Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Single, continuous statement of comprehensive income (36 pi The following income statement items appeared on the adjusted trial balance of XYZ Corporation for the

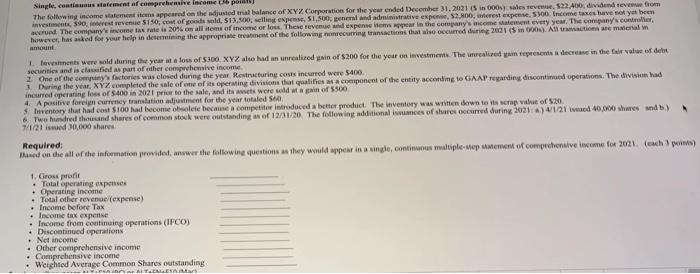

Single, continuous statement of comprehensive income (36 pi The following income statement items appeared on the adjusted trial balance of XYZ Corporation for the year ended December 31, 2021 (5 in 000s) sales revenue, $22,400, dividend revenue from investments, 590, interest revenue $150, cost of goods sold, $13,500, selling expense, $1,500, general and administrative expense, $2,800, interest expense, $300 Income taxes have not yet been accrued The company's income tax rate is 20% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 (S in 000). All transactions are material in amount 1. Investments were sold during the year at a loss of $300 XYZ also had an unrealized gain of $200 for the year on investments. The unrealized gain represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $400. 3. During the year, XYZ completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP regarding discontinued operations. The division had incurred operating loss of $400 in 2021 prior to the sale, and its assets were sold at a gain of $500 4. A positive foreign currency translation adjustment for the year totaled 560. 5. Inventory that had cost $100 had become obsolete because a competitor introduced a better product. The inventory was written down to its scrap value of $20. 6. Two hundred thousand shares of common stock were outstanding as of 12/31/20 The following additional issuances of shares occurred during 2021: a) 4/1/21 issued 40,000 shares and b) 7/1/21 issued 30,000 shares Required: Based on the all of the information provided, answer the following questions as they would appear in a single, continuous multiple-step statement of comprehensive income for 2021. (each 3 points) 1. Gross profit Total operating expenses . Operating income Total other revenue (expense) Income before Tax Income tax expense Income from continuing operations (IFCO)) Discontinued operations Net income . Other comprehensive income Comprehensive income Weighted Average Common Shares outstanding o Wishes Mar

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross profit Sales revenue Cost of goods sold Gross profit 22400 13500 8900 2 Total operating expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started