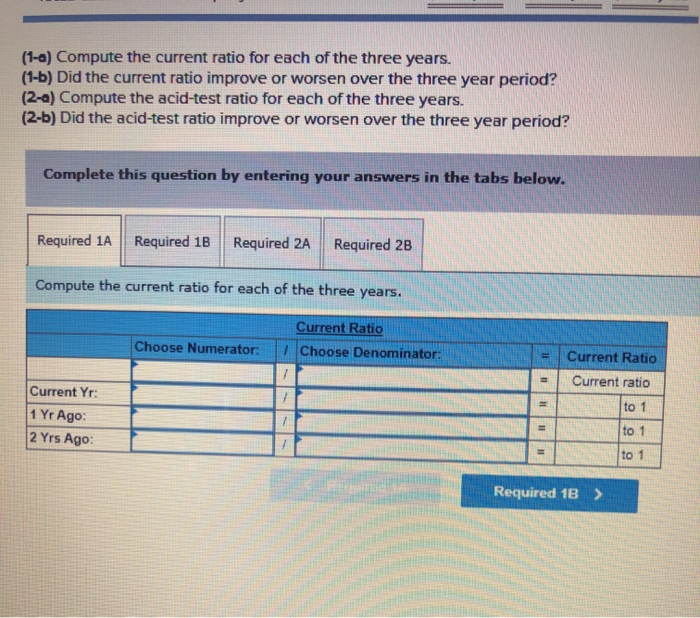

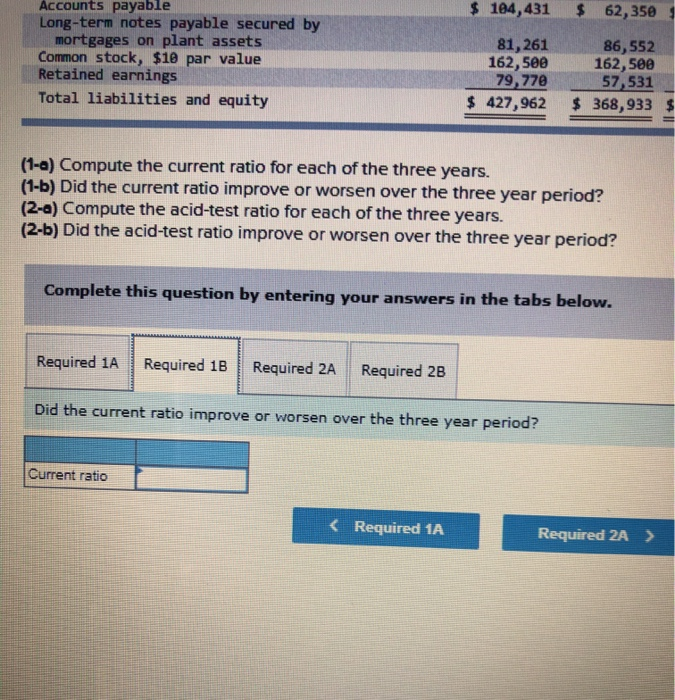

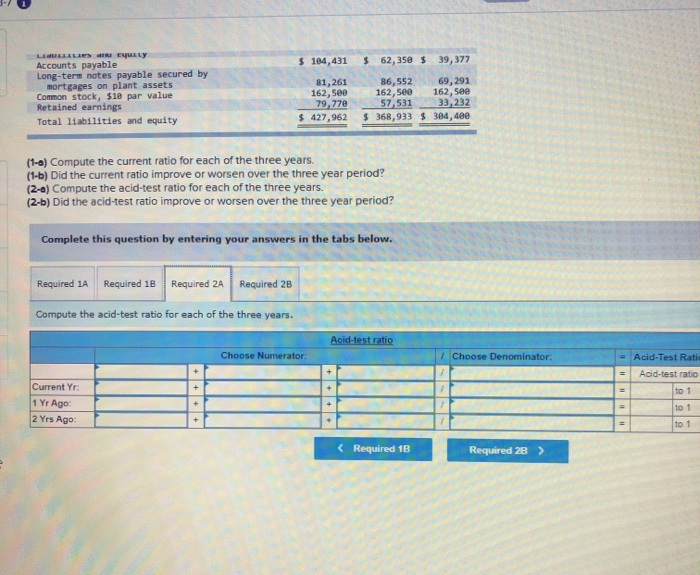

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 24,997 72,450 93,852 8,850 228,613 $ 427,962 $ 29,515 $ 30,437 51, 134 40,984 68,935 42,360 7,825 3,348 211,524 187,271 $ 368,933 $ 384,480 $ 104,431 81,261 162,500 79,770 $ 427,962 $ 62,350 $ 39,377 86,552 69,291 162,500 162,500 57,531 33,232 $368,933 $ 384,400 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2A Required 28 Compute the current ratio for each of the three years. Current Ratio Choose Numerator: Choose Denominator Current Ratio . Current ratio Current Yr to 1 = to 1 1 Yr Ago 2 Yrs Ago: to 1 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Compute the current ratio for each of the three years. Choose Numerator: Current Ratio 7 Choose Denominator: 11 Current Ratio Current ratio to 1 1 1 = Current Yr: 1 Yr Ago: 2 Yrs Ago: Il to 1 to 1 Required 1B > $ 104,431 $ 62,350 Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 81,261 162,500 79,770 $ 427,962 86,552 162,500 57,531 $ 368,933 $ (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Did the current ratio improve or worsen over the three year period? Current ratio $ 184,431 $ 62,350 $ 39,377 LULU EYULLY Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 81,261 162,500 79,270 $427,962 86,552 69,291 162, see 162,5ee 57,531 33, 232 $ 368,933 $ 384,400 (1-0) Compute the current ratio for each of the three years. (1-1) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-6) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Compute the acid-test ratio for each of the three years. Acid-test ratio Choose Numerator: Choose Denominator: = Acid-Test Ratio = Acid-test ratio + to 1 Current Yr: 1 Yr Ago 2 Yrs Ago: + 1 - to 1 to 1 mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 81, 261 162,500 79,770 $ 427,962 86, 552 162,500 12 57 531 $368,933 $ 3 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Did the acid-test ratio improve or worsen over the three year period? Acid-test ratio