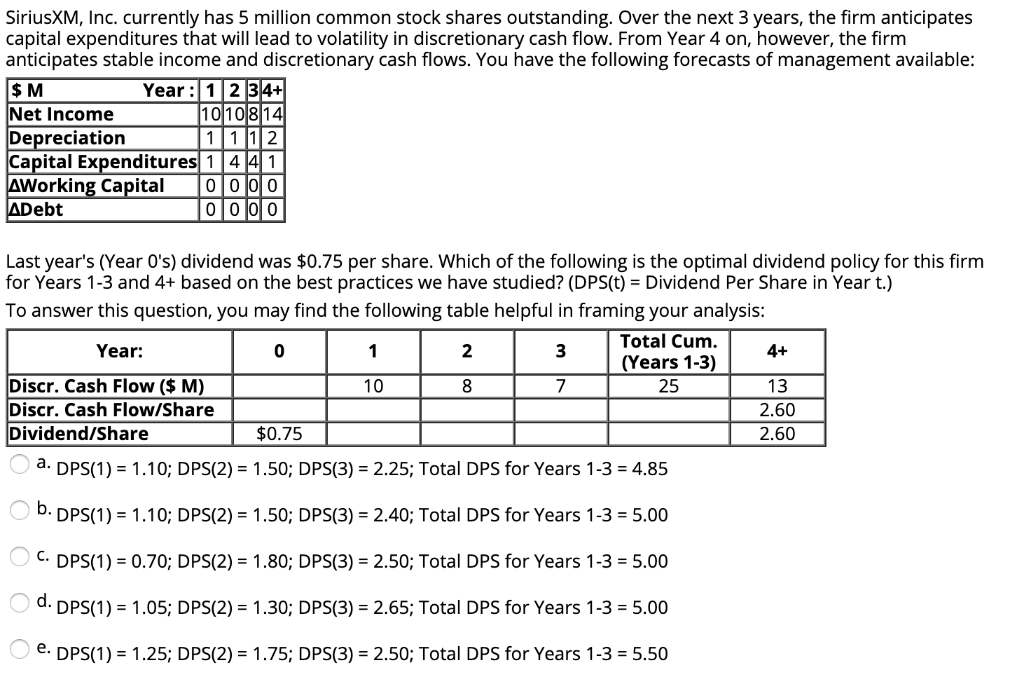

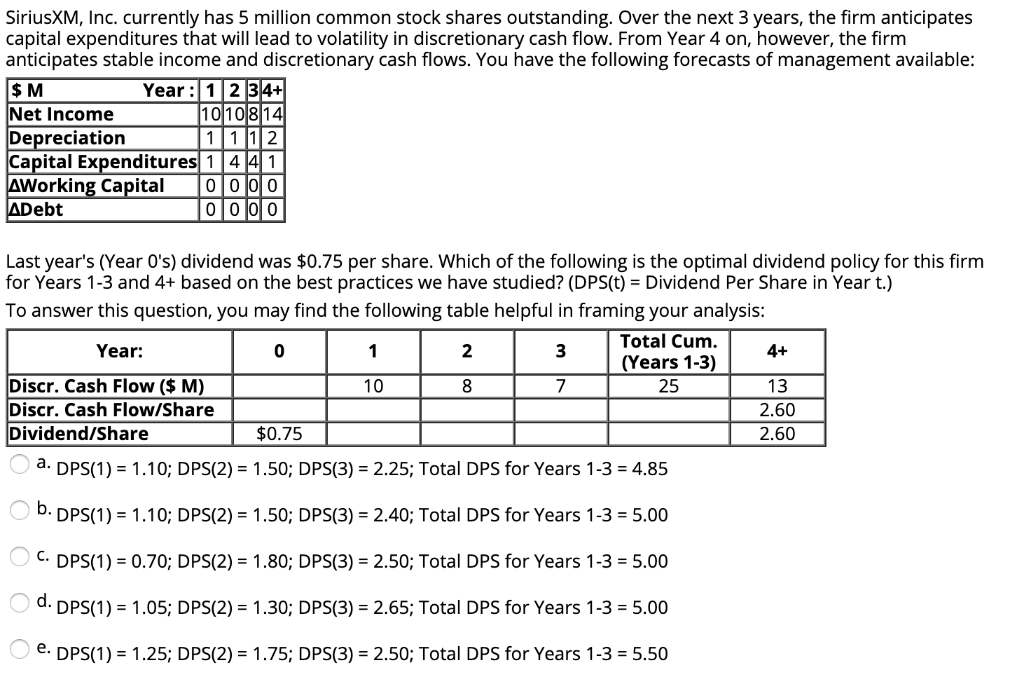

SiriusXM, Inc. currently has 5 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firnm anticipates stable income and discretionary cash flows. You have the following forecasts of management available $ M Net Income Depreciation Capital Expenditures 144 1 Year 12 34+ 1112 Working Capital 0lolol0 Debt Last year's (Year O's) dividend was $0.75 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t) = Dividend Per Share in Year t.) To answer this question, you may find the following table helpful in framing your analysis: Total Cum. (Years 1-3) 25 Year: 0 2 Discr. Cash Flow ($ M) Discr. Cash Flow/Share Dividend/Share 7 2.60 2.60 $0.75 a. DPS(1) 1.10, DPS(2) - 1.50; DPS(3)- 2.25; Total DPS for Years 1-3 4.85 b. DPS(1)-1.10; DPS(2)-1.50; DPS(3)-2.40; Total DPS for Years 1-3-5.00 C. DPS(1) -0.70; DPS(2) 1.80; DPS(3) 2.50; Total DPS for Years 1-3- 5.00 d. DPS(1)- 1.05; DPS(2) 1.30; DPS(3) 2.65; Total DPS for Years 1-3 5.00 e. DPS(1)-1.25; DPS(2) 1.75; DPS(3) 2.50; Total DPS for Years 1-3 - 5.50 SiriusXM, Inc. currently has 5 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firnm anticipates stable income and discretionary cash flows. You have the following forecasts of management available $ M Net Income Depreciation Capital Expenditures 144 1 Year 12 34+ 1112 Working Capital 0lolol0 Debt Last year's (Year O's) dividend was $0.75 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t) = Dividend Per Share in Year t.) To answer this question, you may find the following table helpful in framing your analysis: Total Cum. (Years 1-3) 25 Year: 0 2 Discr. Cash Flow ($ M) Discr. Cash Flow/Share Dividend/Share 7 2.60 2.60 $0.75 a. DPS(1) 1.10, DPS(2) - 1.50; DPS(3)- 2.25; Total DPS for Years 1-3 4.85 b. DPS(1)-1.10; DPS(2)-1.50; DPS(3)-2.40; Total DPS for Years 1-3-5.00 C. DPS(1) -0.70; DPS(2) 1.80; DPS(3) 2.50; Total DPS for Years 1-3- 5.00 d. DPS(1)- 1.05; DPS(2) 1.30; DPS(3) 2.65; Total DPS for Years 1-3 5.00 e. DPS(1)-1.25; DPS(2) 1.75; DPS(3) 2.50; Total DPS for Years 1-3 - 5.50