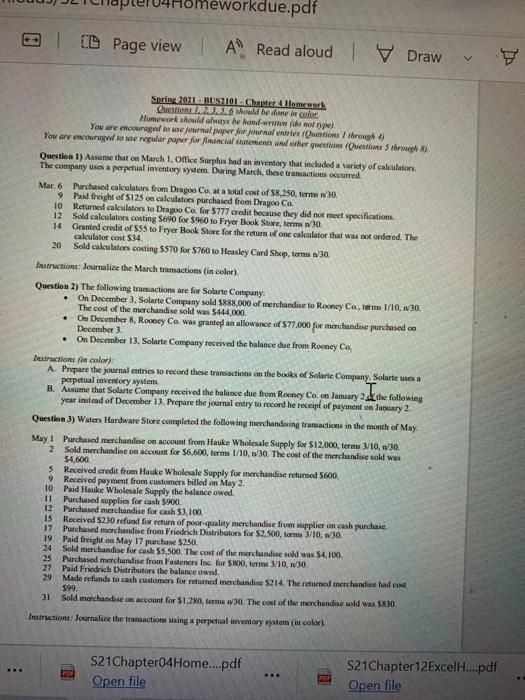

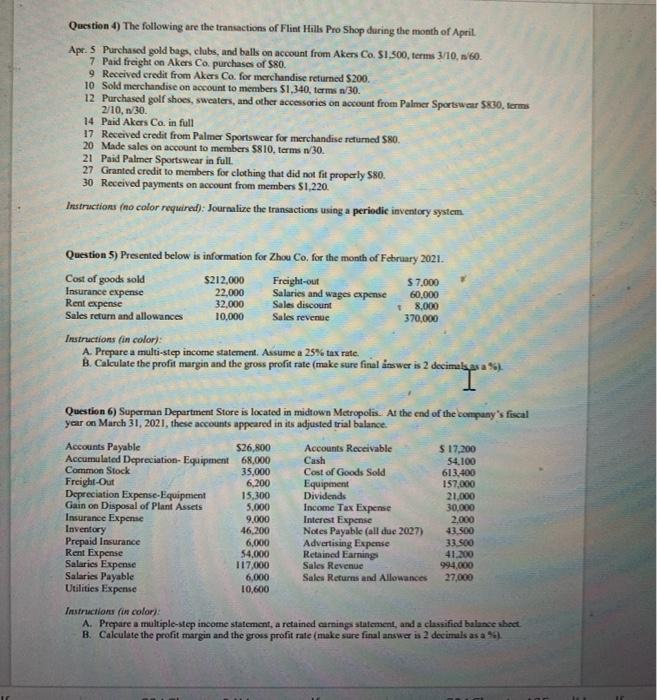

workdue.pdf CD Page view AN Read aloud Draw V . Spring 2011_BUSRIOL Chapter Honor Crition should be done in color Homework should be handed more You are encouraged to me journal paper for journal entries (Castors through You are encouraged to me regular paper for financial statements and other questiom (utions through) Question 1) Assume that on March 1, Office Surplus had an inventory that included a variety of calculators The company uses a perpetual inventory system. During March, these transactions curred Mar 6 Purchased calculators from Dragon Coata total cost of $8.250 ferm 30. 9 Paid freight of S125 on calculators purchased from Dragoo Co. 10 Returned calculators to Deagoo Ca for 5777 credit because they did not meet specifications 12 Sold calculators costing 56100 for $960 to Fryer Book Store, terms 30 14 Granted credit of 555 to Fryer Book Store for the return of one calculator that was ordered. The calculator cost $34 20 Sold calculators costing 5570 for $760 to Heasley Card Shop,terms 30 Instruction: Journalize the March transactions (in color) Question 2) The following transactions are for Solarte Company On December 3. Solarte Company sold $888.000 of merchandise to Rooney Co, tome 1/10, 1/30 The cost of the merchandise sold was $444,000 On December 8, Rooney Co. was granted an allowance of $77.000 for merchandise purchased on December 3. On December 13. Solarte Company received the balance due from Rooney Co, Instructions in color: A Prepare the journal entries to record these transactions on the books of Solarte Company Solarte sesa perpetual inventory system B. Assume that Solarte Company received the balance due from Rooney Co. on January 2d the following I year instead of December 13. Prepare the journal entry to record he receipt of payment on January 2. Question 3) Water Hardware Store completed the following merchandising transactions in the month of May. May 1 Purchased merchandise on account from Hauke Wholesale Supply for $12,000, term 3/10, 1/30 2 Sold merchandise on socount for $6,600, torms 1/10, n. 30. The cost of the merchandise sold was 54.600 5 Received credit from Hauke Wholesale Supply for merchandise returned 5600 9 Received payment from customers billed on May 2. 10 Paid Hauke Wholesale Supply the balance owed 11 Purchased supplies for cash 8900 12 Purchased merchandise for cash 53.100 15 Received $230 refund for return of poor quality merchandise from supplier on cash purchase 17 Purchased merchandise from Friedrich Distributors for $2.500, terma 3/10, 1/30. 19 Paid freight on May 17 purchase 5250 24 Sold merchandise for cash 55.500. The cost of the merchandise sold was $4,100 25 Purchased merchandise from Fasteners Inc. for SHOO, Terme 110, 130 27 Paid Friedrich Distributors the balance owed 29 Made refunds to cash customers for returned merchandise 5214. The returned merchandise had cost $99. 