Question

Since LSUS corporation is producing at full capacity, Amanda has decided to have Han examine the feasibility of a new manufacturing plant. This expansion would

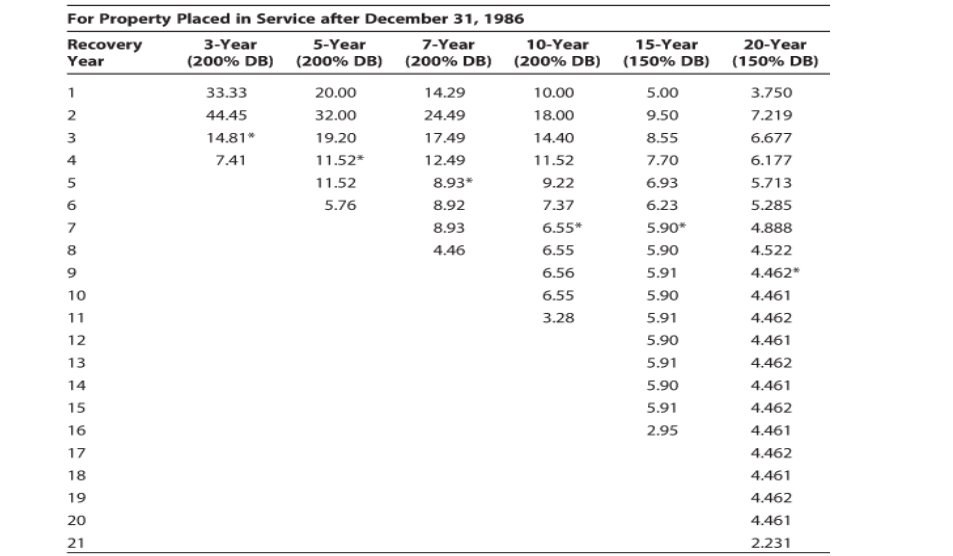

Since LSUS corporation is producing at full capacity, Amanda has decided to have Han examine the feasibility of a new manufacturing plant. This expansion would represent a major capital outlay for the company. A preliminary analysis of the project has been conducted at a cost of $1.6 million. This analysis determined that the new plant will require an immediate outlay of $54 million and an additional outlay of $31 million in one year. The company has received a special tax dispensation that will allow the building and equipment to be depreciated on a 20-year MACRS schedule. Because of the time necessary to build the new plant, no sales will be possible for the next year. Two years from now, the company will have partial-year sales of $17 million. Sales in the following four years will be $28 million, $37 million, $40 million, and $43 million. Because the new plant will be more efficient than LSUS corporations current manufacturing facilities, variable costs are expected to be 65 percent of sales, and fixed costs will be $2.4 million per year. The new plant will also require net working capital amounting to 8 percent of sales for the next year. Han realizes that sales from the new plant will continue into the indefinite future. Because of this, he believes the cash flows after Year 5 will continue to grow at 2.5 percent indefinitely. The companys tax rate is 40 percent and the required return is 12 percent.

1) Amanda is not sure about the capital budgeting technique and want like Han to elaborate clearly what are and are not important elements to engage the capital budgeting decision for the LSUS corporation.

2) Amanda is recommended to use profitability index, NPV, and IRR, she wants Han to examine extensively the benefits and drawbacks of each approach.

3) After the examine of three approaches, Amanda would like Han to analyze the financial viability of the new plant and calculate the profitability index, NPV, and IRR.

4) After the empirical results, Han would like to provide the recommendation to Amanda and Board of directors, what is Hans recommendation? Amanda also wants Han to provide a sensitivity analysis and change any one of elements documented before and see what happens? For example, increase or decrease growth rate and at what level the firm can break even when NPV=0.

I need help in understanding the above question 4. Whoever helps me on this question, can you please address the question with good detail and explain to me Han's recommendation. Thank you

For Property Placed in Service after December 31, 1986 Recovery 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year (200% DB) (200% DB) (200% DB) (200% DB) (150% DB) (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2. 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 5 11.52 8.93* 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462* 10 6.55 5.90 4.461 3.28 5.91 4.462 12 5.90 4.461 5.91 4.462 14 5.90 4.461 15 5.91 4.462 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 11 13 16 For Property Placed in Service after December 31, 1986 Recovery 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year (200% DB) (200% DB) (200% DB) (200% DB) (150% DB) (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2. 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 5 11.52 8.93* 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462* 10 6.55 5.90 4.461 3.28 5.91 4.462 12 5.90 4.461 5.91 4.462 14 5.90 4.461 15 5.91 4.462 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 11 13 16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started