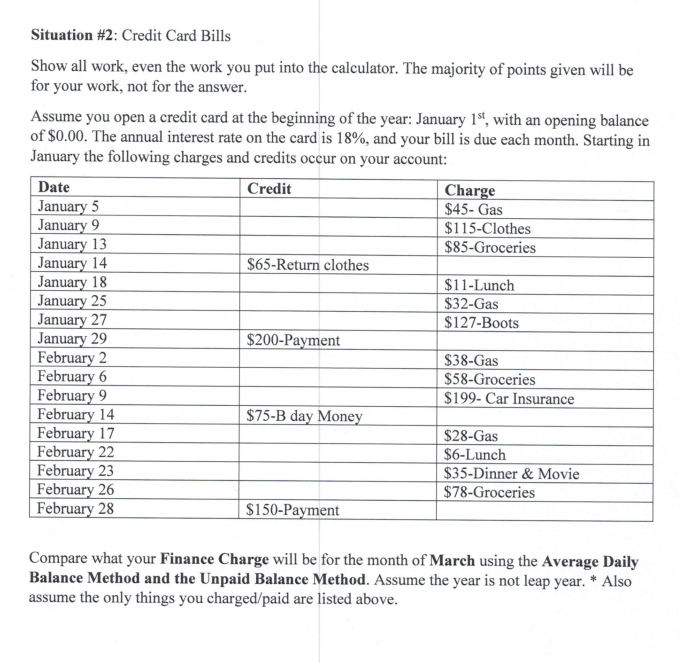

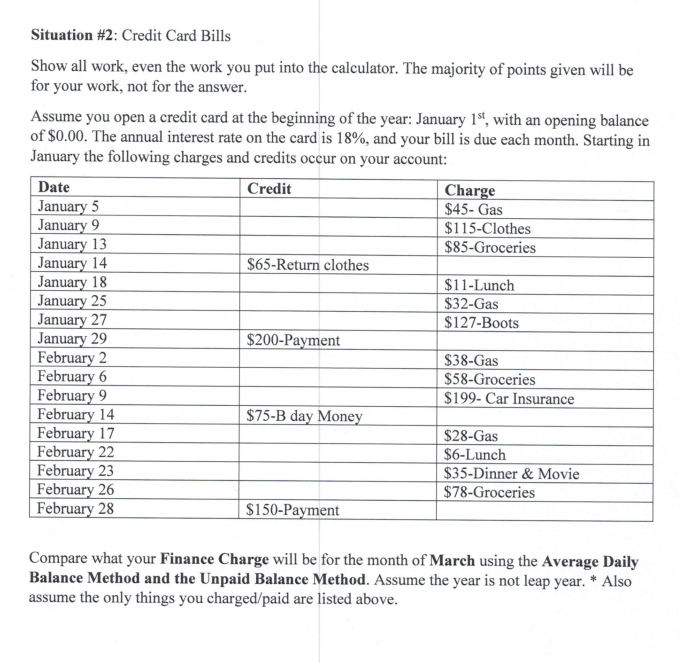

Situation #2: Credit Card Bills Show all work, even the work you put into the calculator. The majority of points given will be for your work, not for the answer. Date Assume you open a credit card at the beginning of the year: January 15, with an opening balance of $0.00. The annual interest rate on the card is 18%, and your bill is due each month. Starting in January the following charges and credits occur on your account: Credit Charge January 5 $45- Gas January 9 $115-Clothes January 13 $85-Groceries January 14 $65-Return clothes January 18 $11-Lunch January 25 $32-Gas January 27 $127-Boots January 29 $200-Payment February 2 $38-Gas February 6 $58-Groceries February 9 $199- Car Insurance February 14 $75-B day Money February 17 $28-Gas February 22 $6-Lunch February 23 $35-Dinner & Movie February 26 $78-Groceries February 28 $150-Payment Compare what your Finance Charge will be for the month of March using the Average Daily Balance Method and the Unpaid Balance Method. Assume the year is not leap year. * Also assume the only things you charged/paid are listed above. Situation #2: Credit Card Bills Show all work, even the work you put into the calculator. The majority of points given will be for your work, not for the answer. Date Assume you open a credit card at the beginning of the year: January 15, with an opening balance of $0.00. The annual interest rate on the card is 18%, and your bill is due each month. Starting in January the following charges and credits occur on your account: Credit Charge January 5 $45- Gas January 9 $115-Clothes January 13 $85-Groceries January 14 $65-Return clothes January 18 $11-Lunch January 25 $32-Gas January 27 $127-Boots January 29 $200-Payment February 2 $38-Gas February 6 $58-Groceries February 9 $199- Car Insurance February 14 $75-B day Money February 17 $28-Gas February 22 $6-Lunch February 23 $35-Dinner & Movie February 26 $78-Groceries February 28 $150-Payment Compare what your Finance Charge will be for the month of March using the Average Daily Balance Method and the Unpaid Balance Method. Assume the year is not leap year. * Also assume the only things you charged/paid are listed above