31 Sold merchandise on account for 51.280, terms w30. The cost of the merchandise sold was SR30 Instruction: Journalire the transactions using a perpetual inventory system (in color) ... POY S21Chapter04Home....pdf Open file POF S21Chapter 12 ExcelH....pdf Open file Question 4) The following are the transactions of Flint Hills Pro Shop during the month of April Apr. 5 Purchased gold bags, clubs, and balls on account from Akers Co. $1.500, terms 3/10, 60. 7 Paid freight on Akers Co. purchases of $80. 9 Received credit from Akers Co. for merchandise returned S200. 10 Sold merchandise on account to members $1,340, terms /30. 12 Purchased golf shoes, sweaters, and other accessories on account from Palmer Sportswear 5830 terms 2/10, 130 14 Paid Akers Co. in full 17 Received credit from Palmer Sportswear for merchandise returned $80. 20 Made sales on account to members $810, terms 30. 21 Paid Palmer Sportswear in full 27 Granted credit to members for clothing that did not fit properly $80. 30 Received payments on account from members $1,220. Instructions (no color required): Journalize the transactions using a periodic inventory system. Question 5) Presented below is information for Zhou Co. for the month of Fehruary 2021. Cost of goods sold $212,000 Freight-out $ 7.000 Insurance expense 22,000 Salaries and wages expense 60,000 Rent expense 32.000 Sales discount 18.000 Sales return and allowances 10.000 Sales revenue 370,000 Instructions (in color): A. Prepare a multi-step income statement. Assume a 25% tax rate. B. Calculate the profit margin and the gross profit rate (make sure final answer is 2 decimalyana ). Question 6) Superman Department Store is located in midtown Metropolis. At the end of the company's fiscal year on March 31, 2021, these accounts appeared in its adjusted trial balance. Accounts Payable $26,800 Accounts Receivable $ 17,200 Accumulated Depreciation Equipment 68.000 Cash 54.100 Common Stock 35,000 Cost of Goods Sold 613.400 Freight-Out 6,200 Equipment 157.000 Depreciation Expense-Equipment 15.300 Dividends 21,000 Gain on Disposal of Plant Assets 5,000 Income Tax Expense 30.000 Insurance Expense 9,000 Interest Expense 2.000 Inventory 46,200 Notes Payable (all due 2027) 43.500 Prepaid Insurance 6,000 Advertising Expense 33.500 Rent Expense 54,000 Retained Earning 41.200 Salaries Expense 117,000 Sales Revenue 994.000 Salaries Payable 6,000 Sales Returns and Allowances 27,000 Utilities Expense 10.600 Instruction in color): A. Prepare a multiple-step income statement, a retained carning statement, and a classified balance sheet B. Calculate the profit margin and the gross profit rate (make sure final answer is 2 decimals as a %)